Why The Hardest Money Always Wins

Authored by Nick Giambruno via InternationalMan.com,

French Emperor Napoleon III reserved a special set of aluminum cutlery for only his most honored dinner guests.

Ordinary guests had to settle for gold utensils.

In the mid-1800s, aluminum was rarer and more coveted than gold.

As a result, aluminum bullion bars were included among France’s national treasures, and aluminum jewelry became a status symbol of the French aristocracy.

Aluminum—element 13 on the periodic table—is abundant in nature, but it’s typically bound up in complex chemical compounds rather than found in its pure metallic form.

Extracting pure aluminum from these compounds was an extremely costly and complex process, making it harder to produce than gold. The price reflected that.

In 1852, aluminum was around $37 per ounce, significantly more expensive than gold at $20.67 per ounce.

But aluminum’s story was about to change dramatically.

In 1886, a groundbreaking discovery enabled the mass production of pure aluminum at a fraction of the cost.

Before this innovation, global aluminum output was just a few ounces per month.

Afterward, America’s leading aluminum company began producing 800 ounces a day. Within two decades, that same company—later known as Alcoa—was churning out over 1.4 million ounces daily.

The price of aluminum collapsed—from a staggering $550 per pound in 1852 to just $12 in 1880. By the early 1900s, a pound of aluminum cost around 20 cents.

In just over a decade, aluminum had gone from the world’s most expensive metal to one of its cheapest.

Today, aluminum is no longer a prized metal for imperial feasts or national treasuries. It’s a household material, used in soda cans and kitchen foil.

Aluminum’s dramatic fall from luxury to ubiquity highlights a key monetary principle: hardness—the most important quality of a good money.

What Aluminum’s Collapse Reveals About Good Money

Hardness does not mean something that is necessarily tangible or physically hard, like metal. Instead, it means “hard to produce.” By contrast, “easy money” is easy to produce.

The best way to understand hardness is as resistance to debasement—a crucial trait for any good store of value and an essential function of money.

Would you trust your life savings to something anyone can create effortlessly?

Of course not.

That would be like storing your wealth in arcade tokens, airline miles, aluminum—or government fiat currency.

What is desirable in a good money is that someone else cannot make it easily.

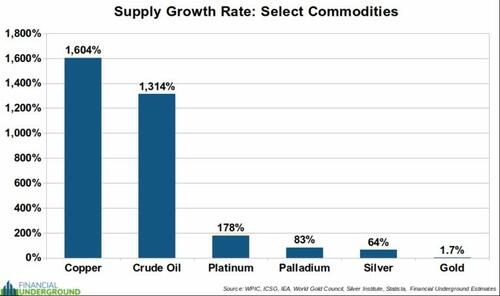

Hardness can be measured by the supply growth rate—the amount of new supply created each year divided by the existing stock.

The lower the supply growth rate, the harder the asset.

Historically, gold has been humanity’s hardest asset. Its extremely low and stable supply growth rate has made it the best form of money for thousands of years.

According to the World Gold Council, around 6.8 billion ounces of gold have been mined globally, with roughly 117 million ounces added annually.

That puts gold’s supply growth rate at just 1.7%—a figure that has remained remarkably consistent over time.

In other words, no matter how hard humans try, they can’t increase the gold supply by more than 1-2% each year, a trivial amount.

The chart below illustrates the supply growth rate of various physical commodities.

No other physical commodity comes close to gold’s low supply growth rate and resistance to debasement.

Monetary commodities like gold and silver have relatively low supply growth rates. In contrast, industrial commodities tend to have much higher rates.

A high supply growth rate means new production can significantly impact overall supply—and prices.

For industrial commodities, annual production often exceeds existing stockpiles, resulting in supply growth rates over 100%. That’s because these stockpiles are consistently depleted by ongoing industrial use.

Take copper, for example. According to the International Copper Study Group, annual production is around 21.9 million tonnes, while stockpiles are just 1.4 million tonnes. In other words, yearly copper output is more than 15 times the size of existing reserves.

Because industrial processes consume copper continuously, stockpiles remain low, and new production has an enormous influence on prices.

Here’s the bottom line:

An asset cannot be a reliable store of value if its price is vulnerable to the whims of ever-changing industrial conditions.

That’s why a high supply growth rate disqualifies a commodity from being a good money.

Three key factors can explain gold’s exceptionally low supply growth rate of 1.7%:

-

First, gold is indestructible. It doesn’t corrode or decay, which means nearly all the gold ever mined still exists and contributes to today’s stockpile.

-

Second, gold has been mined for thousands of years, unlike platinum and palladium, which have only seen a couple of centuries of production.

-

Third, industrial processes don’t significantly consume gold, unlike other metals. As a result, most of the mined gold remains in circulation.

These three traits mean gold’s existing stockpiles are massive relative to new annual production.

No one can arbitrarily flood the market with gold, making it a neutral, reliable store of value. This is what gives gold its unmatched monetary properties.

Don’t Confuse Hardness with Scarcity

It’s important to clarify that hardness is not the same as scarcity; They are related concepts but not the same thing.

For instance, platinum and palladium are much scarcer than gold.

Roughly 6.8 billion ounces of gold have been mined throughout history.

By comparison, since platinum’s discovery in 1741, only about 322 million troy ounces have been mined. For palladium, that number is even lower—around 193 million ounces.

There are far fewer ounces of platinum and palladium than gold—so why aren’t they considered better forms of money?

Because despite their scarcity, platinum and palladium are not hard assets. Their annual production is high relative to their existing stockpiles.

Unlike gold, these metals haven’t benefited from millennia of accumulation. And because industrial uses consume a large share of them, new production plays a far bigger role in pricing.

That’s why their supply growth rates—platinum at 178% and palladium at 83%—are so high. These figures underscore their role as industrial, not monetary, metals. It’s no surprise that almost no one uses them as money.

Here’s the key takeaway:

Hardness is the most important trait of a good money. All other monetary characteristics are meaningless if the money is easy for someone to produce.

That’s why, throughout history, the hardest asset has always won. And why gold has always reigned supreme.

The Next Monetary Reset Is Coming—Are You Ready?

Throughout history, the hardest money has always prevailed—and in times of crisis, gold shines.

With global debt soaring, fiat currencies faltering, and trust in central banks eroding, a major monetary reset is no longer a question of if, but when.

I’ve prepared an urgent report breaking down what’s unfolding behind the scenes, how gold is poised to play a pivotal role, and what you need to do right now to protect and grow your wealth.

Click here to download the PDF report on the coming monetary reset.

Tyler Durden

Wed, 09/17/2025 – 21:45