GE grows on a gas boom

The projected increase in energy demand, driven, among others, by the improvement of artificial intelligence, led to a large increase in orders and the valuation of GE Vernova stock exchange. Although the prospects of the American gas turbine maker look optimistic, they are not risk-free - analyses "Financial Times".

The diary refers to the results that the company has recorded 1 year after the reorganisation of General Electric's many difficulties. As a result, GE was divided into 3 separate groups, specialised in the production of health, aviation and energy equipment. The second section of the market, namely the equipment for conventional power, wind and power grids, is being handled by GE Vernova.

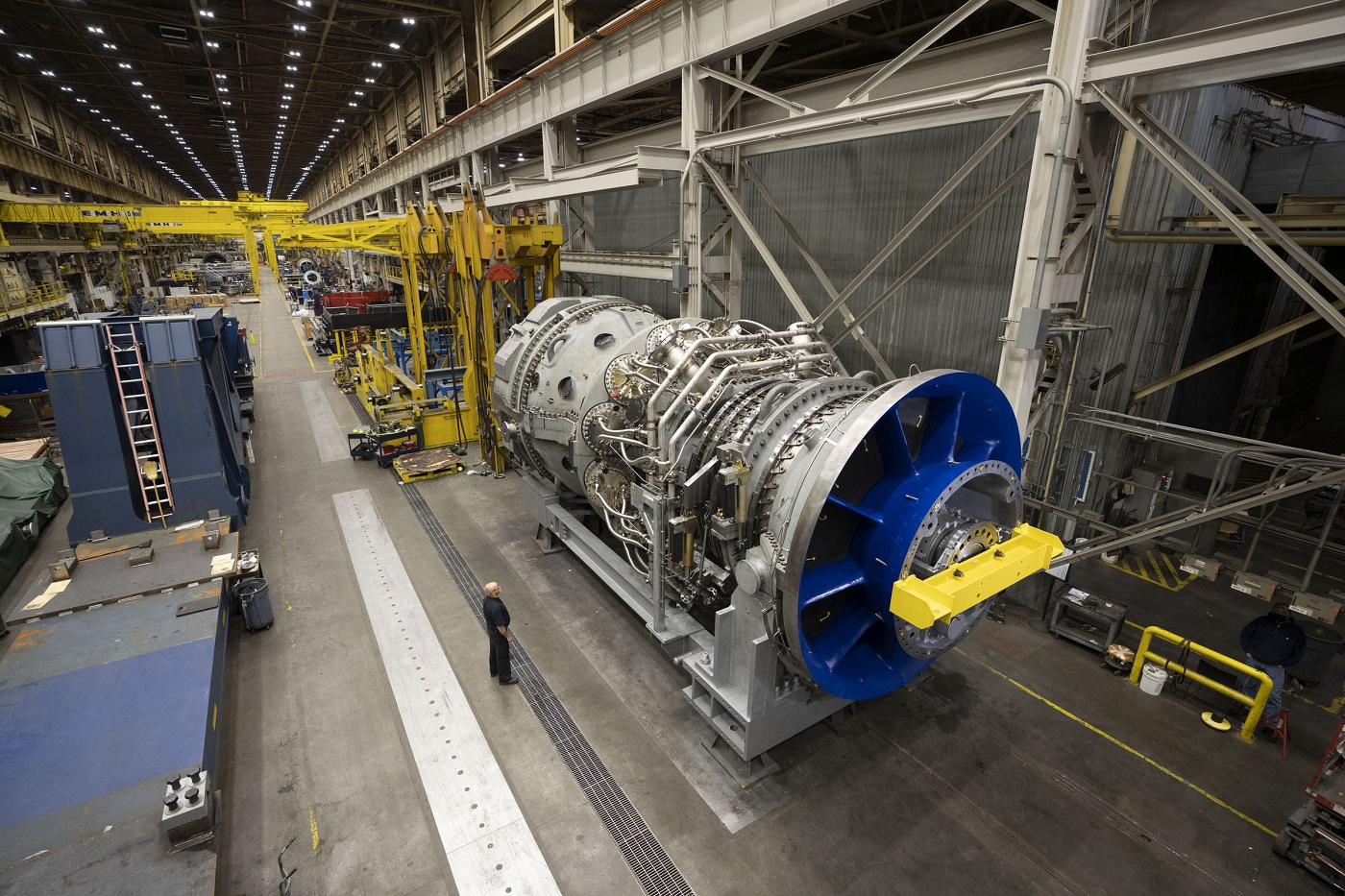

Among these marketplace areas, gas energy is the main driver of the group's growth, as request for large gas turbines is advanced and there are only a fewer global suppliers of specified equipment. In fresh years, the request to build flexible gas power plants has driven the improvement of weather-dependent renewable sources and the request to replace decommissioned coal plants.

However, since last year, especially in the US, these factors have besides been joined by the improvement of artificial intelligence, which translates into the massive construction of energy-intensive data centres that request unchangeable energy supplies. All of this increases energy request and thus the request to build fresh gas plants.

It uses GE Vernova, whose stock exchange listings in January 2025 reached a evidence level of nearly $440 per share - 3 times higher than at the time of its emancipation in April 2024.

"Financial Times", however, emphasizes that the current course of the company is by a 4th lower. This was mainly affected by the cooling of the enthusiasm of stock marketplace investors, which followed the publication in late January of the artificial intelligence model by the Chinese company DeepSeek. According to the authors' assurances, this model, despite its advanced efficiency, is expected to be much little capital intensive and energy-intensive, which means little investment in digital and energy infrastructure.

Therefore, according to any analysts, the current forecasts of a fast, up to a twelve percent by the end of this decade, the increase in energy request in the US may be besides optimistic. Furthermore, Donald Trump's chaotic trade policy is an additional hazard factor, which can translate into perturbations linked to supply chains and weakening economical growth.

In addition, Trump's negative approach to RES is already affecting GE Vernova's wind business. However, as regards gas power, the group remains optimistic, which translates into a plan to invest $600 million in production capacity for gas turbines.

The Management Board indicates that the contracts related to gas power in 2024 doubled and the group’s production capacity in this area is already full booked by 2028. In the first quarter, orders for turbines with a full capacity of 7 GW were placed in the portfolio and combined with orders for nearly 30 GW. GE Vernova is already scheduled to hold talks on contracts for up to 2030.

Total electrification carries many risks

The complete electrification and elimination of fossil fuels from economies poses many risks and the designation of this fact does not mean negation of climate change, but only demonstrates a real assessment of reality - says Javier Blas, Bloomberg's publicist.

Blas stresses that electrification is accompanied by a increasing share of RES sources in energy production, whose availability is dependent on atmospheric conditions. This, on the another hand, poses a threat to the unchangeable supply of energy, for which request increases with electricity, including transport, heating and cooling, or the improvement of artificial intelligence.

Therefore, with specified dynamic transformational changes, the issue of energy safety becomes more crucial than always before. This is indicated, among others, by the MAE, which, as Blas recalls, was created in consequence to the oil crisis in the 1970s.

Bloomberg's publicist points out that in responding appropriately to the current situation, it does not aid that there are 2 camps that stand on 2 opposing sides of the barricade. The first camp is made up of green activists who push complete electrification and want the end of the fossil fuel age. On the another hand, there are climate denialists who reject green technologies and glorify oil, gas and coal.

Meanwhile, as Blas points out, it is not in these extremes, but in the mediate of it is simply a real assessment of the situation which should be primarily addressed by governments. So that the transformation is carried out not only with concern for the climate, but besides with concern for energy security. Therefore, the decision-makers, according to Javier Blas, should bear in head 5 risks of electricity.

Firstly, if it is moving besides fast, a sharp increase in energy request may consequence in this request not being covered by renewable energy. Its generation is dependent on weather and its energy retention capacity is limited. Increased request for energy will so require the launch of fresh fossil fuel plants.

The second hazard is the matching of request to supply resulting from the availability of RES and conventional power plants. The second inactive have a large advantage over wind and solar energy. This problem will not be reduced until energy retention is widespread on a massive scale.

Thirdly, if electrification is to be carried out in a sustainable way through the improvement of RES, immense investments in electricity networks are needed. These, on the another hand, represent a major engineering, financial and social challenge, as fewer people want powerful poles in their neighbourhood.

The 4th risk, as Blas convinces, is the vulnerability of electricity systems to attacks. He adds that the markets for coal, gas and oil have many buffers and stocks that can mitigate the turbulence. For electricity, e.g. a regional cyber attack can lead to a blackout in a large area.

The 5th hazard is associated with price volatility. Although fuel prices are subject to fluctuations, it is not as violent as in the case of electricity quotations, where the scope of prices increases with the power of RES sources - from very advanced in time alleged dunkelflaute, to negative in sunny and windy days. The expanding number of hours with negative prices besides makes it hard to plan fresh investments in energy.

Customs war can harm American LNG

Donald Trump wants the planet to buy more and more U.S. gas, but his customs war does not service that purpose. The consequence is inflation, weakening the global economy or losing as large customers as China - emphasises "The Economist".

The weekly reminders that president Trump's administration thought that the current customs policy will aid the US reduce the trade deficit in goods. At the same time, as a way to alleviate or not impose tariffs on individual countries or political blocs specified as the European Union, it is to increase purchases of American gas.

In fresh years - thanks to shale gas extraction - the USA has become the largest LNG exporter and inactive have large possible for further expansion. This besides depends on Trump himself, who is simply a supporter of the improvement of the economy based on fossil fuels. Therefore, 1 of his first decisions was besides to abolish Joe Biden's stricter environmental regulations for the gas industry.

Theoretically, as the Economist points out, Washington's plans for the expansion of American LNG have reasonable grounds. The European Commission maintains the plans for a complete waiver of Russian natural material, which is intended to replace mainly deliveries from the US. Asian countries, including Japan and India, besides show interest in expanding purchases.

However, from declaration to implementation of the announcements, the road may be difficult. Regardless of policy, appropriate infrastructure is needed, especially the US export terminals. In fresh years, these investments have faced a large increase in costs, which has been affected by inflation related to pandemic and war turmoil in global supply chains. Now this inflation hazard is expanding with the customs war, which besides concerns key materials, including steel.

Customs besides have an impact on the global economy, and this naturally besides translates into fuel request - besides in Asia's fast-growing countries. The global Energy Agency (IAE) forecasts that Asian gas request will increase by 2% in 2025 compared to 5.5% the year before.

At the same time, China, against which the U.S. has targeted the heaviest forces in the customs war, has late stopped importing American LNG, and fresh contracts are concluded with suppliers from arabian countries. As a result, the current actions of Donald Trump's administration are improbable to bring the US closer to a dynamic increase in gas exports.

See also:Gas retention in Europe is almost empty. Traders and governments play the game “who blinks first”

Trump did not deprive the RES manufacture of optimism

The renewable energy sector - both in North and South America - remains optimistic about its prospects despite Donald Trump's negative attitude towards RES and climate policy - writes "Financial Times".

The diary stresses that the installed power of wind and photovoltaic power has tripled in the US over the last decade. As a result, RES became the fastest increasing origin of energy. This was supported by both favourable regulation and a fall in technology prices, especially photovoltaics.

Analysts who mention "Financial Times" indicate that despite changes in U.S. RES manufacture policy there is no collapse.

In the US alone - even with lower preferences than before - request for investment will sustain increasing request for energy, as well as price attractiveness of renewable energy production. Moreover, the sector has a kind of cushion before a fast slowdown in the form of a wave of large investments, which began even before Donald Trump took power.

Outside the US, policies of another countries should not have a crucial impact on the RES sector or should support its further development. For example, in Colombia VAT exemption applies to renewable energy equipment and services.

The solar power of photovoltaics is increasing in Central and South America, and its importance is peculiarly crucial in little developed areas. In regions specified as the Caribbean, this makes it possible to importantly improve access to electricity.

The interest in investments in RES besides does not weaken in countries with large fossil fuels specified as Mexico, Canada, Argentina and Brazil. According to a fresh survey conducted among entrepreneurs in the USA and Mexico, around 70 percent of respondents advocated prioritising investment in RES at the expense of fossil fuels.

In the article "Financial Times", he besides mentions the good situation of the manufacture in another parts of the planet - in this Europe, where he besides noticed a Polish subject among the journal. Menlo Electric, a distributor of photovoltaic panels, was ranked first by the editor in the fresh ranking of the fastest increasing companies in Europe in 2024.