Unprecedented Surge In Swiss Bullion Imports Sends US Trade Deficit To Record High In January

The US trade deficit widened to a record in January as companies scrambled to secure goods from overseas before President Donald Trump imposed tariffs on America’s largest trading partners.

The gap in goods and services trade widened 34% from the prior month to $131.4 billion, Commerce Department data showed Thursday. The deficit was larger than all but one estimate in a Bloomberg survey of economists.

Source: Bloomberg

The value of imports rose 10% to a record $401.2 billion, while exports increased 1.2%. The figures aren’t adjusted for inflation.

Canada’s trade surplus with the US jumped to a record at the start of the year, driven by exports of cars, auto parts and oil, separate data from Statistics Canada showed Thursday.

But, perhaps most notably, the January flurry of imports was broad and included a surge in inbound shipments of industrial supplies and materials.

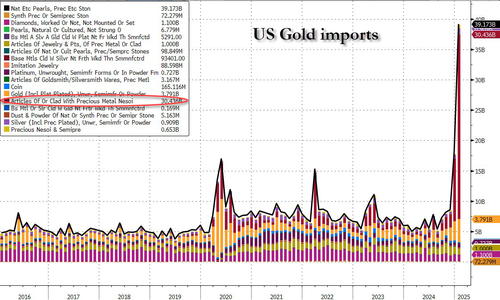

Within that category, imports of finished metal shapes that include gold bullion jumped $20.5 billion, marking a a second month of steep increases.

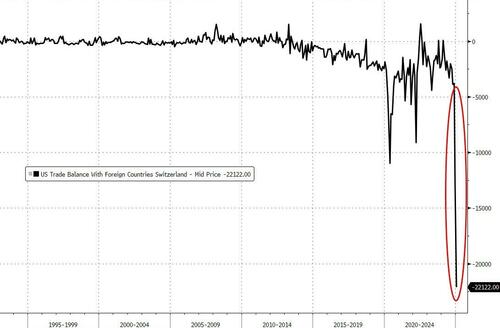

For an even clearer picture of the magnitude of the shift in bullion imports, we note that the Swiss trade deficit (where all that bullion is coming from) rocketed higher (an order of magnitude from historical norms)…

As we detailed here, while everyone has been distracted by talk of the tariff-driven arbitrage between COMEX and LBMA (London)…

Nothing stops the gold train.

And there it is: gold parked at comex vaults just hit an all time high of 39.7mm oz, surpassing the post-covid panic high…. and instead of slowing down, deliveries are again accelerating! Every day, the big bank shorts get closer to default. https://t.co/QbudVZepTk pic.twitter.com/u9Ijgm5Ati

— zerohedge (@zerohedge) March 6, 2025

…it appears Americans have been buying bullion direct from the Swiss.

Dear Switzerland, thank you for the gold avalanche. Oh, and all those who incorrectly claimed the physical gold scramble is just „tariff arbing” London and New York, good luck quietly deleting your posts pic.twitter.com/89rhAz7ECT

— zerohedge (@zerohedge) March 6, 2025

We do note that there is some speculation that this massive surge in bullion imports from Switzerland to US could be an effort to 'refill’ Fort Knox as America’s gold depository has come under scrutiny in recent months.

Obviously, by pure math, this is not good at all for Q1 GDP (as we already saw The Atlanta Fed’s GDPNOW forecast crashing). However, complaining about a decline in GDP due to massive imports of precious metals seems ironic at the very least.

Liesman explaining why soaring gold imports hit GDP lower by 3-4%

Discussed here three days agohttps://t.co/Un8ObwxdJB

— zerohedge (@zerohedge) March 6, 2025

Furthermore, with tariffs now in place, the 'front-running’ is over and the trade balances (imports) will adjust accordingly.

Tyler Durden

Thu, 03/06/2025 – 08:51

![BOCHNIA. Zmiana na stanowisku I Zastępcy Komendanta Komisariatu Policji w Nowym Wiśniczu [ZDJĘCIA]](https://bochniazbliska.pl/wp-content/uploads/2025/03/400-130451-1.jpg)