The introduction of the widow's pension was to be a historical support for single seniors. However, for thousands of Poles the fresh benefit may prove to be a financial trap, which will deprive them of another key supplement – 14th retirement. The problem lies in a rigid income threshold, which has not been updated and combined with March valorization and fresh benefits, creates a paradoxical situation. In September, seniors whose material situation was to improve may experience painful disappointment by seeing a much smaller amount or a full deficiency of it. The “gold for gold” mechanics works relentlessly, and victims are those who have so far been able to trust on full support.

The ruthless threshold of PLN 2900. How does the “gold for gold” mechanics work?

The key to knowing who will lose the right to a full 14th retirement is the income threshold set for PLN 2900 gross. The regulation is simple: only seniors whose monthly pension benefit does not exceed this amount will receive a full of fourteen. Above this limit comes a mechanics known as ‘gold for gold’. This means that all pension zloty above the threshold of PLN 2900 gross reduces fourteen by precisely the same value.

In practice, if your pension is PLN 3000 gross, i.e. by PLN 100 more than the threshold, your 14th pension will be reduced by PLN 100. However, this simple mathematical action has serious consequences. As calculated by portal biznes.interia.pl, seniors receiving a benefit of around PLN 4800 gross (equivalent to approx. PLN 4050 net) completely lose the right to an allowance. These are not sums of wealth, yet the strategy classifys these pensioners as persons to whom no additional support should be provided. Arbitrically set threshold becomes a barrier to an expanding group of people.

March valorization became a trap. Higher retirement is simply a smaller 14

Paradoxically, this year's March value of benefits has become a financial curse for many seniors. Increase in pensions by 6.78%, although it was intended to improve the material situation, it actually pushed thousands of people above the threshold of full 14th retirement. In raising the benefits, the government forgot at the same time to valorize the threshold of PLN 2900 gross, which remained unchanged.

The effects are easy to predict. The pension, which before March received PLN 2,850 gross and qualified for the full fourteen, after valorization, its benefit increased to around PLN 3042 gross. As a result, his 14th pension will be reduced by PLN 142. alternatively of real improvement in the financial situation, the elder will feel a loss. This shows how inconsistent the strategy is – on the 1 hand the state gives a rise and on the another hand takes part of the additional benefit. The minimum pension increased from PLN 1780.96 to PLN 1878.91, but the threshold remained frozen, which makes it possible for less and less people to number on full support each year.

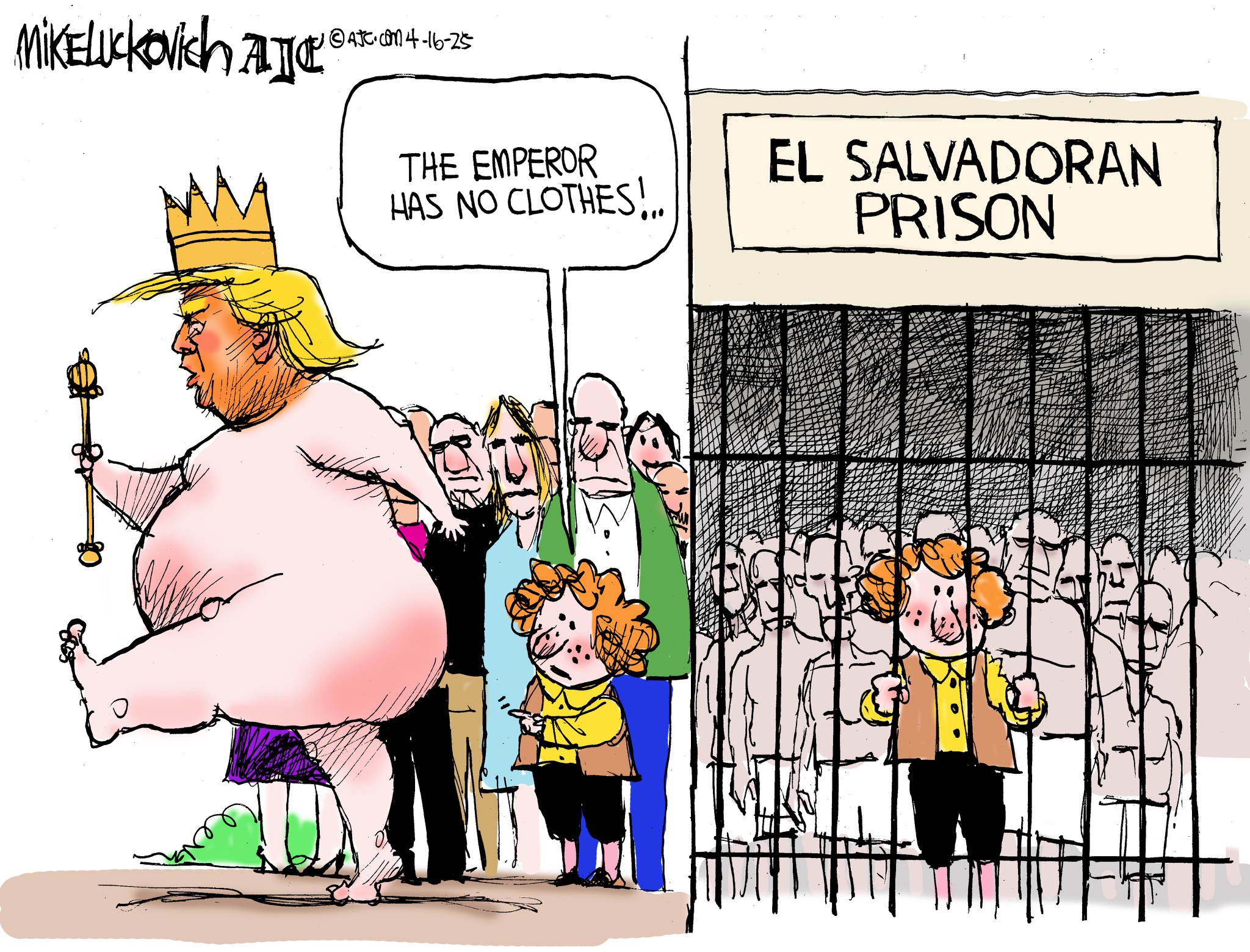

A widow's pension is simply a knife in the back? How a fresh benefit takes 14th retirement

Introduced in July widow’s pension This is 1 of the most crucial social reforms of fresh years to support those who have lost their spouse. Unfortunately, its construction is in direct conflict with the principles of granting 14th retirement. Seniors who decide to combine their own pension with part of the benefit after the deceased spouse will in many cases exceed the income threshold of PLN 2900 gross.

This is simply a classical example of how 1 government improvement can destruct the effects of another. Senior, who earns extra funds all period thanks to the widow's pension, simultaneously loses one-off but crucial support in September. Especially affected are those who have received fourteen for years, and now, after receiving a widow's pension, they will be deprived of it or receive it in a much lower amount. For example, a widow with a pension of PLN 2600 gross, who has received a full fourteen so far, after the addition of a widow's pension, her full benefit may increase to PLN 3200. This means that her 14th pension will be reduced by up to PLN 300. Although her income will increase annually, the September transfer will be a painful reminder of systemic inconsistencies.

These elder groups won't see any gold. Who's excluded from the definition?

Apart from the income threshold, there are groups of persons who are completely excluded from the right to a 14th pension, regardless of the amount of their benefits. The rules clearly state who can't number on extra money. These regulations consequence from the presumption that they receive sufficiently advanced or peculiar benefits from the State. The list of excluded includes:

- Judges and prosecutors at rest – their salaries are treated as advanced adequate not to request additional support.

- Winners of the biggest sporting events – Olympic medalists, Paralympics and planet championships who receive special, life-long benefits, besides do not qualify for fourteen.

- Persons with pre-retirement suspension – this applies to persons who have exceeded the profit limit, which has resulted in the suspension of the payment of their basic benefit at the date of examination of entitlement to fourteen.

These exemptions aim to direct aid to the most deprived, but combined with a rigid income threshold and a deficiency of valorisation of this threshold, the strategy is becoming increasingly complex and simply unfair for many seniors.

Continued here:

The government introduced a widow's pension. It's a 14th retirement trap for thousands of Poles