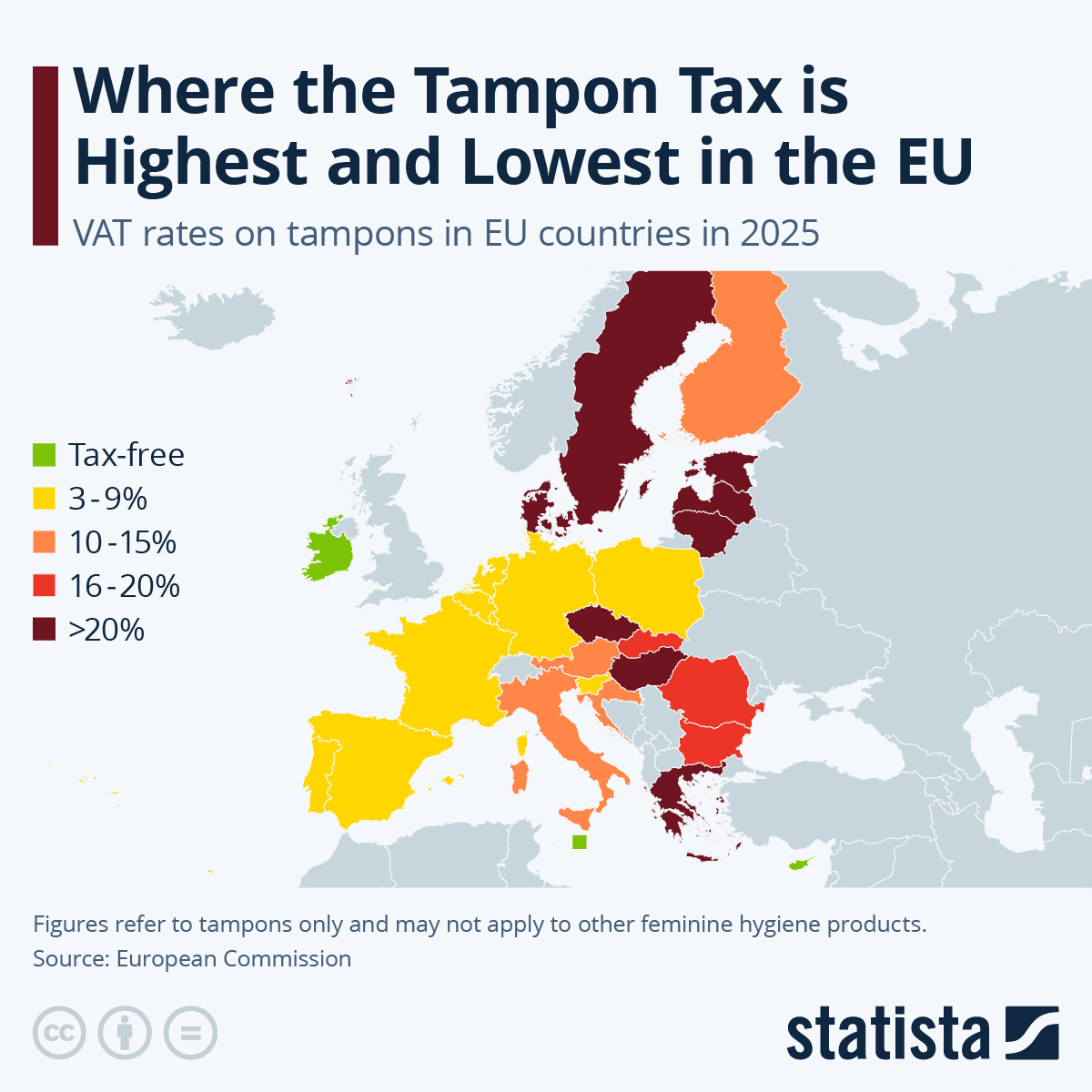

Period Pains – Where The Tampon Tax Is Highest And Lowest In Europe

Around the world, women pay high tax rates on period supplies like pads and tampons.

As Statista’s Valentine Fourreau reports, these items are included in high sales tax brackets in many countries, ignoring possible reductions permissible for essential items or even declaring them luxuries before the law.

In the EU for example, countries are free to depart from standard sales tax rates since 2007 and apply super discounted tax rates to feminine sanitary products.

Still, many countries haven’t lowered their tax rates. According to data from the European Commission, the VAT rate on tampons in Hungary is currently 27%, the highest of all EU member states.

You will find more infographics at Statista

Denmark and Sweden tax tampons at 25%, and Greece at 24%. These figures, however, only refer to tampons, and may not apply to other feminine hygiene products.

Finland lowered its tax rate on menstrual products from 25,5% to 14% on January 1, 2025, and similarly, Spain, Poland and Luxembourg have taken steps to reduce VAT on tampons to between 3% and 5%. In Germany, VAT on menstrual hygiene products was reduced from 17% to 7% after they were listed as necessities in 2020.

Three EU countries currently have a zero VAT rate on tampons: Ireland, Cyprus and Malta.

The tax-free status of menstrual products has existed in Ireland since before EU-wide VAT harmonisation rules took effect; Cyprus imposed a zero VAT rate on a selection of essential products, including feminine hygiene products, in October 2023; and Malta removed taxes on menstrual products in January 2025.

Tyler Durden

Fri, 05/30/2025 – 02:45