In the landmark judgement of 19 June 2025 (C-396/24), The Court of Justice of the European Union challenged the common practice of banks in Poland, which, after the cancellation of the credit agreement, demanded repayment of the full amount of capital, without account being taken of payments made by consumers. The ruling strengthens the position of Frankoviches and can importantly influence the procedural strategy of the banking sector. Our expert comments on the verdict Cornel Kamienik, Legal advisor at the Chancellery of Yacht Saturday.

The fresh ruling of the EUSEU in Case C-396/24 – an crucial change for the Frankoviches

In the judgement of the Court of Justice of 19 June 2025 in Case C-396/24 We read: the banks cannot claim repayment of the full amount of capital without taking account of the payments made to the consumer and regardless of the amount outstanding, as follows from Article 7(1) of Council Directive 93/13/EEC of 5 April 1993, stressing that ‘in the case of unfair terms in consumer contracts, it must be interpreted that: it precludes national jurisprudence, according to which, where the condition of a credit agreement declared unfair leads to the annulment of that contract, the trader has the right to require the consumer to reimburse all the nominal amount of credit granted, irrespective of the amount of the payments made by the consumer in the performance of that contract and regardless of the outstanding amount’.

At the outset, before we proceed to clarify the Court's judgement for the practice of Polish jurisprudence in franc matters, it is worth briefly recalling 2 concepts of clearing invalid credit agreements.

Procedures for clearing invalid credit agreements

- The explanation of 2 conditionings – assumes that the consumer and the bank may claim their claims independently: the consumer is entitled to reimbursement of the sum of all payments made and the bank is entitled to reimbursement of all the credit capital paid;

- balance theory – assumes that the common claims are settled: if the consumer has paid the bank little than he has borrowed, he must pay the difference if the bank has received repayments higher than he has paid, then he returns the overpayment.

Bank practice not in line with the EU Directive

The common practice in Poland is that banks request the francoquis after the cancellation of the agreement to reimburse the full amount of credit. The Court found that specified practice violates EU consumer protection Directive 93/13. This is simply a very crucial change as the courts will no longer be able to charge banks the full amount of capital without taking account of the repayments made by the borrower.

Supreme Court case law versus the TEU position

According to the resolution of the full composition of the civilian Chamber of the ultimate Court of 2021 (III CZP 11/21), the courts ruled that banks have the right to a separate claim for reimbursement of the full amount of the debt capital paid. specified rulings do not consider how much credit has already been paid. In its current judgment, the TEU concluded that specified a mechanics puts consumers at a disadvantage and defined them as contrary to European Union law.

Judgment of the EU Court of Justice and possible changes in bank procedural strategies

Many commentators point out that the conviction marks a control to balance theory. However, this seems to be a hasty interpretation.

The case dealt with by the TEU afraid the explanation of Council Directive 93/13/EEC of 5 April 1993 where the bank made a claim against the consumer, alternatively than the other. The judgement so states first of all that it is the bank (the entrepreneur) that must not request more than an unpaid share of the capital. The other takes the sense of EU protection against unfair contractual terms. In its ruling, the CEU did not contradict the earlier guidelines (e.g. C-28/22) on consumer rights and did not indicate that consumers could not claim the bank's full repayments by credit. Consumers can so proceed to request reimbursement of the full amount paid back with interest.

Action of banks after judgement – deductions and settlement proposals

In view of the above, the banks, in their current position, may be exposed to dismissing their claims, in which the full amount of capital comes. A change in bank strategy is so expected, for example by making offsetting statements or more actively proposing settlements. The deduction declaration should be preceded by a call for payment sent to the client in which he will be called upon to pay an amount equal to the outstanding amount of the debt capital. The bank should then make a message to the client on the deduction of common claims, i.e. the settlement of the sum of all the debt instalments due to the client with the amount of capital paid.

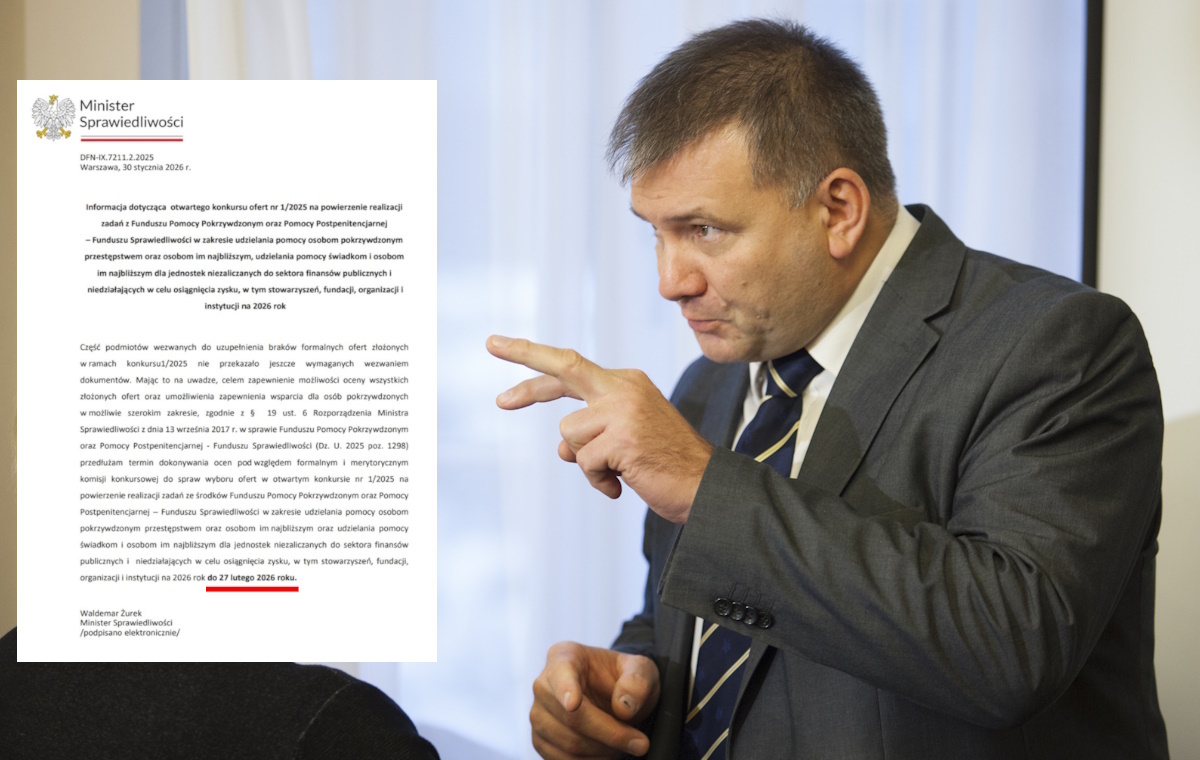

The Ministry of Justice has already announced that it will adapt the draft law on peculiar arrangements for the designation of cases relating to contracts concluded with consumers of a denominated credit or indexed to a Swiss franc to judgement C-396/24.

Summary

It follows from the judgement in question that:

- The Court did not deny its earlier rulings, the explanation of 2 conditionings is inactive valid,

- banks must take account of the repayments of consumers and may no longer require repayment of all capital after the cancellation of the credit agreement,

- a change in bank strategy is expected in the close future by deducting claims or proposing settlements.