Yilds Tumble, Set For Bigger Plunge If CPI Comes In Cool

Perhaps taking a cue from our CPI commentary last week in which we research why today's inflation print will likely come in on the dovish side after beating extremes for 5 months in a row...

... moments ago 10Y years embedded fresh multi-week lows, sliding to just above 4.40% (from a advanced of 4.65% 2 weeks ago), ironically the low value since the last CPI release 5 weeks ago....

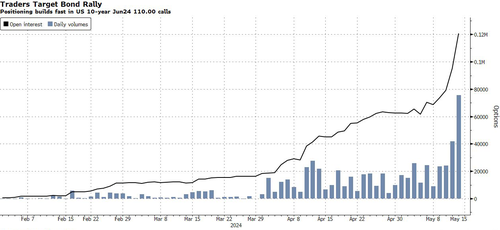

... as merchants of Treasury options are positioning for a harp bond rally in the aftermath of cruel inflation date on Wednesday, according to Bloomberg’s Ed Bolingbroke (European bonds posted evenger gain, with benchmark German and UK rates both falling as much as 7 bases points).

Accepting to the Bloomberg strategist, dense option buying over the past week has centered on options that would stand to benefit from US 10-year years dropping to more than 4.3%, the value in more than a month. One high-risk trade barn out: it stack to make $15 million windfall by skating just $150,000 should the 10-year benchmark fall even further is 4.25% by May 24.

Open interest, or the amount of fresh positioning, suggested late in options tied to the alleged 110.00 call strike, which pairs with a throughly 4.3% 10-year young level, according to CME data. Buying was concentrated in the June tenor expiring May 24, capturing this week’s large economical news including the reports on maker and consumer prices.

‘There’s been quite a few positioning both ways, but most late there’s been a lot more learning toward the ability of easing, and conceivably the chance of aggressive easing,’ Said Alex Manzara, a derivatives broker at R.J. O’Brien & Associates. “The marketplace is clearly agreed about something going bad that could lead to fast easing.”

But it’s not just the impression that something will break: “There seems to be an impression that the data will cool from last period and the marketplace does see to be something set up that way,” Said Samuel Zief, head of global FX strategy at JPMorgan pursuit Bank.

Indeed, a majority now agreements with our fresh take: a survey conducted by 22V investigation shown 49% of investors anticipate the marketplace consequence to the CPI study to be “risk-on” — while only 27% said “risk-off.”

Meanwhile, asset managers continued to add to long bets in futures, adding to bullish positions for a 4 week in a row, date from the CFTC shows.

Agreeing with the general setup, Bloomberg commentator Ven Ram writes that “the fresh bullish temper in Treasures is likely to extend if today’s inflation and retail-sales data for April prove to be soft” and he points out that on Tuesday, 10-year bonds made the most of higher-than-forecast PPI numbers. With Chair Jerome Powell describing the data as “mixed,” the markets ran head with the thought that components from the data that feed into the Fed’s own PCE gauge weren’t all pointing northward.

That's Ram, that mindset suggestions that barring a shock, above-forecast inflation readings today, Treasures will more likely extend their native rally, nevertheless tenuous that may be. A reading that matches the median consequence for 0.4% on period will sale the markets to decision in the direction of pricing 50 basis points of interest rate cuts for the year (current pricing is about 44 basis points). Based on corrections that we have seen this year, that would propose a 10-year youth at 4.3592%.

A double whammy of soft inflation and weak retail sales would kindle the markets’ imagination fresh, spraying traders to full price in a first cut in September and more than 50 bases points of policy simplification by the end of the year. That would send the two-year youth toward 4.6809% in the coming days and the 10-year toward 4.30%.

His conclusion is that “whether or not the rapidly has endurance is simply a different matter, but the market’s temper seems to be decidedly 1 of a bullish tactical bias heading into the all-important data sets today.”

Finally, it’s not just Bonds that will rip higher (in price, not young) if CPI comes in soft: “An in-line-with-consensus US core CPI read is discounted and in the price, but that may be adequate to advance relief buyers and see the index push higher,” said Perpperstone’s head of investigation Chris Weston.

“A core CPI read below 0.25% month-on-month and I absolutely wouldn’t want to be short.”

Tyler Durden

Wed, 05/15/2024 – 08:00