Blowout 10Y Auction: Lowest Yield Since Last September’s 50bps Jumbo Cut; Near-Record Foreign Demand

After yesterday’s remarkably strong 3Y auction, which in our view was one of the „top 3″ best 3Y sales in history, moments ago the US Treasury sold 10Y paper (in a 9-Year 11-Month reopening) in what may well be one of the „top 3″ 10Y auctions too.

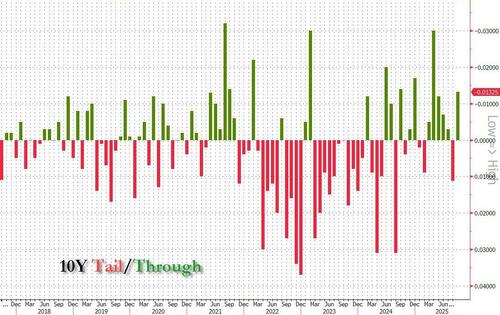

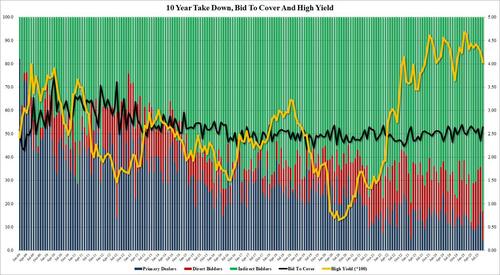

Starting at the top, the auction priced at a high yield of 4.033%, down significantly from 4.255% last month, and the lowest since last September, when the market suffered another growth scare and the Fed ended up cutting by 50bps just a week after a similar 10Y auction priced. And just like the Sept 2024 auction, this one also stopped through the When Issued by a solid 1.3bps: this was the highest stop through since the market chaos in April.

The bid to cover was a solid improvement, from 2.351 to 2.650: the highest since April’s 2.665% and above the six auction average of 2.556.

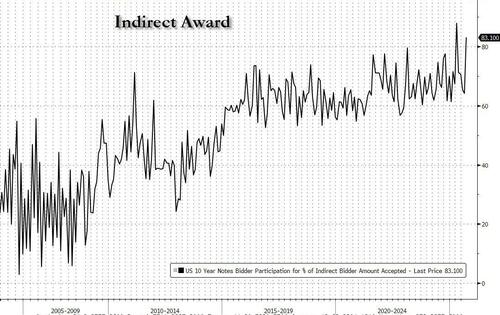

However, like yesterday’s 3Y auction, it was the internals that were most notable, and specifically Indirects: yes, foreigners just couldn’t get enough of today’s reopening, and took down a near record 83.1%, ghe second highest on record, and just April’s 87.9% market panic/basis trade collapse was higher.

And with Directs taking 12.66%, the lowest since April, Dealers were left with 4.2%, the lowest on record.

Overall, this was another stellar auction, one which dragged yields to a session low of 4.03% from an earlier high of 4.10%, which was to be expected after today’s huge PPI miss, and now the question is whether tomorrow’s CPI will reaffirm the deflationary glideslope and prompt Powell to cut 50bps next week.

Tyler Durden

Wed, 09/10/2025 – 13:41