Ugly JOLTS Shows Most Unemployed Vs Job Openings; Plunge In Hiring And Quits

One month ago, before that catastrophic August jobs print (and first negative monthly print in years) and before the devastating 911K negative payrolls revision, we looked at the just published very ugly JOLTS report and correctly predicted the September rate cut (and also subsequent easing). Of note, the report showed not only that job openings plunged and came below the lowest estimate, but that for the first time since April 2021, there were more unemployed workers than job openings.

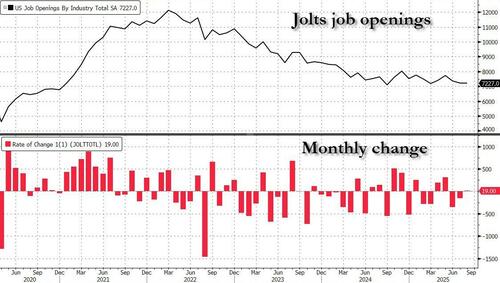

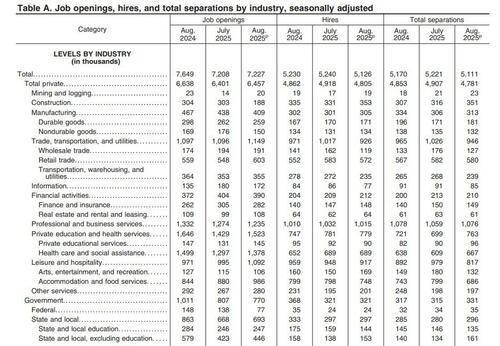

Fast forward to today when the already ugly labor market picture got even uglier, when moments ago the BLS reported the latest, August, JOLTs report (which may very well be the last Federal labor market report for a long time once the government shuts down at midnight tonight) and which showed that job openings remained depressed, if rising modestly from the upward revised July print of 7.208MM (up from 7.181MM), to 7.227MM, and beating muted estimates of 7.2MM.

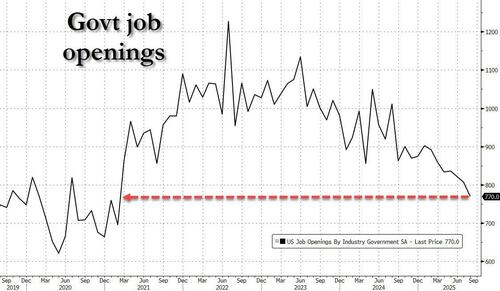

The number of job openings decreased in construction (-115,000) and in federal government (-61,000).

Indeed, as shown in the chart below, the best news about today’s report is that ahead of the government shutdown which will lead to mass government worker layoffs, the number of government job openings was already the lowest since Feb 2021.

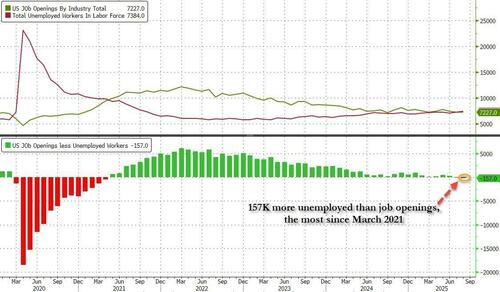

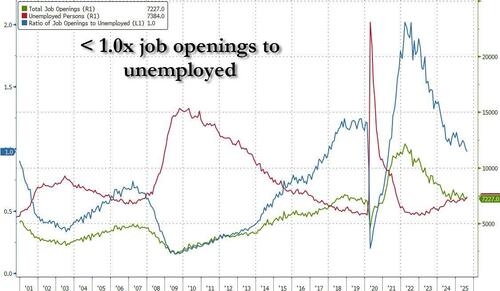

In the context of the broader jobs report – which may or may not print this Friday – the most important data was what we predicted ahead of today’s JOLTS report, namely that the number of unemployed workers is now greater than job openings.

JOLTS to show the most number of unemployed vs job openings since March 2021 as labor market becomes most demand constrained in 4 years

— zerohedge (@zerohedge) September 30, 2025

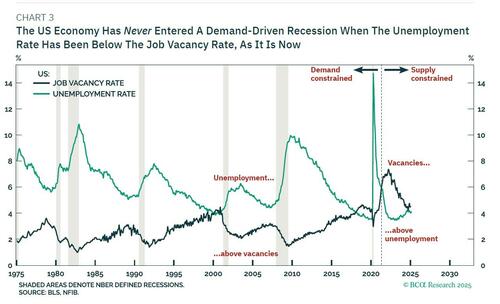

And sure enough, after four years of the US labor market dodging the bullet, its luck has finally run out because whereas in June the labor market was still supply-constrained, when there were 342K more openings than jobs in the US, in July we are finally back to demand constrained, with 28k fewer job openings than unemployed workers, the first negative print this series since April 2021. One month later, it’s gotten much worse, with 157K more unemployed than job openings, the highest differential since March 2021.

As we discussed previously, The US never entered a recession in a period when there were more job openings than unemployed workers (i.e. the job market was supply constrained). As of this moment, we know it is no longer supply constrained and is instead demand constrained.

Said otherwise, in August the number of job openings to unemployed dropped further below 1.0x, after spending the past 4 years above it.

While the job openings data was ugly and potentially the first harbinger of the coming recession – things were even uglier below the surface, starting with hiring where the number of new hires tumbled by 114K to 5.126MM the lowest since June 2024, while at the same time the number of people quitting their jobs – also known as the take this job and shove it indicator – also slumped by 75K to 3.091MM, the lowest of 2025.

How to make sense of this ongoing deterioration in the labor market?

Well, as we said last month, it likely has to do with the DOL – which recently lost its previous commissioner after Trump fired her two months ago – starting to factor in the collapse in the shadow labor market, the one dominated by illegal aliens, and the replacement of illegals with legal, domestic workers which in turn is pushing the labor market into a demand-constrained imbalance. Last month we said „the question is how long until this appears in much weaker than expected payrolls prints” and we got the answer just two days later when we got a truly catastrophic jobs report, which was then cemented by the full year revisions on Sept 9 which we correctly predicted would show „another 600K-900K in jobs that were never there and were simply imagined by the Biden DOL, in the process greenlighting not only a 25bps rate cut, but potentially a jumbo 50bps… just like exactly one year ago.”

It ended up being 911K, but what is more important for today is that today’s JOLTS report was not terrible but it certainly was ugly enough to ensure that the Fed cuts in three weeks time if the government shuts down tonight and is closed indefinitely, preventing the Sept jobs report from being published this Friday.

Tyler Durden

Tue, 09/30/2025 – 10:43