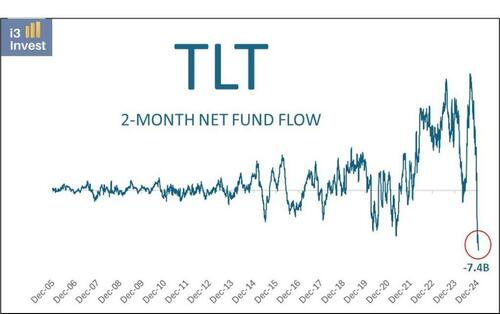

Outflows From TLT Are Tremendous

Via RealInvestmentAdvice.com,

Outflows from bond ETFs, such as TLT, have been tremendous over the last two months.

ETFs, unlike mutual funds, allow dealers to redeem shares for the underlying securities and vice versa.

The exchanges most often occur when the demand to buy or sell the ETF is high, thus creating a small arbitrage for the dealer.

Investors frequently associate strong inflows with higher ETF prices and outflows with weaker performance.

While at times that is certainly true, other times, it’s a false indicator.

For instance, as the graph of TLT below shows, fund inflows were at record-high levels in 2022 as TLT sold off precipitously.

Bonds are out of favor, and as shown below, TLT, the 20-year U.S. Treasury bond ETF, has seen record outflows.

There are numerous ways to interpret the graph.

Our take is that much of the recent decline is tax-related. With stocks gaining 40+% over the last two years, TLT is one of the few investor holdings that experienced a loss over the period.

Therefore, investors looking to offset tax gains with losses were likely to sell TLT. Some TLT investors were probably selling TLT but buying Treasury bonds to maintain their bond exposure.

Thus, selling the ETF and buying bonds created an arbitrage for dealers. That partially explains the large outflows from the ETF.

However, some were undoubtedly due to selling pressure in bonds and bond ETFs like TLT.

For those interpreting the outflows as bearish, we offer up advice from legendary investor Sir John Templeton:

“The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

Tyler Durden

Wed, 01/08/2025 – 07:20