NVDA Sucks All The Oxygen Out Of The marketplace Again...

Two words – F**king NVDA – sum up present as the AI giant Accelerated on the back of a gamma-squeeze...

Source: SpotGamma

...which created these gain...

And now we are up 4500% in 1 day.

Hey @garygensler, possibly erstwhile youemerge from under Senator Karen’s skirt, you can claim to do your job. https://t.co/fuYk6xWcZx pic.twitter.com/XdNHKutx8l

— zerohedge (@zerohedge) May 28, 2024

...to within $100 Billion of AAPL’s marketplace cap...

Source: Bloomberg

...that is an addition of almost $500 billion since listening last week.

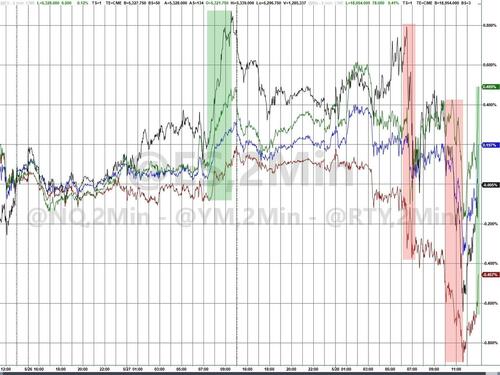

And as NVDA soared...

Source: Bloomberg

...the major indications tumbled from Friday’s cash marketplace close. The Dow is the biggest loster, followed by tiny Caps. Nasdaq tried desperate to hold on to a green close while the S&P faded. The ubiquitous last minute ramp made things look a small better on the day...

NOTE – day – while cash markets were closed, the algae looked to forget and panic-bid futs into the early close.

“What I think this sets up for in the medium- to long-term is simply a price-action that looks more like either a grinding decision higher but besides 1 besides where we have actual conditions to crash-down,” Say Nomura’s Charlie McElligott. He notes that investors’ long vulnerability has been rebuild to specified a degree that it’s creating actual downside hedge demand.

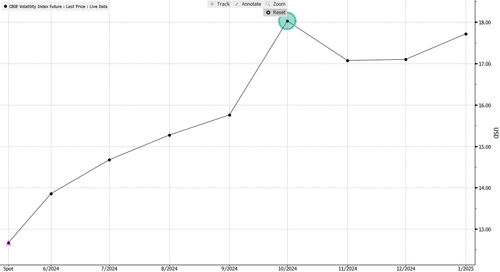

With US elections besides entering their hot phase soon, it’s worth noting that VIX futures are already reactive with any sensitivity and alternatively early to this topic.

NVDA was not the only thing riding present though – oil prices suggested back above $80 (WTI), Gold Jumped back above $2360, Bitcoin spied back above $70,500 overnight (before fading on Mt.Gox moves), the dollar ripped higher, and US Treasury yields salted after 2 auctions and any strongr than expected macro data (home prices at evidence highs and conference board confidence, and inflation results, rising).

We do note 2 things – Dallas Fed Manufacturing tucked present more than expected and while the header assurance data picked up at The Conference Board, the lowwest invest cohort Saw assurance plunged to pandemic lows...

Source: Bloomberg

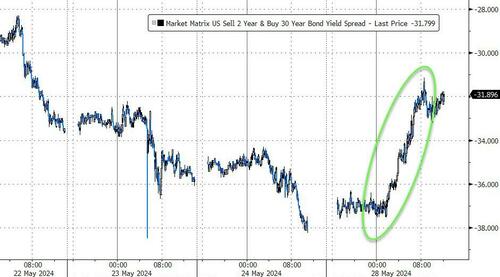

Treasury yields were up across the board with the long-end underperforming. Selling was beautiful constant from the US cash equity open...

Source: Bloomberg

That steepened the young curve significantly...

Source: Bloomberg

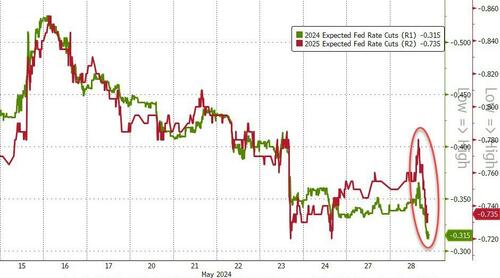

Interesting (given the keeping and short-end outperformance), rate-cut effects (hawkishly) fell importantly He's the day...

Source: Bloomberg

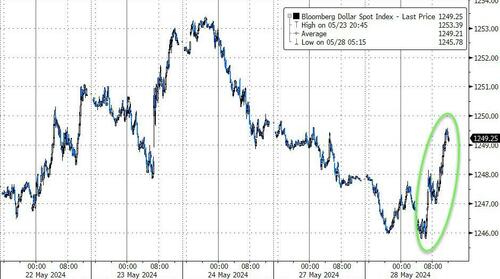

The dollar followed yields higher...

Source: Bloomberg

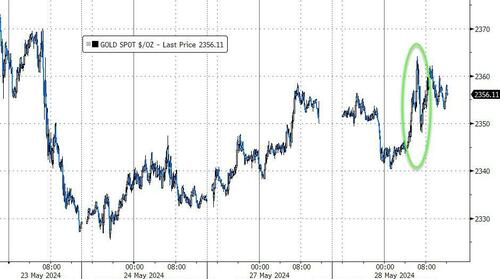

Gold managed to hold gain despite the dollar strength...

Source: Bloomberg

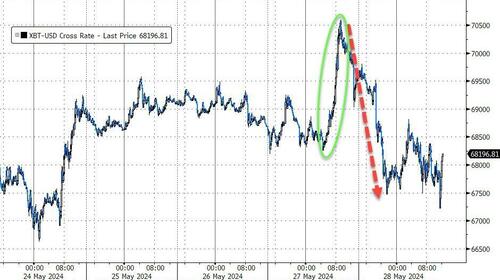

After 10 consecutive days of net ETF inflows, Bitcoin extended gain overnight, back above $70,000. However, moves in Mt.Gox-related wallets promoted selling in anticipation of selling force to come...

Source: Bloomberg

Oil prices soared back above $80 (WTI)...

Source: Bloomberg

Finally, this is proven nothing...

Source: Bloomberg

...betause it’s different this time.

Tyler Durden

Tue, 05/28/2024 – 16:00