The Autopen And The Sword

By Michael Every of Rabobank

This week already saw President Trump announce that as President Biden used an autopen on controversial blanket pardons, these are now void. That starts a political firestorm, could prompt an investigation into the process around those pardons and, again, may end up with the Supreme Court. But from the autopen to the sword – which remains pointed at markets.

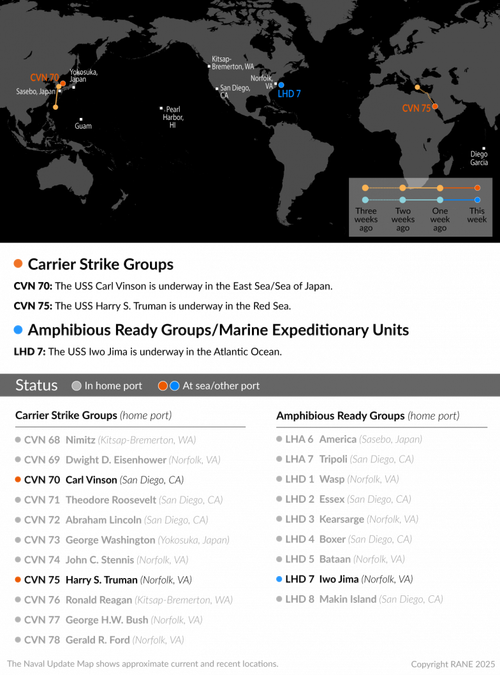

President Trump has warned Iran further attacks by the Houthis could mean attacks on it too. There are now unconfirmed rumours three US carrier strike groups and up to 35 ships in total will head to the Middle East – though actual deployment has yet to happen.

If so, it ups the ante there massively, just as Israel restarts attacks on Hamas after its refusal to hand over remaining hostages (and, in the background, the US reportedly agreed to an Egyptian proposal to rebuild Gaza without Hamas, with a local price tag of $50bn). A direct US attack on Iran is still a tail risk for now, but the Houthis may be about to find out what an operation to guard prosperity really looks like.

Presidents Trump and Putin will speak today about a ceasefire in Ukraine. Moreover, a Trump-Xi summit in the US is being floated. And when does ‘Rocket Man’ get another call?

Can you spot a pattern here? If not, you should. The US, pen in one hand and sword in the other, is looking for a new modus vivendi with the axis of Russia, China, Iran, and North Korea – on its terms. How they hold respond remains to be seen. That highest-stakes, highest-risk, highest-reward Great Game is the defining feature of our present, and future, global environment. Everything else is just a sub-set of it.

On Ukraine, the UK is promising to send peacekeepers for “as long as it takes.” Critics point out its traditionally naval-based armed forces are in no condition to sustain deployment in size for any length of time, nor to scale up should they *not* be able to keep the peace. The cost of being able to do entails far more than cost-cutting via closing a quango, curtailing some civil servants’ state credit cards, and cutting disability benefits.

In Europe, today should see Germany’s debt brake come off so it can rearm, as the European Commission considers a fresh €40bn arms package for Ukraine. While there is no guarantee Europe is about to rearm itself appropriately for the geopolitical environment it is in, what might be needed is clear: the leader of the European People’s Party in the EU parliament is calling for a “war economy” –which Russia has– where civilian production is converted across to the military.

Focusing only on near-term news like the German IFO Institute now expecting GDP growth of just 0.2% in 2025, down from 0.4% in January, tells you nothing at all about what next year might bring. Or, looking at the Middle East, next month.

Indeed, swords, wielded or rattled, are also deep in trade news, an area we delude ourselves is only about the pen:

- The EU, opposed to US tariffs, may impose its own tariffs on aluminium the US won’t take to protect the EU industries needed for rearmament – which is also the US argument;

- US Trade Representative Greer is to take greater charge of the tariff process, with a return to asking firms for input before announcing them via social media… but the 2 April big reciprocal tariff day still looms;

- US-EU trade tensions are likely to rise as Trump backs “BEAUTIFUL, CLEAN COAL”, putting the US, Chinese, and Indian economies –and Germany’s when it has to– in the coal camp;

- Germany’s BMW will integrate Huawei’s tech into its locally produced new models in 2026. For some, that’s an equally critical with-us-or-against-us political choice;

- Ukraine is warning the EU, “If you won’t sort out our trade relationship, there will be consequences.” Its duty-free access to the EU market expires in June but its goods have been blocked by Hungary, Poland, and Slovakia. The weaker Ukraine’s agri economy is, the less money it has to spend on its military, and so the more it ends up costing Europe (alone) to support it; and

- New Zealand started FTA discussions with India, as the Kiwi PM also agreed to deepen political, cultural, and defence and security ties, showing economic prosperity and national security are now linked and pure FTAs are out.

Broader aspects of the economy and markets than ubiquitous cries of ‘tariffs!’ are also being sucked into this geopolitical vortex.

Elon Musk tells Senator Cruz there are 14 government “magic money computers” that “just send money” automatically. That sounds like a crash course in the Cantillon effect and/or MMT; and on what crashes can occur when you suddenly stop both.

The US is proposing changing how it measures GDP to exclude state spending. That worries markets who ‘need to know what’s going on in the economy’. The same markets who don’t have an issue with very questionable GDP from some other sources; nor with GDP not capturing the key issue Western economies now face (i.e., what is supplied, not consumed); and who don’t ask the key question, “What is GDP *for*?”

Foreign Policy magazine asks, ‘Will Trump Use the Federal Reserve as Leverage, Too?’, and warns, “When the next crisis hits, global markets may not be able to count on America’s financial backstop.” The argument is that Fed swaplines will be weaponised for geopolitical ends: and, indeed, why wouldn’t that current Fed autopen be used as a sword? “Because markets?” Please!

Those who take White House anti-establishment arguments seriously can join the dots to see something no Fed Dot Plot does. For example, how the US might instate a 30% withholding tax on interest for foreign holders of US securities to dissuade capital inflows, forcing a narrowing of its trade deficit in tandem; or use its new Sovereign Wealth Fund to push US capital into other economies, also meaning the US current account narrows (and then tariffing those who refuse US capital inflows).

Some ignore or dismiss these ideas because such things won’t happen or aren’t worth thinking about in advance: as was heard in advance of the Global Financial Crisis, negative interest rates, Brexit, Trump’s first win, a US-China Cold War, the Russian invasion of Ukraine, the effective closure of the Suez Canal, the end of the US security guarantee for Europe, and sudden European rearmament.

It’s the start of a two-day Fed meeting today. One wonders how much of this backdrop they are paying attention to.

Of course, the simple answer is rates on hold for now –see our Fed preview— and many could write that with an autopen at the moment; the Fed probably will.

However, where the sword is pointing to later is arguably of far greater importance.

Tyler Durden

Tue, 03/18/2025 – 10:25