Connecticut Tops California As America’s 'Wealthiest’ State

The average American’s net worth across all states is nearly $595,000. However, wealth levels vary among states alongside cost of living and other factors.

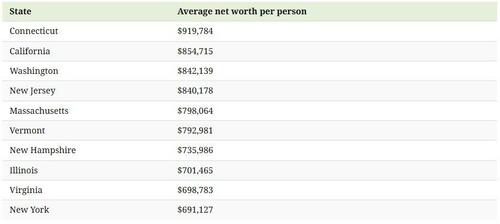

As Visual Capitalist’s Alejandra Dander notes, according to anonymized data from nearly 2 million Empower Personal Dashboard users, we highlight the top ten states with the highest average net worth per person.

A closer look at average net worth

Net worth is calculated by taking what a person owns (their assets) and subtracting what they owe (their debts). Here are the leading states by net worth as of September 2024.

Connecticut has the highest net worth of nearly $920,000, but also has higher prices than the U.S. average. Meanwhile, California and Washington are the only Western states to make the top ten, and Illinois is the only one from the Midwest.

In total, U.S. household wealth hit a record of $164 trillion in the second quarter of 2024. This is an improvement over the pre-pandemic peak of $152 trillion. The increase in the second quarter was driven primarily by more than $1.7 trillion in real estate gains and $662 billion in stock gains.

Net worth goals

Nearly three-quarters of people expect to increase their net worth in 2024. This is important given that nearly half of Americans define financial independence as reaching a certain net worth. What are some strategies people plan to take to improve their finances?

-

Prioritizing investments (80%)

-

Asking for a raise (35%)

-

Getting a second job (25%)

When it comes to planning for the future, Americans say “dreamscrolling”—looking at dream purchases—helps them to be smarter with their money (56%) and better plan to achieve their financial goals (25%).

Building wealth

In order to build net worth, Americans can focus on both reducing debt and increasing savings and investment contributions. Tax-optimized retirement savings accounts like IRAs and 401(k)s can play a critical role in building net worth.

Apart from the tax advantages, nearly all companies with 401(k) offer some kind of matching contribution based on how much an employee contributes. Yet only 35% of people are contributing enough to get their employer match, suggesting workers should take a closer look to avoid leaving money on the table.

Tyler Durden

Fri, 03/14/2025 – 21:20