Appeals Court Rules Trump Can’t Fire Cook, As Miran Wins Fed Confirmation By 1 Vote Margin

A US appeals court issued an 11th ruling, blocking President Trump from removing mortgage-challenged Fed Governor Lisa Cook from her post while her lawsuit challenging the dismissal proceeds. In a win for the embattled economist, an appeals court in Washington on Monday affirmed that Cook can continue working for now. The ruling means that she can attend the Fed’s highly anticipated Sept. 16-17 meeting to vote on whether to lower interest rates. Still, Trump will immediately ask the Supreme Court to step in, at which point all bets are off.

On Sept 9, US District Judge Jia Cobb – and a sister of the same sorority in which Cook was formerly a member – ruled that Cook could remain on the job as her case proceeded, saying that Trump’s attempt to oust her likely violated the law. The appeals court decision allows that ruling to stand for now.

BREAKING: The DC Circuit has *rejected* Trump’s bid to fire Lisa Cook from the Fed board, allowing her to participate in tomorrow’s interest-rate setting meeting.

Trump’s last hope is a quick stay from SCOTUS. https://t.co/wNtfx9GWW2 pic.twitter.com/1eZGAmLjhO

— Kyle Cheney (@kyledcheney) September 16, 2025

Last month, Cook sued Trump after the president moved to oust her over allegations of mortgage fraud, which she denies even though she has yet to give a clear reason why she listed two primary residences. The lawsuit has emerged as a major flash-point in the growing clash between the White House and the Fed, which has resisted Trump’s demands to lower interest rates.

What is somewhat ironic in this whole situation, is that Trump is pursuing the person seen as one of the biggest doves on the FOMC during the Biden admin. As Rabobank’s Benjamin Picton wrote this morning, „Bloomberg Economics lists Cook amongst the most dovish Fed Governors on its spectrometer, which seems to run counter to the idea that Trump wants to stack the FOMC with doves.”

So what is really going on here? Could it be, Picton asks, that the President is convinced that Fed Governors’ determinations of the appropriateness of monetary policy are not a purely technocratic process and actually exhibit some malleability dependent on who happens to be occupying the White House?

If he is right, this former super dove may well vote for a rate hike on Wednesday (even as Bowman and Waller vote for a 50bps rate cut), in the process confirming what Trump may have set out to demonstrate all along: that the Fed is anything but independent, may very well be vindictive, and is certainly not impartial depending on who is in the White House.

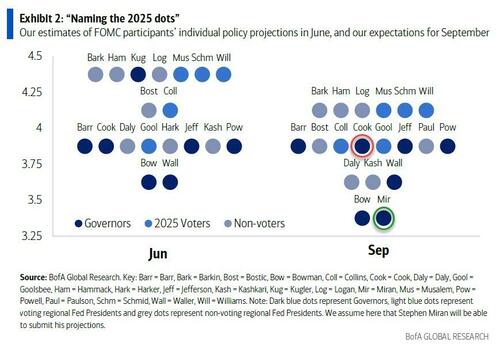

In somewhat offsetting news, and hitting at almost the same time as the Cook update, the Senate confirmed Trump’s economic adviser Stephen Miran, to a post on the Fed Board, clearing his presence at the Wednesday meeting.

In a 48-47 vote along party lines, the Senate voted to approve Miran’s nomination, setting him up to walk into the Fed’s Washington offices Tuesday morning, just in time for a crucial FOMC meeting scheduled for Tuesday and Wednesday. Republicans had fast-tracked approval of Miran’s nomination with Trump pressuring the central bank to cut interest rates.

Investors and economists surveyed by Bloomberg expect Fed officials to lower rates by a quarter percentage point on Wednesday, although there i a roughly 10% chance of a 50bps rate cut, which by the way is what we got exactly a year ago, when inflation was far hotter, and when the economy was decidedly stronger, especially following last week’s record negative jobs revision.

“I think you have a big cut,” Trump told reporters on Sunday on his way back to Washington. “It’s perfect for cutting.”

Miran had to sit through his second grueling hearing this year, facing Democrats who ripped his temporary leave of absence from the White House as ridiculous and a threat to the independence of the central bank, especially after Trump moved to fire Fed Governor Lisa Cook and bragged to reporters he would soon have “a majority” on the Fed board.

“Every claim he makes and every vote he takes will be tainted with the suspicion that he isn’t an honest broker, but instead is Donald Trump’s puppet,” Democratic Senator Elizabeth Warren of Massachusetts said at his hearing.

Ironically, it was the same Senator who exactly one year ago, said that the „Fed must cut by 75bps on Sept 18” and then Powell proceeded to cut by 50bps two days later, confirming he was Warren’s – and Biden’s – puppet.

Elizabeth Warren, Sept 16, 2024: „Fed must cut by 75bps on Sept 18” (Fed cut 50bps two days later)

Elizabeth Warren, Sept 15, 2025: „Every claim [Stephen Miran] makes and every vote he takes will be tainted with the suspicion that he is Donald Trump’s puppet” pic.twitter.com/dXFgTC9wu1

— zerohedge (@zerohedge) September 16, 2025

Miran, who has chaired the White House Council of Economic Advisers, told senators he would take an unpaid leave of absence to join the Fed, with no clarity yet on how long he might remain. Trump could nominate him for a full 14-year term to begin in February, or he could choose someone else. Miran could also stay on indefinitely if Trump chooses no one to fill the new term.

One thing is certain: Miran will vote for a 25bps rate cut, and may even vote 50, and he won’t be alone since both Waller and Bowman may do the same. Which means that on Wednesday history may be made when we get a four-way vote split: uber doves voting for a 50bps rate cut, Powell and the „moderates” voting for 25bps. Then you have the hard-line pro-Biden supporters (sorry guys, hate to break it to you, but the Fed – which until recently was tasked with enabling a green agenda and social „equity” – has never been and never will be independent) like Goolsbee and Hammack, who may vote to keep rates unchanged, and there is the Lisa Cook wildcard, who may decided to go scorched earth and to vote for a 25bps rate hike.

In such a circus outcome, all bets will truly be off.

Tyler Durden

Mon, 09/15/2025 – 20:55