Wedbush Boosts Tesla Price Target To Street-High $500 Ahead Of „Golden Age Of Autonomy”

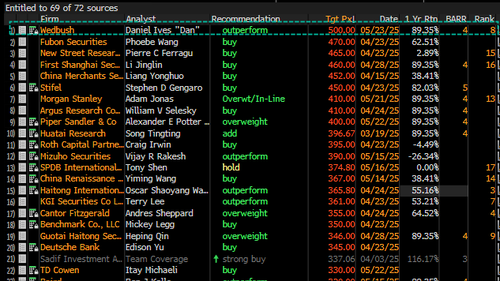

Daniel Ives of Wedbush Securities raised his 12-month price target on Tesla to a Street-high $500 from $350 on Friday morning, citing the near-term launch of Tesla’s autonomous ride-hailing Cybercabs as a major catalyst to spark the „golden age of autonomy.”

„We believe the golden age of autonomous is now on the doorstep for Tesla with the Austin launch next month kicking off this key next chapter of growth for Musk & Co. and we are raising our price target from $350 to $500 reflecting this massive stage of valuation creation ahead. We maintain our OUTPERFORM rating,” Ives said.

We believe the golden age of autonomous is now on the doorstep for Tesla with the Austin launch next month kicking off this key next chapter of growth for Musk & Co. and we are raising our price target to $500 reflecting this massive stage of valuation creation ahead.

— Dan Ives (@DivesTech) May 23, 2025

Key takeaways from Ives:

-

Autonomy as a catalyst: Tesla’s Full Self-Driving (FSD) rollout and the planned „Cybercab” initiative are seen as central to future margin expansion and valuation upside.

-

Political tailwind: Ives suggests that with Elon Musk stepping back from DOGE and the Trump administration potentially easing regulatory hurdles, Tesla is well-positioned to accelerate its FSD and AI goals.

-

AI positioning: Tesla is described as „the most undervalued AI play in the market today,” and is grouped with top tech names like Nvidia, Microsoft, OpenAI, Palantir, Amazon, Meta, and Alphabet as a long-term AI winner.

-

Vision beyond cars: The note emphasizes Tesla’s evolution into a disruptive tech and robotics company and forecasts the long-term potential to license its autonomous tech globally.

Wedbush’s Dan Ives is raising his price target on Tesla $TSLA from $350 to $500 as the “golden age of autonomous” nears:

“We believe the golden age of autonomous is now on the doorstep for Tesla with the Austin launch next month kicking off this key next chapter of growth for…

— TESLARATI (@Teslarati) May 23, 2025

„We estimate the AI and autonomous opportunity is worth at least $1 trillion alone for Tesla and we fully expect under a Trump White House these key initiatives will now get fast tracked as the federal regulatory spiderweb that Musk & Co. have encountered over the past few years around FSD/autonomous clears significantly under Trump,” the Tesla bull said.

He added, „We believe Tesla could reach a $2 trillion market cap by the end of 2026 in a bull case scenario.”

„Rome was not built in a day…and neither will Tesla’s autonomous and robotics strategic vision. There will be many setbacks….but given its unmatched scale and scope globally we believe Tesla has the opportunity to own the autonomous market and down the road license its technology to other auto players both in the U.S. and around the globe,” Ives concluded.

Now that we’ve reached the midpoint of the 2020s, we have a clearer picture of which technologies—and which companies—will potentially lead the 2030s. The firms leading in EVs, autonomous drones, space-based technologies, humanoid robotics, semiconductors, and AI are not just re-shaping consumer markets today—they’re also building dual-use technologies with direct applications in defense and national security (remember President Trump wants hemispheric defense – yet another emerging investing theme).

Tesla stands uniquely positioned in 2025. Or, more accurately, Elon Musk does. From EVs and AI to space-based technologies, power grid technologies, tunnels, and even neural interfaces, Musk controls a tech empire that spans nearly every strategic frontier that will be critical for the U.S. to secure dominance in the 2030s. Find another US-based company with these technologies under one roof that can easily scale… Yet China has several.

Suppose the 2030s are defined by technological innovation in a world fracturing into a dangerous bipolar state. In that case, the U.S. must consider incentivizing the rise of more Tesla-like companies. As Ives pointed out above, the Trump administration understands this. Read:

- America Must Reclaim These Supply Chains By 2030

And let’s not forget what Goldman Sachs recently said about China’s robotaxi rollout—a reminder that the global race in autonomy is already underway.

Tyler Durden

Fri, 05/23/2025 – 12:05