The Government of the Canadian state of Ontario, as owner of Ontario Power Generation, made an investment decision to build the first BWRX-300 reactor at Darlington atomic power plant. It's expected to cost $6.1 billion or $20 million for MW. Plus, there's 1.6 billion for the infrastructure that's needed to operate 4 blocks of this kind, due to the fact that that's what Darlington is going to be built for. So $7.7 billion comes out of the good morning, and the full BWRX-300 program is expected to cost almost 21 billion.

So we yet found out how much specified an individual could cost and the cost is definitely different from a billion-and-a-half, what amounts were signalled in the past.

OPG already has a construction licence and has done quite a few work that does not require local atomic supervision. With the licence the contractor can start pouring alleged first atomic concrete. By the way, Canadians have revealed that present the deadline for launching the first in the Western planet SMR is 2030.

Brussels draws a plan for divorce with Russian gas

The ban on place transactions at the end of 2025, the extinction of long-term contracts at the end of 2027 - these are the basic assumptions of the road map of full departure from Russian gas, which the European Commission has yet presented. In June, these proposals are expected to take the form of draft applicable regulations.

For the time being, it is not known how the EC intends to legalise the withdrawal of contracts, so that European companies are not liable to the courts. The proposition of the Energy Commissioner Dan Jorgensen at most indicates that an option may be active force majeure, i.e. a higher force to be relied on by EU customers, refusing to pay for gas from Russia.

Russia presently accounts for little than 20% of the gas imported by the Union. In 2022 it was about 45%. Gas pipelines, through Turk Stream import Hungary and Slovakia, and the largest recipient of Russian LNG is France, although it flows to another European terminals.

In return, the Union would bring more LNG from the US, which could be an argument in the resolution of the customs war launched by Donald Trump.

In the meantime, there were again rumors of resumption of Russian gas supply by pipelines. According to Reuters, citing many sources, the US and Russia have secret talks on this subject, deliveries would return after any peace agreement was concluded in the war in Ukraine.

In turn, US LNG exporters lobby in Trump's administration the relaxation of regulations introduced in April. It says that as of April 2028, at least 1% of liquefied gas exports are to carry ships built in the US. And in 2047 it's expected to be at least 15%. According to AMSMarine, 792 methane ships are presently circulating in the seas and oceans, of which only 5 were built in American shipyards, and this in the 1970s, so they won't travel long. And American shipyards are incapable to build adequate to meet the regulatory conditions. By the end of the decade, there would should be 5 methanes in them, but the manufacture says it's impossible.

The first BWRX-300 in Canada to cost $6.1 billion

Czech court blocks atomic contract with KHNP

The Czech court ordered the suspension of the contract with Korean KHNP for the construction of 2 atomic blocks at Dukovany power plant until a judicial examination of the cancellation of the French EDF from the tender decision.

The French lost it, but appealed to the Czech anti-monopoly office, which besides sent them back with a twist. So they appealed to the court and applied for collateral in the form of not signing the contract.

The court which suspended the conclusion of the contract stated that, yes, its decision may hold the full investment, but this does not outweigh the interest in law enforcement.

The contract to grow Dukovana power plant by 2 blocks per 1000 MW each has a value of $17 billion. ČEZ, however, sold Elektrárna Dukovany II for about $150 million, claiming that it needed money for another crucial transformation projects.

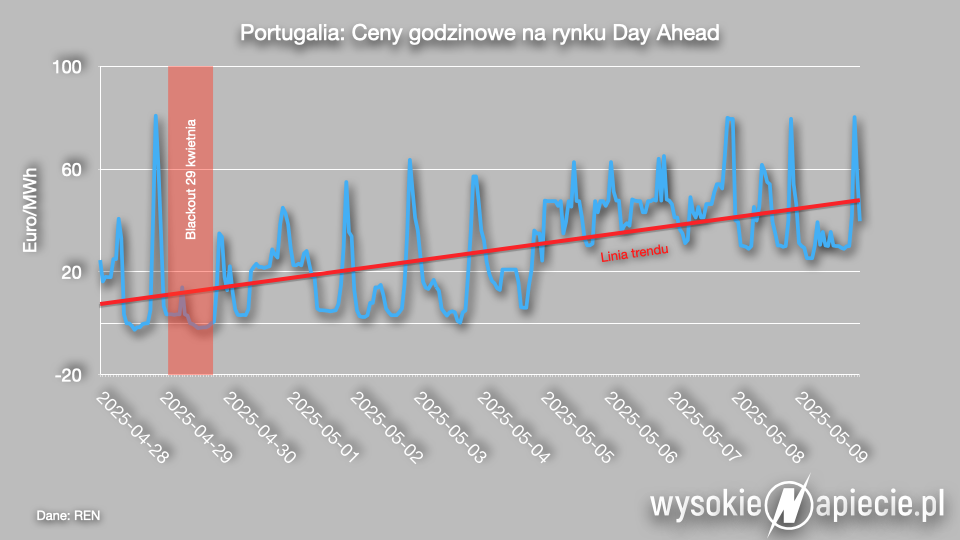

Portugal has cut itself off from Spain and pays dearly

After the Spanish blackout on 28 April, which was besides touched by all Portugal, the REN operator cut off imports of electricity from a neighbour from the Iberian Peninsula. This led to an immediate increase in place prices. The prices on the marketplace the next day jumped immediately from respective to 20-30 euro per MWh.

The limited-scale imports of REN restored on 7 May and the restrictions are due to last until 12 May. The latest data shows that during the day the import capacity does not exceed 900 MW. Meanwhile, just before the major accident in Spain, exports to Portugal went with 2.8 GW. Typically in erstwhile days, exports were at least 1.5 GW, and in the mediate of the day even 3 GW. So, erstwhile the Portuguese remove the restrictions, the marketplace situation should calm down.

Ørsted halts construction of Hornsea wind farm 4

Danish Ørsted decided to complete the Hornsea 4 offshore wind farm task in the UK. The farm was expected to have 2.4 GW, The Danish in September 2024 earned a differential contract for it.

The decision means that Ørsted will neglect to comply with this contract and, of course, it will cost him dearly. The Danish company estimated that the costs of resignation would be between 3.5 and 4.5 billion Danish krona, i.e. from EUR 455 to 585 million. These are write-offs for assets in transmission infrastructure and penalties for cancelling CfD. In addition, the company will compose back up to EUR 130 million for the costs already incurred.

The Danish have announced that since CfD was acquired, the hazard of completing the farm in time and budget has increased significantly. The main reasons are the increase in supply chain costs and higher interest rates, i.e. the cost of loans.

Nitrogens lost their CEO

President of Azotów Adam Leszkiewicz resigned and was appointed president of the Polish Armed Forces Group on the same day. The change was no surprise, the leaks that Leszkiewicz won the competition for the president of the state-owned arms company appeared a fewer days earlier.

Leszkiewicz became president of the Azotes in March last year. Under his leadership, the chemical company began corrective action. The net failure fell from PLN 3.29 billion in 2023 to 1.1 billion in 2024 and EBITDA increased by over a billion.

The Ministry of Assets has announced that the recovery programme will continue, and the change in the position of president "will not weaken the determination of the MAP" to undertake the essential reforms. The direction and scale of these changes will be maintained - stressed the MAP.