US Retail Sales Soared Most In 2 Years In March As Auto-Spending Spiked Ahead Of Tariffs

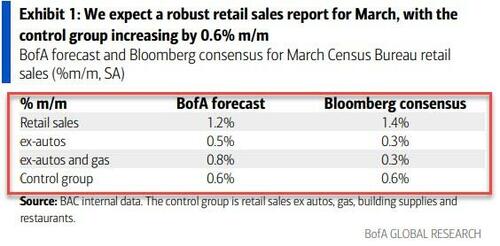

Following two disappointing months, US Retail Sales were expected to rebound strongly in March (despite all the chatter about consumer sentiment collapsing thanks to Trump’s tariff policies). BofA’s omniscient analysts team were slightly less exuberant than consensus but still expected a big 1.2% MoM jump in the headline (and stronger than expected prints in core data).

Notably, before we dive into the data, this was before the real turmoil of Trump’s reciprocal tariffs hit.

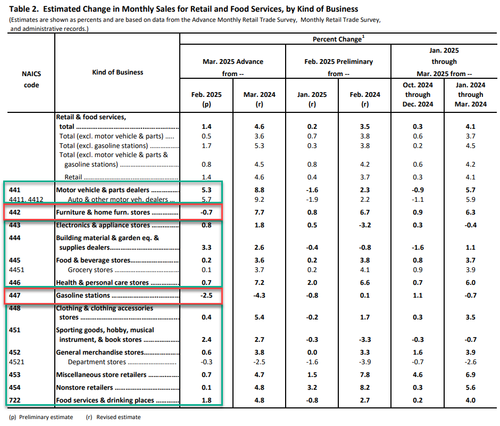

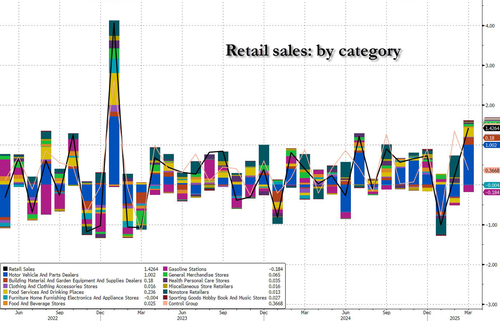

Following January’s plunge and February’s small rebound, March headline Retail Sales rose 1.4% MoM (as expected) – the biggest MoM jump since Jan 2023.

This raised the YoY sales rise to +4.6% – the highest since Dec 2023…

Source: Bloomberg

Ex-Autos, sales jumped 0.5% MoM (better than expected) and February’s print was revised dramatically higher.

Ex-Autos-and-Gas, sales also beat expectations (as BofA suggested), rising 0.8% MoM and also seeing a sizable upward revision for February.

Source: Bloomberg

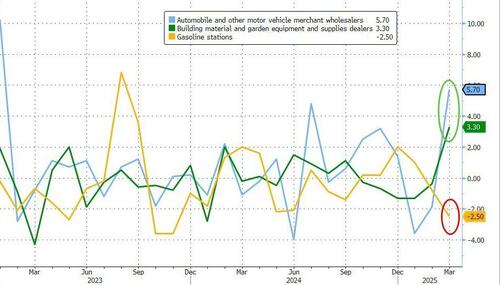

It appears there was a dramatic front-running impact in Autos buying (ahead of the Auto tariffs) and Building Materials (ahead of Canadian tariffs?). We also note that sales at Gasoline Stations tumbled (as gas prices dropped)…

Source: Bloomberg

Obviously the seasonals help to…

Source: Bloomberg

Adjusted roughly for inflation, real retail sales are up by the most in 3 years…

Source: Bloomberg

Of course this will be dismissed by the 'other’ as a one-off pre-tariff surge in spending… while we should take the word of respondents from UMich surveys about their view of inflation as holy writ of course.

Maybe they can shrug off the auto and recreation spending surge, but it’s hard to suggest that people piled into restaurants in some tariff front-running form?

In fact this surge makes sense if the Democrats in the UMich survey are truly expecting 6, 7, 8% inflation this year… they should be buying everything with both hands and feet!

Tyler Durden

Wed, 04/16/2025 – 08:43