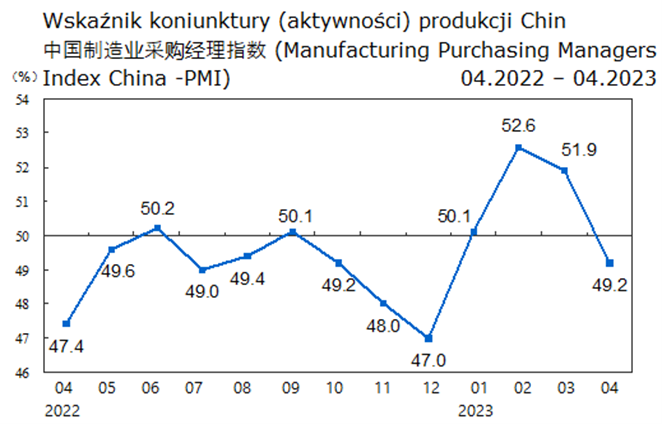

April PMI indicator down!

A large surprise was the April reading of Chinese PMI – the industrial economical (activity) index (Purchasing Managers Index – PMI). After 3 months of growth, it dropped unexpectedly by 2.7 points to 49.2 points, below the neutral 50 point limit. In March, the PMI index for China was 51.9 points.

PMI, Purchasing Managers’ Index, is an indicator of financial activity created by Markit Group and Institute for Supply Management of Financial Activity. It reflects activity of managers acquiring various types of goods and services.

The main PMI index is simply a weighted average of individual sub-indexes (production, fresh orders, employment, etc.) and can take values from 0 to 100. This indicator usually takes a value between 40 and 60 points. Values higher than 50 points signal an increase in economical activity in the sector concerned, and below 50 points indicate a decrease in economical activity in the sector concerned.

The data needed to get the indicator are collected through anonymous surveys, filled out by managers from various economical fields. The calculation of PMI shall take into account, inter alia:

- state of industrial production,

- the amount and cost of the service activity carried out,

- activity in the construction sector and

- the consequence of market-wide activities.

The different elements may vary depending on the characteristics of the selected industry.

For the April reading of Chinese PMI, not all sub-indexes were below 50 pt. The economical region included the service sector (56.4 points), although it was weaker than in March (58.2 points), production (50.2), transportation time (50.3).

However, they do not encourage readings of sub-indexes of fresh orders, employment, stocks which are located in the deconunction region (below 50 points).

April PMI readings are a disturbing signal. Although the world's second largest economy developed in the first 4th faster than expected, it was short of breath in April. interior request is inactive weak, the level of savings in banks is steadily increasing, despite the slowdown in price increases, low inflation (CPI). The situation does not improve the global economy.

PMI data and another economical data announce that the central authorities will most likely proceed to stimulate the economy through fiscal and monetary policies in the second quarter.

Experts believe that PMI fluctuations do not announce a change in the overall trend that the Chinese economy is moving towards a sustainable economical recovery. In this regard, there is no question "or?", the open question is "when?".

Source:

Author: 梁安基 Andrzej Z. Liang, 上海 Shanghai, 中国 China

Email: [email protected]

Editorial: Leszek B.

Email: [email protected]

© China: Facts, Events, Opinions – www.chiny24.com

![Wygrała w sądzie. Z SKO i MOPSem nie było tak łatwo. Warto walczyć do samego końca i życzę innym osobom dużo cierpliwości. Walczcie [Świadczenie pielęgnacyjne]](https://g.infor.pl/p/_files/38488000/podwyzki-38487768.jpg)