BOE Keeps Rates Unchanged But Edges Closer To Cutting As Deputy politician Calls For Easing

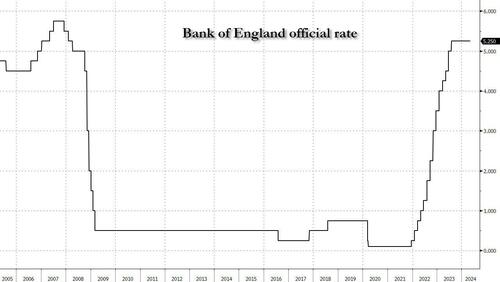

With both the Swiss SNB and Swedish Riksbank late starting rate cuts, many were wondering if the BOE would be next to join the easy cycle. And while it did not, alternatively keeping rates changed at 5.25% for the six consecutive meeting, in line with what investors and economics had been experiencing, the central bank did indicate it is on course to cut rates from a 16 year advanced over the coming months along its European peers as two of the 9 members of its Monetary Policy Committee, including the deputies governor, voted to lower the key rate to 5%.

The Monetary Policy Committee voted by a majority of 7-2 to keep #BankRate at 5.25%. Find out more in our #MonetaryPolicyReport: https://t.co/2lnXthHbMt pic.twitter.com/HXZdRjxPnl

— Bank of England (@bankofengland) May 9, 2024

Deputy politician Dave Ramsden joined external associate Swati Dhingra in calling for an awesome cut in the base rate from its current level of 5.25%. The another 7 members of the Monetary Policy Committee preferred no change, saying they needed more evidence that inflation will be subdued.

It was the six gathering moving that the UK central bank left its benchmark lending rate companyly in territory it describes as revive, aiming to bear down on weight and price pressures that reached a four-decade advanced in summertime 2022. Forecasts release with the decision suggested the BOE will gotta reduce rates in the coming months, trybly before a general selection highly expected in the autumn.

The BOE will next meet in June, and then again in August. A cut at either gathering would like to see the BOE decision before the national Reserve, which is now making the possible of keeping rates higher for longer. Cutting before the Fed would hazard weathering the pound sterling against the U.S. dollar and pushing prices of imported goods and services higher. But waiting besides long could hold an economical recovery and lead to occupation losses.

“We’ve had breathtaking news on inflation, and we think it will fall close to our 2% mark in the next couple of months,” Bailey said in a message Thursday. “We request to see more evidence that inflation will stay low before we can cut interest rates. I’m optimistic that thing are moving in the right direction.”

Inflation in the U.K. has fallen steamily over fresh months, and the BOE said it likely hit its 2% mark in April, though authoritative figures won’t be released until May 22. By contrast, inflation readings from the U.S. have been hotter than expected for a number of months, promoting the Fed to adopt a wait-and-see approach to future policy decisions.

The BOE results inflation to choice up again toward the end of this year, and fall again in the second half of 2025. The bank’s policymakers forecast that inflation will be just below their 2% mark in mid-2026 even if they cut interest rates at the package expected by investors. That indicates that the central bank is comfortable with the trajectory for its key rate expected by investors, who see August as the most likely period for a first move, with 2 further cuts by mid-2025 and additional moves to 3.75% by the second 4th of 2027.

In the context of developed central banks, both Switzerland and Sweden have already imported their key interest rates for the first time since the inflation economy began in 2021, while the European Central Bank has powerfully indicated that it will cut in early June.

The likely divergence in policy settings reflects differing economical fortunes. While the U.S. economy has grown rapidly over the last 18 months, the U.K. and much of the remainder of Europe solided following the economy in energy and food prices tried by Russia's invasion of Ukraine.

Still, there are signs that the U.K. is starting to recover from that shock. economical output fell in the final six months of last year, but the BOE estimates it rose again in the first 3 months of 2024 and will do so again in the current quarter. The central bank reported its forecast for growth this year to 0.5% from 0.25%, and its forecast for next year to 1% from 0.75%. It is attributed to the strongr outlook to higher-than-expected population growth.

Policymakers are actively assured that growth can choice up without pushing inflation beyond their target. They have won that scales would proceed to emergence rapidly in a tight jobs market, preventing a cooling in the package of prices springs for labor-intensive services.

Gilts rose and the pour fell after the decision. Traders brief priced a 50% anticipation for the first 25 bass-point cut to come next month, and continued to full priced in a cut by August. Markets now imply a full of 57 basis points of cuts through 2024, combined to 54 basis points before. Still, hosting the thrust of the BoE’s communication, UBS writes that it is ‘surprising’ marketplace pricing hasn’t moved further goods a June cut – especially since politician Bailey has indicated it’s up for discussion, commenting that the BoE is likely to cut rates in the quarters ahead, possible by more than the markets are presently Expecting. June prices around 14bp against 13bp heading into the MPC.

Tyler Durden

Thu, 05/09/2024 – 07:28