Retail Speculation Is Back With A Vengeance

Authored by Lance Roberts via RealInvestmentAdvice.com,

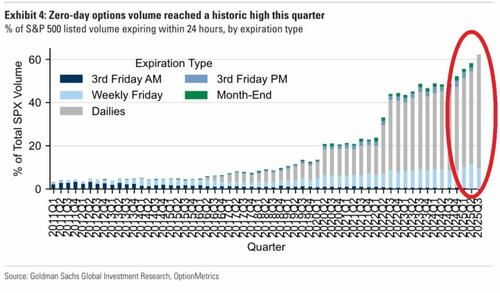

Retail speculation is once again gripping the markets. A recent Wall Street Journal article highlighted how the latest retail gambling vehicle—zero-days-to-expiration (0DTE) options—has exploded in popularity. According to CBOE, trading volumes in these contracts have surged nearly sixfold over the past five years, with retail traders now accounting for more than half of all transactions. This rapid rise in speculative options trading has intensified since 2020.

This is more than a quirky market statistic. It’s a glaring warning sign of rising risk-taking behavior among retail investors. History consistently shows that markets peak when the average investor starts chasing lottery-like returns. Options, by design, are speculative instruments used to hedge risk or make directional bets. However, the explosion in 0DTE options points to a significant behavioral shift from investing to outright gambling.

One of the most visible examples of this shift is Robinhood. The brokerage earns four times more revenue from options trading than traditional stock commissions, while its stock price has soared over 300% in the past year. The speculative fervor isn’t limited to options; we continue to see it in meme stocks, cryptocurrencies, and high-flying tech names. The appeal is easy to understand—0DTE options offer the illusion of life-changing returns for a small upfront cost. Unfortunately, the reality is far harsher. Most retail traders lose money, often spectacularly. While market makers like Citadel Securities collect billions in profits, the average investor learns, too late, that leverage cuts both ways.

Retail Speculation & the Perils of Leverage

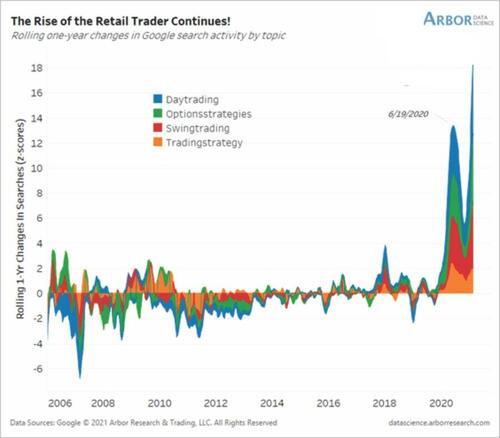

This cycle of retail speculation is nothing new. In early 2021, just months before the market corrected in 2022, we noted how inexperienced retail investors were rushing into markets. In a piece titled “Long On Confidence And Short On Experience,” we highlighted how retail traders exhibited high confidence without the experience to manage risk appropriately. Online searches for terms like “how to trade stocks” surged, echoing similar speculative periods of the late 1990s and mid-2000s.

“In a “market mania,” retail investors are generally “long confidence” and “short experience” as the bubble inflates. While we often believe each ‘time’ is different, it rarely is. It is only the outcomes that are inevitably the same. A recent UBS survey revealed some fascinating insights about retail traders and the current speculation level in the market. The number of individuals searching “google” for how to “trade stocks has spiked since the pandemic lows.”

For anyone who has lived through two “real” bear markets, the imagery of people trying to learn how to “daytrade” their way to riches is familiar. From E*Trade commercials to “day trading companies,” people left their jobs to trade stocks.

From the dot-com bubble to the meme stock mania, the behavior has remained the same. Retail traders feel invincible in rising markets, convincing themselves that the more risk they take, the more money they’ll make. As we noted then, young investors were even taking on personal debt to invest, a behavior not seen since the tech bubble of 1999, when traders used credit cards and home equity loans to speculate on stocks. Of course, these episodes ended similarly, with many small investors wiped out when markets corrected.

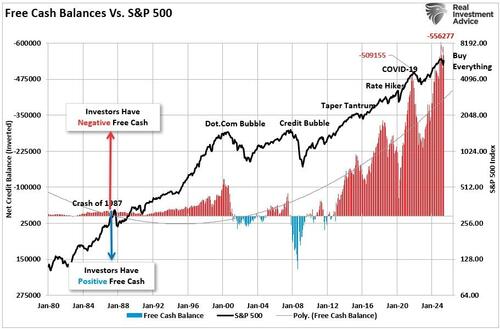

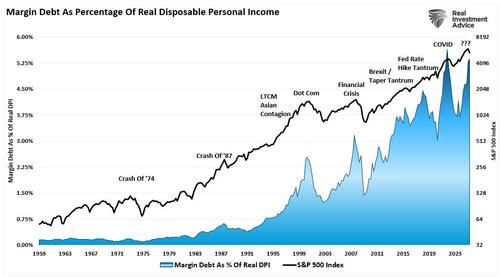

Speculation in risky stocks is one thing, but speculation combined with leverage turns ordinary pullbacks into major corrections. Today, we see excessive leverage building up across markets. Margin debt is again climbing toward record highs, and free cash balances among investors have fallen deep into negative territory.

This is a dangerous setup. When investors run out of disposable income, they borrow to buy more stock. Margin debt relative to disposable personal income has historically peaked before major market downturns. Adding to the risk, many investors are piling into 2x and 3x leveraged ETFs while speculative call options massively outweigh protective puts. These dynamics create a fragile market structure. Rising prices fuel more leveraged buying, which pushes markets higher in a feedback loop. But when selling starts, the loop reverses—margin calls kick in, forced selling accelerates, and liquidity evaporates, causing sharp market downturns.

We’ve seen this happen repeatedly: the Volmageddon crash in 2018, the COVID selloff in 2020, and the meme stock blow-up in 2021. Now, we may be setting up for another sharp unwind centered around the zero-day options mania.

Complacency and Overconfidence Among Retail Investors

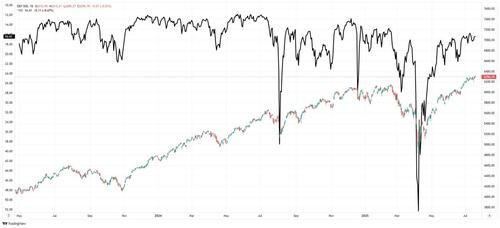

Greed and complacency have always been notable contrarian indicators for markets. Unfortunately, they are frequently ignored until it’s too late. Despite the growing risks, complacency has returned in full force. The Volatility Index (VIX) has collapsed to multi-year lows over the past three months, while credit spreads and other risk indicators remain near their most complacent levels in years.

Beneath this surface calm, the market is loaded with speculative leverage, narrow leadership in a handful of mega-cap stocks, and weak underlying breadth. At the same time, retail options activity remains at record levels, creating the perfect conditions for a market correction. Historically, markets are most vulnerable to sharp reversals when everyone expects calm.

Investors are once again convincing themselves that “this time is different.” Yet history shows the cycle of retail speculation and market corrections never really changes. Every bull market ends similarly, with euphoric excess by inexperienced investors, followed by painful corrections. The late 1990s tech bubble saw retail investors flooding into IPOs and call options before the Nasdaq fell 80%. In the mid-2000s, retail investors leveraged up on housing and stocks before the S&P 500 crashed by more than 50%. The 2021 meme stock mania ended in disaster, with GameStop and AMC round-tripping their gains. Each cycle has a different narrative, but the outcome is always the same.

Today, the story is driven by artificial intelligence, zero-day options, and massive concentration in the largest market-capitalization stocks. But the warning signs are no different: extreme retail optimism, widespread leverage, and complete complacency about risk.

What Investors Should Do to Manage Risk

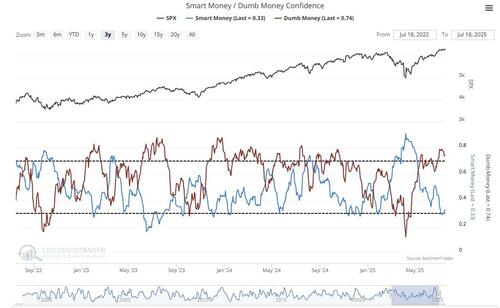

One of the most concerning developments is the growing divergence between professional and retail investors. Institutional investors have quietly reduced risk, shifting toward defensive sectors and fixed income, while retail traders continue chasing speculative trades. Sentiment surveys confirm this imbalance, showing extreme bullishness among small traders, especially in options markets.

With these risks building under the surface, prudent investors should proactively protect their portfolios. No one can predict precisely when the market will correct, but the ingredients for a sharp downturn are clearly in place. Savvy investors should use this period of complacency to reduce risk exposure before the cycle turns.

Here are six practical steps investors should consider:

-

Rebalancing portfolios to reduce overweight exposure to technology and speculative growth names.

-

Increasing cash allocations to provide flexibility during periods of volatility.

-

Rotating into more defensive sectors like healthcare, consumer staples, and utilities that tend to outperform during corrections.

-

Reducing exposure to leverage by avoiding margin debt and leveraged ETFs.

-

Using options prudently—not for gambling, but for protecting portfolios through longer-dated puts on broad market indexes.

-

Focusing on companies with strong balance sheets, stable earnings, and reasonable valuations.

The explosion of zero-day options trading is not a sign of a healthy market. It is a symptom of an unhealthy market increasingly driven by speculation rather than investment discipline. Retail traders have moved from investing to gambling, chasing fast profits while ignoring the mounting risks. Greed is rampant, leverage is extreme, and complacency is near record levels.

Markets can remain irrational longer than expected, but history tells us these speculative periods always end in a painful correction.

Bull markets do not die quietly; they end with euphoric retail excess followed by painful corrections.

Investors who recognize the signs early will avoid the worst of the fallout and be positioned to capitalize when value opportunities return.

Tyler Durden

Mon, 07/21/2025 – 14:25