FORT WORTH- American Airlines (AA), based in Fort Worth (DFW), Delta Air Lines (DL), headquartered in Atlanta (ATL), and United Airlines (UA), based in Chicago (ORD), have each taken very different paths in how they configure and deploy their long-haul widebody aircraft.

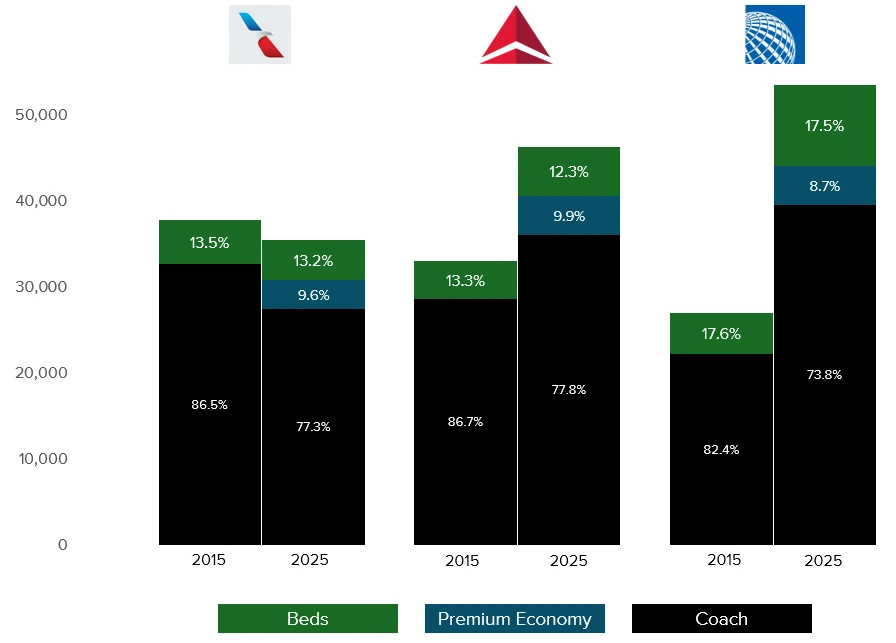

Between 2015 and 2025, all three carriers introduced a premium economy class. But beyond that shared move, the similarities end. Fleet size, seat counts, and the proportion of premium cabins have shifted in very different ways — with real strategic consequences.

Photo: Aero Icarus | Flickr

Photo: Aero Icarus | FlickrAmerican, Delta, and United’s Long Haul Strategy

Let’s break it down. The analysis by Cranky Flier shows legacy airlines’ widebody aircraft and counts the total number of installed seats in each cabin: business class (flat-bed “Beds”), premium economy, and coach. It doesn’t reflect where these aircraft fly or how often — just the physical configuration of each fleet.

The chart below illustrates the seat mix for each airline in 2015 and 2025. The black bars represent coach, green represents lie-flat business class seats (“Beds”), and blue shows the newer premium economy cabins.

Photo: Cranky Flier

Photo: Cranky FlierAmerican Airlines Shrinks Its Widebody Footprint

American Airlines (AA) has actually reduced the total number of widebody seats in service. In 2015, the carrier had roughly 38,800 widebody seats. By 2025, that number drops to just over 35,300.

The main reason: aggressive fleet simplification during the pandemic. American permanently retired its entire Airbus A330-200, A330-300, and Boeing 767-300ER fleets. That’s a combined 69 aircraft removed from service. Although it added two more Boeing 777-300ERs and expanded its Boeing 787 fleet, it wasn’t enough to offset the retirements.

American’s Boeing 787-8s are particularly light on premium seats. In their current layout, they carry only 20 business-class seats. That makes them difficult to configure with both premium economy and a competitive number of lie-flat beds without eating into coach capacity.

Here’s the result:

- Business class as a share of total widebody seats fell slightly from 13.5% to 13.2%.

- Premium economy now makes up 9.6% of the total, mostly carved out of business class rather than coach.

American’s widebody seat count is smaller, and its premium mix is less aggressive than its peers.

Delta Air Lines Airbus A50 with 100 Years Livery | Photo: Clément Alloing

Delta Air Lines Airbus A50 with 100 Years Livery | Photo: Clément AlloingDelta Air Lines Adds Capacity, Cuts Business Share

Delta Air Lines (DL) has gone in the opposite direction on capacity. The airline increased its total widebody seat count from roughly 33,000 in 2015 to more than 46,000 in 2025.

This growth came from two brand-new fleets: the Airbus A330-900neo and the Airbus A350-900. Together, they account for 75 aircraft, none of which existed in Delta’s fleet ten years ago.

Delta retired its Boeing 747s and Boeing 777s, but kept its international Boeing 767-300ER fleet relatively stable. Most of those 767s have now been reconfigured with premium economy. A few remain in the older high-business-class layout for specific routes like New York (JFK) to Prague and San Francisco (SFO) to JFK.

Even with more airplanes and more total seats, Delta’s percentage of business class seats fell from 13.3% to 12.3%. The main reason is how it chose to configure its new A330-900neos and A350-900s. These aircraft carry fewer business class seats as a percentage of total capacity than the older widebodies.

Delta is now retrofitting its A350s to increase business class capacity from 32 to 40 seats, which should lift that percentage back up.

Photo: Clément Alloing

Photo: Clément AlloingUnited Airlines Doubles Down on Premium

United Airlines (UA) has grown the most — by far. In 2015, it had the fewest widebody seats among the Big Three, just under 27,000. By 2025, it will surpass 53,000 seats, the largest widebody seat count of any US carrier.

What’s more impressive is how it maintained a high percentage of business class seats while adding premium economy. In 2015, business class made up 17.6% of the total. In 2025, it still holds at 17.5%, even with premium economy now taking up 8.7%.

A major factor: the reconfiguration of 24 Boeing 767-300ERs into premium-heavy aircraft, each with 46 lie-flat business class seats. These aircraft operate high-yield transatlantic routes, especially to London (LHR), and are internally known as “the London chariots.”

United’s Boeing 787-9 fleet (45 aircraft) also plays a big role. While its Boeing 787-8s and 787-10s have smaller business cabins, those fleets are relatively small.

United’s strategy has been consistent. Even in 2015, before premium economy was introduced, its widebody fleet carried a higher share of business class seats than its competitors.

Photo: JFK Spotting

Photo: JFK SpottingWhat This Means for the Market

Each airline has aligned its cabin strategy with a different view of demand:

- American Airlines (AA) chose fleet simplification and a conservative premium mix. It now lags in both total seats and premium share.

- Delta Air Lines (DL) added significant capacity and leaned heavily into premium economy, but reduced business class share. It’s now adjusting course.

- United Airlines (UA) expanded its fleet aggressively and preserved a high percentage of business class seats. It built aircraft specifically designed for premium-heavy markets.

These choices reflect different assumptions about what long-haul passengers want and what generates the best returns.

United’s premium-forward strategy appears to be paying off in financial performance. Delta is making changes to rebalance its cabins. American seems comfortable with its current mix, even if that means a smaller footprint and fewer premium seats.

Stay tuned with us. Further, follow us on social media for the latest updates.

Join us on Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News

American, Delta, United Airlines Silently Charging Solo, Business Travelers Higher Fares

The post American, Delta and United Airlines Unique Long-Haul Strategy in 2025 appeared first on Aviation A2Z.