Out of the hole?

As expected in August, the national consumer price / inflation index (China Consumer Price Index (CPI) and the ex-factory maker price index (China maker Price Index) showed affirmative trends.

Inflation in August in China was 0.1% y-o-y, which means at least a temporary exit from the deflation region (in July, inflation was recorded at –0.3% y-y).

In terms of period to period (m/m) this trend could already be observed in July.

The increase in inflation in China was mainly influenced by the increase in service prices (by 1.3% y/y).

The price index of producers has besides been expanding since July, but this does not mean a definitive breakthrough. In August, the PPI in China was – 3.0% y/y. But in July it was – 4.4% y/y, so there is simply a clear improvement.

Regardless of this data, it is apparent that the deflation threat inactive exists. Uncertainty is inactive dominant in the description of the Chinese economy. There are inactive no factors conducive to strong reflection, recovery of vigor.

The increase in maker prices is mainly due to the increase in natural material and production components prices.

In the area of consumer goods, deflation seems to be the past, in the area of industrial goods it seems to be decreasing, signaling a slow and average process of economical recovery.

It is clear that the current situation means the request for further encouragement from the government, and this applies peculiarly to home demand. This depends on expanding the income of residents, which is the key to expanding consumption.

Source:

Foreign trade in August

Published data on China's abroad trade in August this year July, two-digit declines did not become a trend{1}. The August results are negative (fourth period in a row), but let to conclude that the downward trend is gradually, slow reversed.

The volume of Chinese abroad trade in August decreased by 8.2% year-on-year (r/y), with exports shrinking by 8.8% year-on-year and imports by 7.3% year-on-year.

The trade surplus besides decreased by 13.2% y/y.

Sales volume decreased in relations with China's largest trading partners:

- ASEAN countries 10.32% y/y

- EU countries 19.58% y/y

- U.S. by 9.53% y/y.

During the same period, trade with Russia increased by 16.31 y/y.

In the period January to August this year, abroad trade turnover decreased by 6.5% compared to the same period last year, with exports decreasing by 5.6% y/y and imports by 7.6% y/y. At the same time, the trade surplus increased by 0.8% y/y and amounted to $553.4 billion (about PLN 2.388 trillion).

During the same period, private companies were liable for 52.9% of the turnover in abroad trade in the PRC, state companies for 16.2%, and abroad companies for 30.9% (the share of the 3rd companies decreased by 9.6% compared to July).

Electromechanical products accounted for 58% of the full Chinese exports, and increases were recorded in exports, among others:

- electrical machinery and equipment +69%,

- photovoltaic panels +50.1%,

- PVC +28%,

- appliances +18.6% y/y.

Chinese import is dominated by natural materials as usual.

Between January and August of this year, the most crude oil was imported (China is the world's largest importer of this natural material), natural gas, iron ore, coal, soy (the decreasing prices encouraged from this). Imports of electromechanical products decreased by 9.9% y/y.

There are changes in the specificity of Chinese trade with abroad. Trade with members of the Belt and Road project, ASEAN, Latin America and Africa is expanding and with EU and US countries is falling.

{1} Source:

http://caijing.chinadaily.com.cn

{2} percent changes based on USD results, unless otherwise indicated

{3} Analyzing the results of abroad trade in RMB will consequence in better results, due to the weakening of RMB to USD – this year by more than 6%

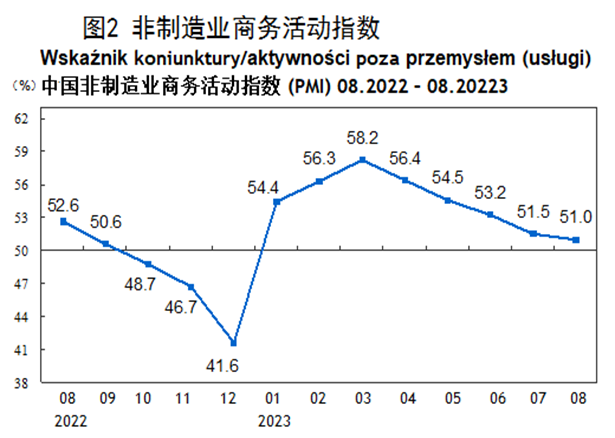

PMI: manufacture up, services down

The PMI index for manufacture in August was 49.7 points. Which means continuing growth in the last months (in May this year it was 48.8).

The PMI index for services in August was 51 points which means a decrease in the period to period ratio. However, it remains in the recovery zone.

Data State Statistical Office (chin. 国家统计局)

Source:

Author: 梁安基 Andrzej Z. Liang, 上海 Shanghai, 中国 China

Email: [email protected]

Editorial: Leszek B.

Email: [email protected]

© www.chiny24.com

![W sklepach nowość. Ziemniaki o wymiarze 20-28 mm (jak orzech). Według rządu jadalne. Do tej pory odpad. Jak się obierze pestka czereśni. Zebrane przed osiągnięciem pełnej dojrzałości, o skórce łuszczącej się [projekt rozporządzenia]](https://g.infor.pl/p/_files/38870000/ziemniaki-38869625.png)