5Y Auction Tails Despite Stellar Foreign Demand

Hot on the heels of yesterday’s stellar 2Y auction, moments ago the Treasury sold $70BN in 5 year paper in an auction which may not have been quite as impressive at first sight, but which was nonetheless just as solid when taking a closer look below the surface.

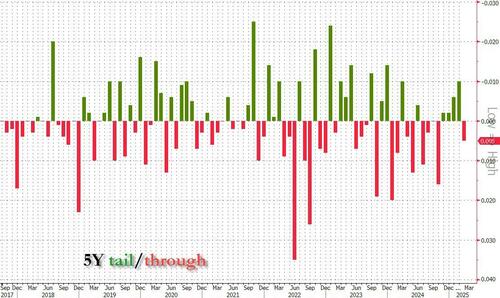

The auction stopped at a high yield of 4.100%, down from 4.123% last month and the lowest since September; however, it also tailed the When Issued 4.095% by 0.5bps, the first tailing 5Y auction since October.

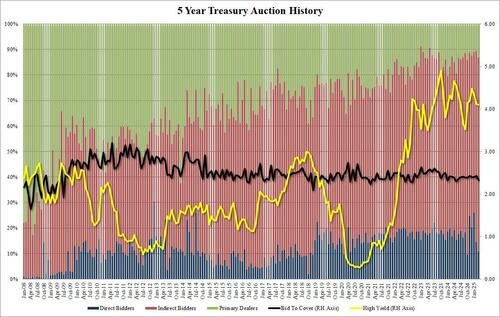

The bid to cover was also a bit on the light side, sliding from 2.42 in February to 2.33, the lowest since May 2024.

But this is where the weakness ended, because the internals were probably the strongest since middle 2024: Indirects were awarded 75.84%, the highest since October and well above the six auction average of 69.3%. And with Directs dropping to just 10.97%, which was the lowest since last October, and well below the 18.9% recent average. This left 13.2% to Dealers, up from 10.6% in February and the highest since, you guessed it, October.

Overall, the optics of the auction were not very strong – despite the stellar foreign demand – and the market reacted accordingly,pushing the 10Y yield higher by about 1bp near session highs on the break. Which is notable because the stock market is dumping and one would expect a rotation out of equities and into rates, but we are certainly not seeing that today.

Tyler Durden

Wed, 03/26/2025 – 13:16