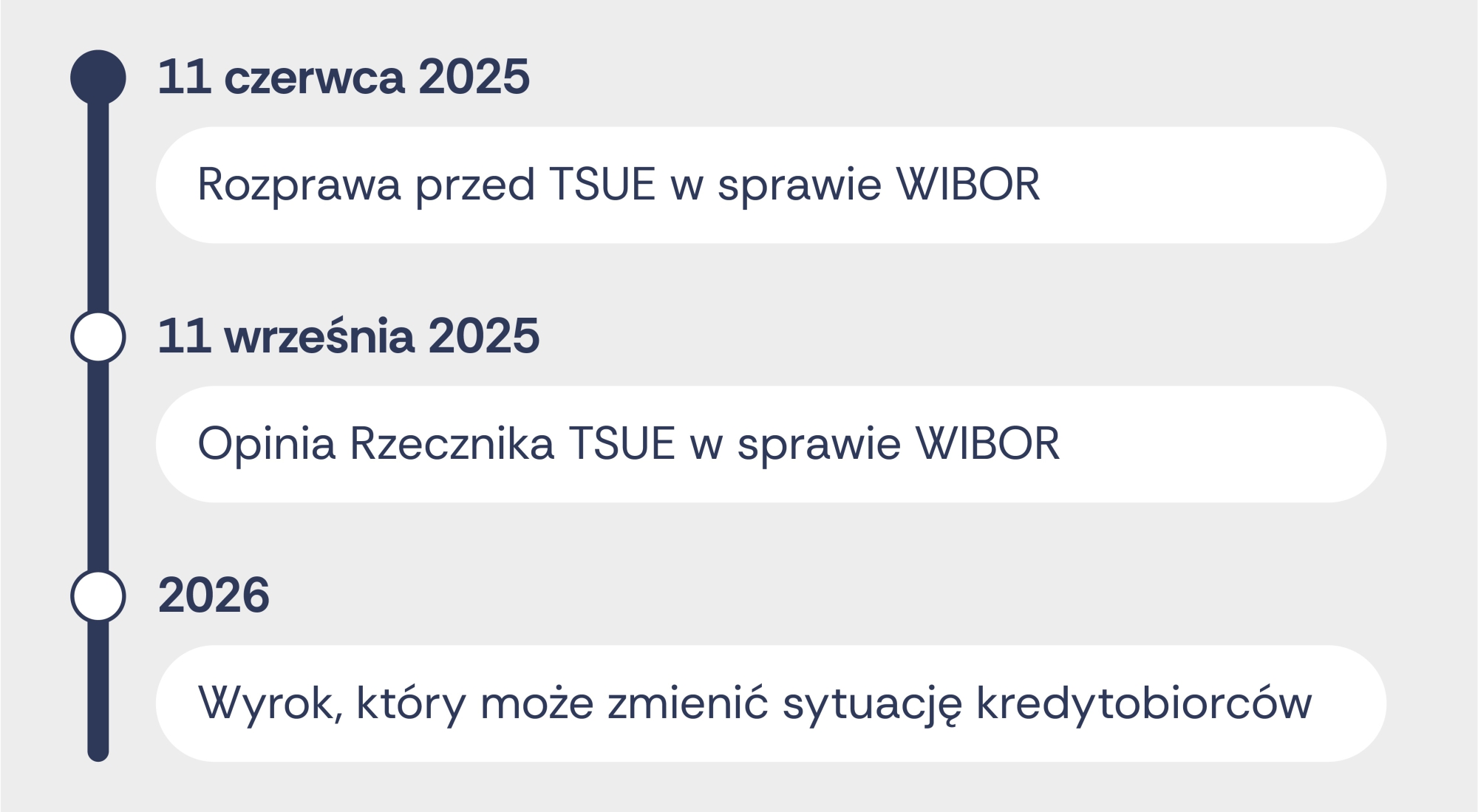

Following the June proceeding before the TEU and before the September Opinion of the Advocate General of the TEU, the case concerning WIBOR-based credit agreements enters a crucial phase. There are many indications that we may be dealing with a replay of the script that launched the celebrated Franc case of the Dziubak State (C-260/18).

WIBOR (Warsaw Interbank Offered Rate) is the basis for the interest rate on most mortgages and consumer loans in Poland. It is based on bank estimates of the amount of interest at which they are willing to lend each another funds alternatively than real transactions.

On 11.09.2025. The Advocate General of the Court of Justice of the European Union (TEU) has been given an opinion on the WIBOR variable interest rate, which may be of crucial importance for gold-credit holders based on this indicator.

A breakthrough just around the corner?

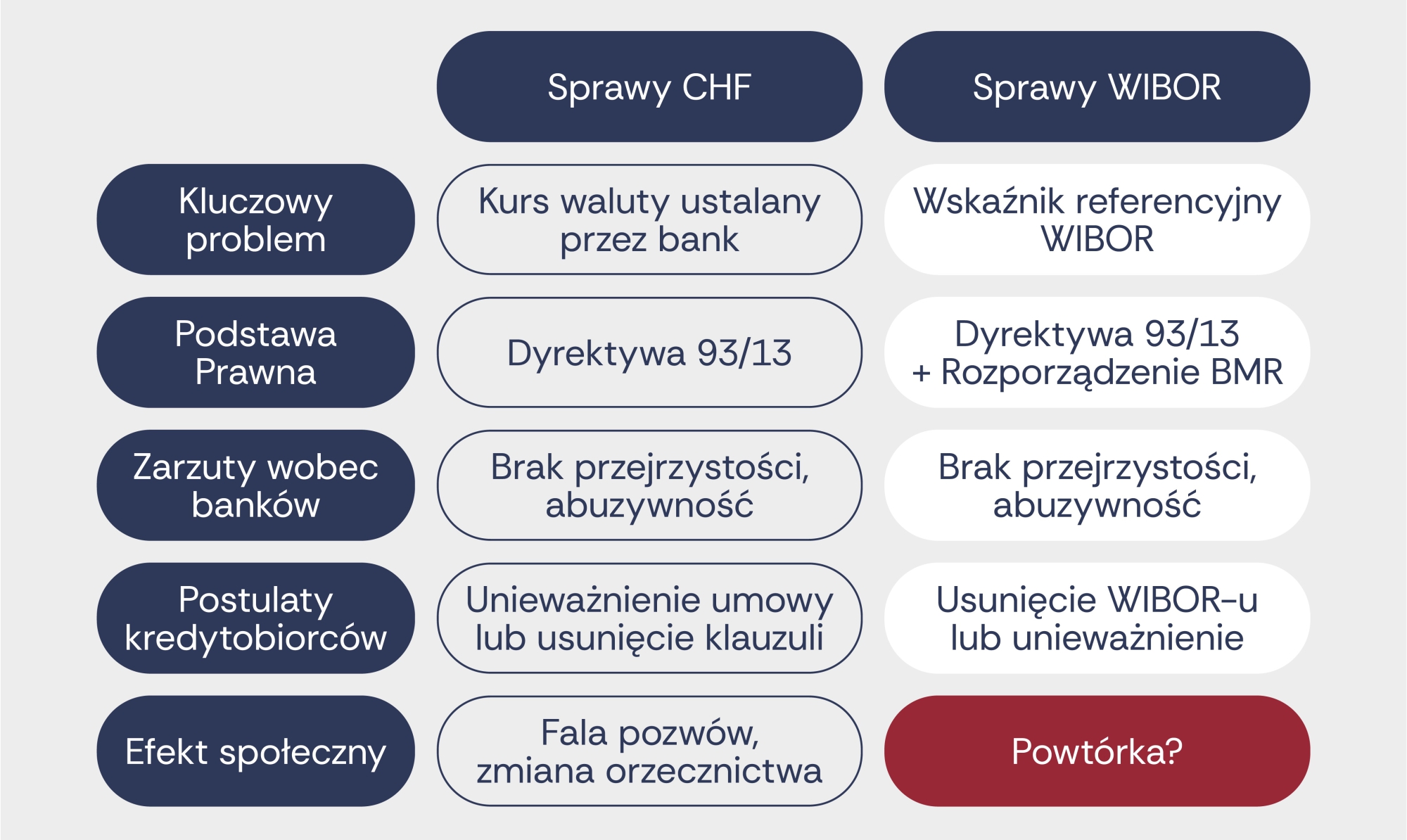

The WIBOR case has many points in common with what happened earlier with the FFT loans:

In August 2018, the Warsaw territory Court referred a preliminary question to the TEU. On 19.02.2019 the first proceeding was held before the TEU, and on 14.05.2019 the opinion of the Advocate General of the TEU was issued. The consequence was a landmark judgement of the CJEU of 03.10.2019, in which the CJEU indicated that if clauses in the franc agreement are unfair and are prevented from executing the contract, the consumer may request the cancellation of the full credit agreement.

Where are we on WIBOR?

At the heart of the dispute, the question is whether national courts may consider clauses referring to WIBOR to be unfair if transparent information about variable interest hazard is not provided to the consumer.

The situation is very akin to the phase at which they were frankovists in May 2019 – just before the breakthrough. The Ombudsman’s opinion may find whether courts will have grounds for:

- recognising WIBOR records as unfair,

- eliminating WIBOR from the contract (with a margin left),

- and even cancel the full credit agreement.

For banks, this would mean a serious financial risk, for borrowers, a chance for lower instalments and reimbursement of overpayments.

Our firm keeps an eye on the improvement of this case. Following the publication of the opinion of the TEU, we will print a discussion and present possible scenarios. We encourage all Gold borrowers to track our updates – this could be the beginning of large changes.

If you request professional and comprehensive legal assistance delight contact:

analysesed== sync, corrected by elderman ==

Law Firm Saturday Yachtira – Legal advisor to Wrocław