Boeing CEO Confirms China Halted Orders; Goldman Notes „Improved Earnings Results” For Planemaker

Boeing reported first-quarter results that Goldman analysts described as „improved,” but the real headline this morning isn’t the earnings—it’s CEO Kelly Ortberg’s CNBC interview, in which he revealed that China has halted aircraft deliveries.

In a televised interview with CNBC’s Squawk on the Street, CEO Ortberg stated that Chinese airlines had „in fact stopped taking delivery of aircraft due to the tariff environment.” He noted that the aviation giant would begin marketing the commercial jets to other carriers if deliveries were prolonged.

„We’re working with our customers right now, we’re not going to wait too long,” Ortberg said in the interview, adding, „We’ll give the customers an opportunity if they want to take the airplanes. That’s what we’d prefer to do. But if not, we’re going to remarket those airplanes to people who want them.”

Aircraft rejected by Chinese airlines (read: here) could be headed to Air India Ltd. Bloomberg noted that through the end of March, the airline had accepted 41 737 Max jets built initially for Chinese airlines.

Boeing CFO Brian West told investors that Chinese customers represent about 10% of the commercial backlog. He noted that if tariff impacts expand beyond China, then additional problems could arise for the planemaker.

The possible tariff fallout comes as the struggling planemaker prepares to lift the 737 Max and 787 models in the coming months. The CEO was adamant about not letting trade war woes „derail the recovery” of Boeing.

In an earlier earnings release, Boeing confirmed that plane production would soon rise as first-quarter results showed earnings and cash consumption improvements.

Goldman analysts, including Noah Poponak, gave clients a first look at the earnings report, commenting that the results showed improvement.

Bottom line: BA 1Q25 results show improvement in the business. Commercial aircraft production rate plan commentary was held, defense margins are positive, services margins beat, and free cash is ahead of consensus and guidance. Yesterday the company announced the sale of portions of Digital Aviation Solutions, at a multiple higher than its own, which will help accelerate balance sheet deleveraging.

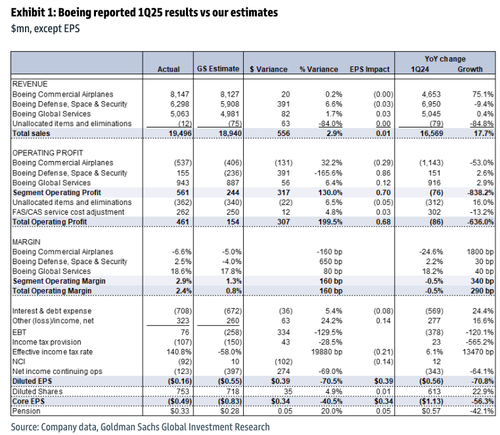

Details: Revenue of $19.50bn is in line with FactSet at $19.46bn, and up 18% yoy. Core EPS of $(0.49) compares to consensus at $(1.18) and our $(0.83), driven primarily by revenue and margin at BDS. The BCA segment operating income of $(537)mn compared to our estimated $(406)mn. BDS margin of 2.5% is above our (4.0)% estimate. The BGS margin of 18.6% is 80bps above our estimate and up 40bps yoy. 1Q25 free cash flow is $(2.3)bn, ahead of us and consensus at $(3.7)bn. The company still expects to reach a rate of 38/month on 737 and 7/month on 787 this year.

1Q25 Results:

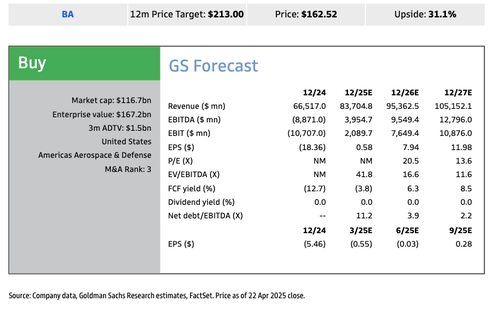

Poponak remained „Buy” rated on Beoing shares with a 12-month $213 price target:

Our 12-month price target of $213 is derived from targeting a 4.25% free cash flow yield on 2026E free cash, discounted back one year at 12%. Key risks: (1) the pace of air traffic growth, (2) supply chain ability to ramp-up production, and (3) contract operating performance within the defense segment.

Since the Max jet crashes and Covid, Boeing shares have been trading in a tight range.

CEO Ortberg outlined Boeing’s turnaround efforts in a press release: „Our company is moving in the right direction as we start to see improved operational performance across our businesses from our ongoing focus on safety and quality.”

Tyler Durden

Wed, 04/23/2025 – 22:10