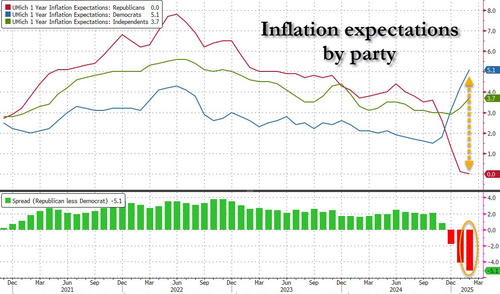

Democrats Send UMich Inflation Expectations Exploding Higher In Feb

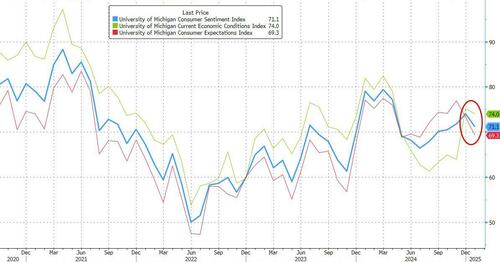

With Democrats driving inflation expectations (dramatically) higher in January, all eyes will be on this morning’s UMich preliminary data for February… and right they were as 1-year inflation expectations ramped up to 4.3% (from 3.3% vs 3.3% expected). Additionally, the medium-term inflation expectation jumped up to 3.3% – its highest since June 2008…

Source: Bloomberg

Most notably, the surge in inflation expectations was due entirely to Democrats (we guess they’ve been reading Politico’s 'tariff tax’ fearmongering too much?)…

Source: Bloomberg

Overall, sentiment slumped in February, from 71.1 to 67.8, greatly disappointing the expectation of a rise to 71.8 with both current conditions and expectations sliding…

Source: Bloomberg

Finally, the slump in broad sentiment seems driven by partisan politics of course with Democrats’ now at their least confident since Aug 2020…

Source: Bloomberg

All five index components deteriorated this month, led by a 12% slide in buying conditions for durables, in part, according to Survey Director Joanne Hsu, due to a perception that it may be too late to avoid the negative impact of tariff policy.

Expectations for personal finances sank about 6% from last month, again seen across all political affiliations, reaching its lowest value since October 2023.

Many consumers appear worried that high inflation will return within the next year.

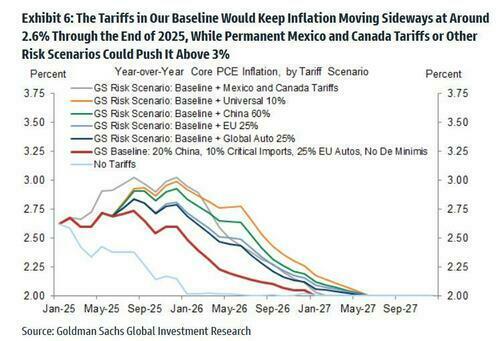

Perhaps some Democrats should read what Goldman Sachs has said on the matter of FULL tariffs…

Goldman’s rule of thumb is that every 1% increase in the effective tariff rate raises the core PCE price level by 0.1%, the bank now estimates that tariffs will provide a one-time boost to year-on-year core PCE inflation of 0.5% (vs. 0.3% previously), leaving it at 2.6% in December.

Interviews for this release concluded on February 4… so before Mexico and Canada had folded and Trump delayed tariffs.

Tyler Durden

Fri, 02/07/2025 – 10:11

![Piątkowy wieczór w towarzystwie fotografii Artura Szarpały w Mielcu [ZDJĘCIA]](https://static.korso.pl/korso/articles/image/6524ea43-3476-4217-af70-be6f01eb74ea)