The institution of debt acquisition is defined in Article 519 of the civilian Code:

Article 519. § 1. A 3rd organization may take the place of the debtor who is released from the debt (take-over of the debt).

§ 2. Acquisition of debt may take place:

1) by contract between the creditorand a 3rd partywith the consent of the debtor; a declaration by the debtor may be made to either party;

2) by contract between the debtorand a 3rd partywith the consent of the creditor; a message by the creditor may be made to either party; it shall be ineffective if the creditor did not know that the debtor was insolvent.

Taking over the debt in the 3rd party's place in place of the debtor while exempting the erstwhile debtor from the debt. Future debt may besides be the subject of the takeover.[1] A change in the debtor may be subject to a certain time limit or a condition.[2] Thus, the debt takeover institution is characterised by the following elements:

- the acquirer of the debt as his own responsibility,

- exemption from the debt of the erstwhile debtor,

- preserving the identity of the existing obligation.[3]

The debtor takes over all the obligations of the erstwhile debtorwhich arise from a contract or a bill. It is so obliged to pay the creditor the debt, to be held liable for the delay, failure to execute or incorrect execution.[4] He is besides entitled to any charges against the creditor which the debtor had previously had, but for the charge of deduction from the debtor's claim.

First of all, the fresh debtor has rights affecting the maintenance of the benefit in an appropriate size, rights arising from the deficiency of cooperation from the creditor and the ability to require the creditor to confirm the fulfilment of the benefit.[5]

Despite the deficiency of code restrictions, it is assumed that not all types of debt can be taken over. This situation may arise from the characteristics of the undertaking or the condition of the buyer.[6] It follows, inter alia, from the case law of the ultimate Court that the debt of a public contract contractor cannot be the subject of the takeover.[7] It is besides not possible to take over public law obligations, e.g. taxation liabilities.[8]

In accordance with Article 522 of the civilian Code, an agreement to take over the debt should be concluded in writing under the terms of nullity.

The legislator provided for 2 means of taking over the debt: 1/ conclusion of a contract between the creditor and a 3rd organization with the consent of the debtor submitted to either of the parties to the contract; 2/ conclusion of a contract between the debtor and a 3rd organization with the agreement of the creditor submitted to either party.

In the second case, consent shall be unsuccessful if the creditor did not know that the debtor was insolvent. At the same time, the civilian Code does not specify the concept of insolvency. It's usually understood by them. the condition of the debtor's assets which are not adequate to cover the claim, i.e. that the execution of the debtor's assets cannot satisfy the creditor[9]regardless of the origin of this condition[10].

The legislator protects the creditor from unfair debtors by requiring his consent to change the debtor. The request for the creditor to give consent is besides linked to the fact that it frequently does not substance to him who owes it. There are times erstwhile the service is related to the individual qualities of the debtor. In this situation, taking over a debt without the creditor's consent would undermine its legitimate interests.[11] Furthermore, the asset situation of the future debtor is not insignificant. A declaration of consent may be submitted to any of the parties to the agreement prior to the conclusion of the debt transfer agreement, at the same time as the conclusion of the contract[12]as well as after its conclusion[13]in writing (as regards the consent of the debtor, the views differ: It follows from the caselaw of the ultimate Court that it may be expressed in any way[14][15], in turn from the views of any of the doctrine – that it should be expressed in writing for the purposes of evidence, and in the event of its failure to comply, the fact that the debtor has given his consent will not be proved in dispute by evidence from the proceeding of witnesses or parties[16]). According to the view of the doctrine, the consent expressed prior to the conclusion of the takeover agreement must indicate the individual of the acquirer. The consent shall not entitle the debtor or the creditor to enter into a contract with anyone but with a circumstantial person.[17] Therefore, in practice, the alleged ‘blank consent“ in which the creditor agrees to take over all or part of the debt in the future, according to this provision, does not fulfil the condition of consent. They are so not an effective licence to change the debtor. In turn, the agreement given after the conclusion of the contract has been retroactive since the conclusion of the contract.[18] It should be borne in head that the creditor’s agreement to take over the debt is besides considered to be a written call for the borrower to comply with the obligation. The action against the debtor to comply with the contract of taking over the debt shall besides give the creditor’s consent to this acquisition.[19] If you do not agree to take over the debt, you will not.[20]

Pursuant to Article 520 of the civilian Code, any organization to the contract that has concluded a debt take-over agreement may designate a individual whose consent is needed for the effective take-over, a reasonable time limit for consent. The ineffective expiry of this word is unambiguous with refusal of consent. Many factors find what time limit can be considered appropriate. It should take into account, inter alia, the request for checking operations to measure the risks arising from the change of the debtor, the size of the service, the complexity, skills and qualifications of the acquirer, and the place of residence of the individual whose consent is required.[21] If the time limit has been set by both parties to the debt-collection agreement, the effect of the provision in question in the form of refusal of consent shall be deemed to consequence in the expiry of the time limit set first.[22]

According to Article 521(1) of the civilian Code, if the effectiveness of the debt-collection agreement depends on the consent of the debtor and the debtor of the consent refused, the contract is deemed not to have been concluded (it was only unsuccessful before refusing). It so has no effect between the parties.

In accordance with Article 521(2) if the effectiveness of the agreement to take over the debt depends on the consent of the creditor and the creditor of the agreement refused, the organization who was to take over the debt is liable to the debtor for not being required by the creditor to comply with the benefit. It follows from the wording of that provision that the deficiency of the creditor’s consent means no change in the erstwhile obligation: the debtor remains the debtor and the creditor remains the creditor. However, the refusal of the creditor to give his consent gives emergence to a defaulter’s liability to the debtor for not being required by the creditor to comply with the benefit. However, according to the doctrines, the cited provision is simply a comparatively applicable provision[23], which means that the debtor and the future acquirer may exclude its usage or otherwise form its effects.

Exceptional care should be taken erstwhile the creditor agrees to take over the debt due to the advanced hazard involved, namely that the fresh debtor may not be paid. However, in accordance with Article 519(2)(2) of the civilian Code, the declaration of acceptance of the debt is ineffective in the event of insolvency of the debtor if the creditor of that insolvency did not know, However, this is only about insolvency at the time of consent. If the entity that has taken over the debt has become insolvent after consent has been given, the message of consent shall be effective and any claim relating to the performance of the contract shall be addressed to the entity that has taken over the debt.

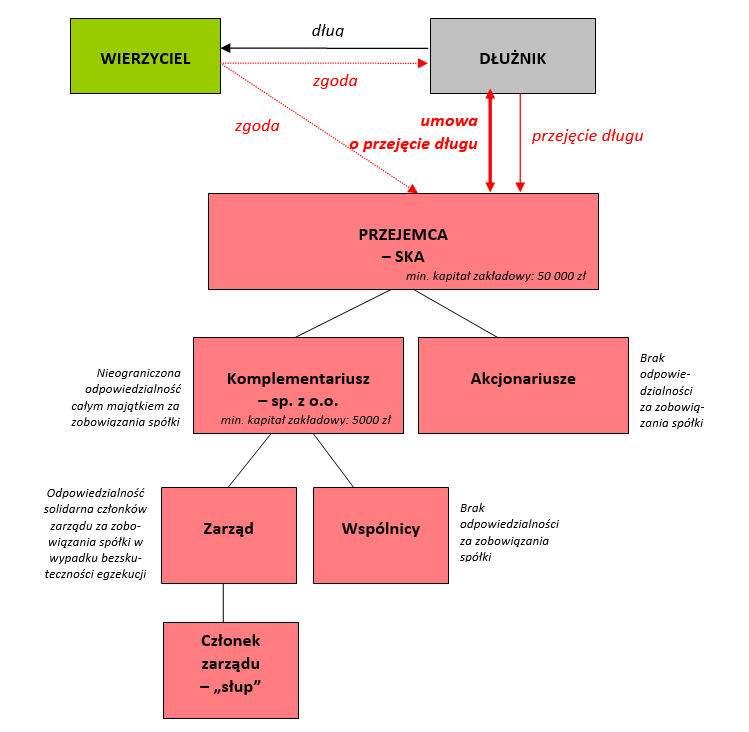

The above will be presented on the example of a limited partnership (SKA). The minimum share capital of the limited partnership is PLN 50 thousand. At first glance, the limited partnership seems to be an highly attractive counterparty due to the liability of the subsidiary (one of the partners) to creditors with all his assets. His work is simply a subsidy. This means that a creditor may execute a partner's property if the execution of the company's assets proves unsuccessful. In the event that the limited-liability company did not have assets or assets, it would so be insufficient to meet the creditors' claims.

However, not only a natural individual but besides a legal person, e.g. a limited liability company with a minimum share capital of only PLN 5 thousand, can be a compliment. And here comes the danger. The shareholders of the limited liability company are not liable for the company’s obligations to creditors. It is the work of a company which can only be an ‘extortion’ with no assets. However, according to Article 299(1) of the Commercial Companies Code, in the event of unsuccessful enforcement of the company's assets, the members of the board of directors are liable for its obligations, but there is nothing to prevent a person, the alleged ‘slut’ with no assets, from being a associate of the board of directors of specified a company.

The above example shows that it may be hard to get payment from a fresh debtor.

Therefore, peculiar consideration should be given to agreeing to take over the debt.

If you have any questions or doubts about the matter, delight contact our expert, Mr Piotr Włodawce: wlodawiec[at]procurent.com.pl

Author:

Piotr Włodawiec– Legal advisor / elder Partner

[1] judgement of the ultimate Court of 3 November 1998, I CKN 653/98.

[2] E. Gniewek (ed.), "Citizen Code. Comment", 4th edition, Warsaw 2011, p. 960.

[3] Ibid.

[4] judgement of the ultimate Court of 23 January 2002, II CKN 888/99.

[5] E. Anger, pp., p. 959.

[6] Ibid.

[7] judgement of the ultimate Court of 13 January 2004, V CK 97/03.

[8] E. Anger, pp., p. 960.

[9] Ibid.

[10] ultimate Court judgement of 23 March 2000, II CKN 874/98.

[11] W. Czachórski, “Obligations. Conscription of the lecture”, p. 367.

[12] H. Izdebski, M. Malek, “The civilian Code and economical Activity. Commentary, jurisprudence, Index”, Lomianki 2001.

[13] E. Anger, p. 961.

[14] judgement of the ultimate Court of 29 November 2005, III CK 302/05.

[15] ultimate Court judgement of 26 June 1998, II CKN 825/97.

[16] G. Bieniek and Others, "Commentary on the civilian Code. Book three. Commitments”, Warsaw 1999, p. 1, p. 552.

[17] B. Łubkowski, ‘Civil code. Commentary, Vol. 2", Warsaw 1972.

[18] G. Bieniek, pp., p. 552.

[19] judgement of the ultimate Court of 21 December 2005, IV CK 305/05.

[20] Agnieszka Rzetecka-Gil, "Commentary to Art. 519 of the civilian Code", LEX/El. 2011.

[21] E. Anger, p. 961.

[22] Ibid.

[23] E. Łętowska, [in:] "System of civilian Law", Vol. III, part 1, Wrocław 1981, p. 927.