Quarterly Refunding: Treasury Will „Maintain” Auction Sizes For „Several Quarters”, May Boost Buybacks Size, Discusses Stablecoins As Source Of Bill Demand

In our preview of today’s quarterly refunding announcement we said to focus on three things: i) when will Treasury hike coupon sizes again, ii) if there will be any change to the language holding auction sizes steady for „at least” the next several quarters, and iii) will Bessent change the Treasury buyback program to a more activist exercise (similar to what Yellen did with her Activist Treasury Issuance strategy which boosted markets for 2 years as reverse repo drained). In retrospect, there were no big surprises, and in line with our forecast for $370BN in May gross offering, and $125BN in 3/10/30 quarterly refunding auctions…

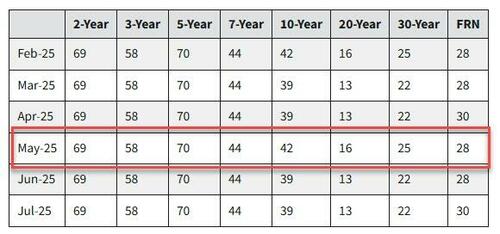

… the Treasury announced just that, revealing a $125BN refunding calendar, made up of the following:

- $58 billion of 3-year notes on May 5

- $42 billion of 10-year notes on May 6

- $25 billion of 30-year bonds on May 8

The refunding will raise new cash of about $30.8 billion. The balance of Treasury financing requirements over the quarter will be met with regular weekly bill auctions, cash management bills (CMBs), and monthly note, bond, Treasury Inflation-Protected Securities (TIPS), and 2-year Floating Rate Note (FRN) auctions, or visually:

The table above is a carbon copy of the one we laid out on Monday, so again, no surprises here at all.

With regard to TIPS, Treasury detailed the following adjustments for the February to April period:

- To increase the June 5-year TIPS reopening by $1 billion

- Boost the July 10-year TIPS new issue by $1 billion

More importantly there were no surprises in the Treasury’s forward guidance put in place iin January of 2024, as it kepts is language unchanged saying the „Treasury believes its current auction sizes leave it well positioned to address potential changes to the fiscal outlook and to the pace and duration of future SOMA redemptions. Based on current projected borrowing needs, Treasury anticipates maintaining nominal coupon and FRN auction sizes for at least the next several quarters.„

Dealers had expected that the Treasury would avoid ramping up longer-dated securities sales for now, in the face of a raft of uncertainties along with the constraint of the debt limit. Since the start of this year, the debt ceiling has left debt managers unable to boost the overall net supply of Treasuries, forcing them to deploy cash reserves and so-called special accounting measures to make good on payment obligations.

„The Treasury is in wait-and-see mode when it comes to debt management,” Santander economist Stephen Stanley wrote in a note ahead of the announcement. “The fiscal outlook is highly uncertain, with a huge tax-and-spending package making its way through Congress over the next few months,” and it’s not yet clear whether federal revenue will ramp up off the back of tariff hikes, or get hurt by an economic downturn, he said.

Stanley, along with many dealers, estimated that the Treasury wouldn’t need to resume boosting the size of note and bond auctions again until early 2026; of course, as a result of outsized fiscal deficits – which everyone agrees have to be slashed but everyone refuses to start doing it now – which are running at $2 trillion a year, mean most analysts see an increase as inevitable at some point.

Separately, some dealers had been on the lookout for any hints that Bessent may be leaning towards boosting the share of bills over time – setting aside past criticism of Yellen for doing just that. In response, the Treasury clarified that „until the debt limit is suspended or increased, debt limit-related constraints will lead to greater-than-normal variability in benchmark bill issuance and significant usage of CMBs” which was also expected. That question is what happens after the debt ceiling deal is reached some time in the late summer.

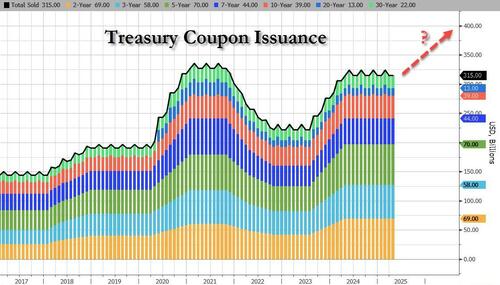

Turning to the big wildcard in today’s announcement, the expectations that Treasury Buybacks may be used more actively while the dormant Fed wakes up to stabilize the bond market, the Treasury advised that it’s “evaluating potential enhancements to its buyback program to better achieve its liquidity support and cash management goals.” As we noted previously, the surprising change comes after Treasury Secretary Scott Bessent earlier this month flagged that “we could up the buybacks” in case needed to address any tumult in the Treasuries market.

Specifically, this is what the Treasury said as it evaluates supplanting the Fed’s missing QT with treasury buybacks:

Given the success of the buyback program since its launch last year, Treasury believes it is an appropriate time to consider ways to improve its efficacy. Accordingly, Treasury will evaluate a broad range of possible enhancements such as: changes to maximum purchase amounts, buyback operation scheduling and frequency, security eligibility, maturity bucket composition, execution process, and counterparty eligibility. In considering these options, Treasury will be guided by the objective of financing the government at the lowest cost over time. Treasury is committed to engaging with a wide range of market participants, including the primary dealers and Treasury Borrowing Advisory Committee, to assess these potential enhancements to the buyback program.

US debt managers will be looking at potential changes to the maximum purchase amounts of their buybacks, along with the frequency of the operations and other details. The current buyback program kicked off last year, and is aimed at improving the liquidity of older securities along with helping smooth out the Treasury’s management of cash.

The Treasury also released its latest buyback schedule for the upcoming refunding quarter. As the schedule indicates, Treasury plans to conduct weekly liquidity support buybacks of up to $4 billion per operation in nominal coupon securities. In longer-maturity buckets, Treasury plans to conduct two operations, each up to $2 billion, over the refunding quarter. Treasury also plans to conduct two operations, each up to $500 million, in each of the TIPS buckets.

Turning to the next potential political scandal, namely the debt limit, the Treasury said that it has been using extraordinary measures to finance the government on a temporary basis. „The period of time that cash and extraordinary measures may last is subject to considerable uncertainty due to a variety of factors, including the unpredictability of tax receipts and the normal challenges of forecasting the payments and receipts of the U.S. government months into the future. Given this unavoidable uncertainty, Treasury is not able at this time to provide an estimate of how long its cash and extraordinary measures may last. We expect to provide an update during the first half of May after the majority of receipts from the April income tax filing season have been received.”

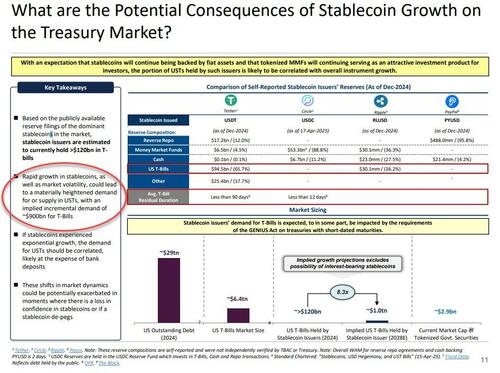

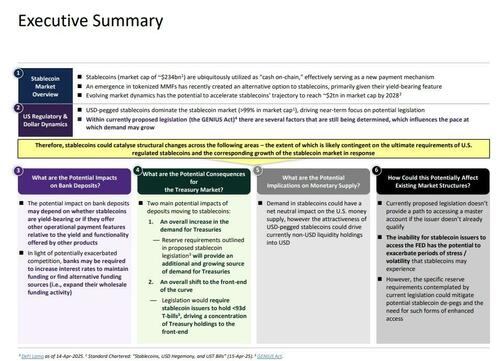

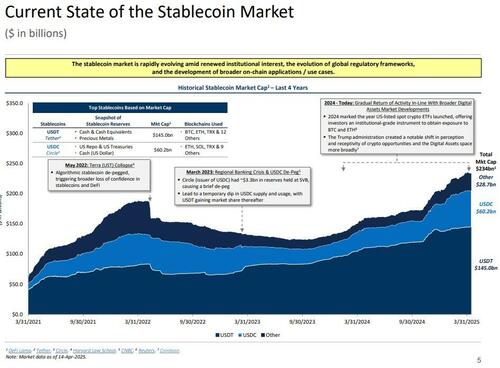

Perhaps the most stunning development is that the department has questioned dealers on the potential bill demand from stablecoins, in one possible indication officials are contemplating a structural change in the market. The minutes of a meeting of the Treasury Borrowing Advisory Committee, a panel of the most important bond market participants in the US, said that “dealers agreed that the digital asset space was important to monitor on an ongoing basis as a potential source of Treasury demand.” Here is the section at hand:

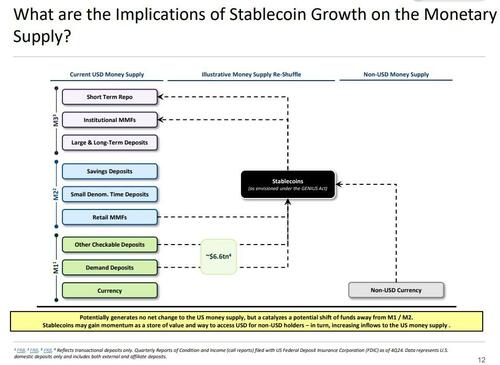

With the growth of the cryptocurrency and digital asset economy has come the expansion of the “stablecoin” market in the United States and abroad. As this asset class continues to grow, the distinctions between money funds and payment stablecoins has continued to converge. Some stablecoins are moving towards paying interest, money market funds are exploring tokenization, and Congress is considering explicitly defining what constitutes a collateralized dollar-backed payment stablecoin. Please articulate the terminal effects of interest-bearing stablecoins from a perspective of Treasury demand, USD hegemony, the expansion of dollar-backed payment stablecoins, and potential effects for insured depository institutions. Further, do tokenized money funds present a risk should they be allowed to compete with other payment or settlement instruments?

And the most notable highlight from the presentation: „Rapid growth in stablecoins, as well as market volatility, could lead to a materially heightened demand for or supply in USTs, with an implied incremental demand of ~$900bn for T-Bills.”

Some more slides from the stablecoin presentation:

The full stablecoin presentation is below (pdf link)

Much more in the full Refunding statement.

Tyler Durden

Wed, 04/30/2025 – 10:50