I do this very rarely, but the issue is so serious that it is worth recalling with crucial changes and additions my text from February 14 of this year: "In defence of the Polish gold we must shout loudly!" [1], in which I stated, among another things, that 1 of the most crucial and anti-Polish decisions of D. Tusk will be "determining the date of Poland's adoption of the fresh German-EU currency, or Euro... due to the fact that why do we request the national and central currency of the National Bank of Poland erstwhile in German Frankfurt am Main the ECB - the European Central Ban issuing the Euro!",

I besides stated that the "frontal attack on the Polish zloty will take place erstwhile the "coalition of 13 December" starts the final war with the NBP and its president Prof. Adam Glapinski (..) and the necessity of the Euro currency is 1 of the demands of those who want to make from the EU a single centralised State of Europe with capitals in Berlin and Brussels. And unfortunately, the current government is the footstool of the EU elite and will agree to whatever Berlin, Paris or Brussels orders with an emphasis of course on Berlin."

And what do we have now? The fresh government led by D. Tusk and the full "coalition 13 December" environment fried a 68-page paper designed to lead the president of the NBP, Prof. Dr. A. Glapiński to convict him in the trial before the Court of State.

And I think everyone realises that it is only 1 thing: to remove A. Glapiński from the function of managing our central bank, due to the fact that it is an obstacle to the introduction of the Euro currency in Poland. And this negative attitude towards the Euro was expressed by the head of the NBP on many occasions and even if he did not question the thought of the EU currency itself, he claimed that first - and before the introduction of this currency - Poland must economically join rich EU countries and this will take many years.

It should be recalled that the 6-year-old - second and last - word of office of the president of NPB ends only in the mediate of 2028, so it may happen that D. Tusk, despite even 4 years of his rule, simply will not be able to introduce the Euro in Poland, yet he erstwhile announced that this currency would be introduced in our country already in 2012.

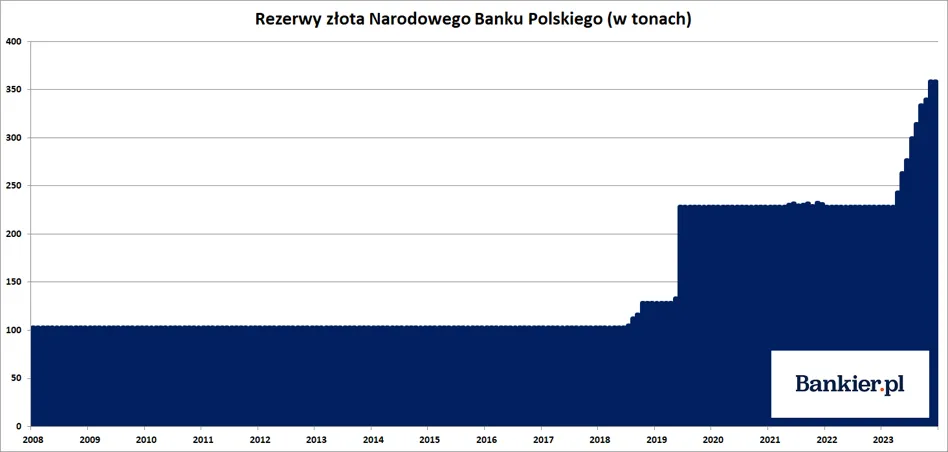

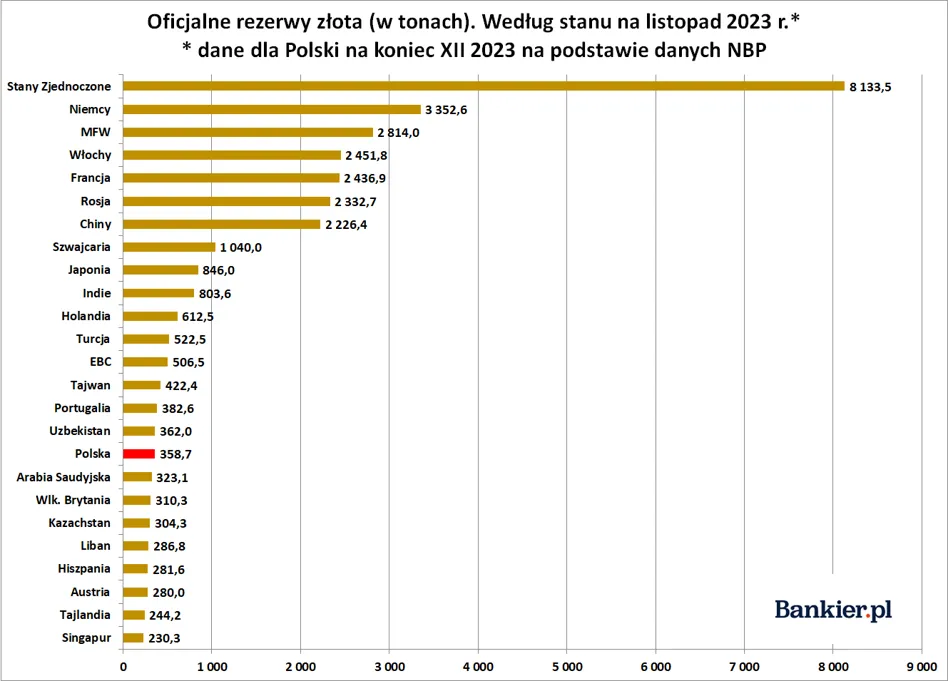

But it is not only about the euro itself, but besides about Polish reserve assets of NBP, which at the end of December 2023 amounted to $193.8 billion, including gold was worth $23.8 billion. At the end of January 2024 reserve assets fell by 4.3 billion dollars and reached a level of $189.6 billion.

It is essential to note that it was the president of NBP A. Glapiński who started buying gold for Poland after many years, which at the end of December 2023 we had about 358.7 tonnes.

Source: ]]>https://www.bankier.pl/news/Polska-zbroi-sie-w-gold-20%...]]>

Source: ]]>https://www.bankier.pl/news/Polska-zbroi-sie-w-gold-20%...]]>

"At the end of 2023, Polish gold reserves were 358.7 tons. This puts Poland in 17th place in the world. Or 15., if the statistic exclude global institutions, the European Central Bank (with 506.5 tons of gold) and the global Monetary Fund (2 814 tons) (...) We are making intensive purchases of gold, (...) we want to scope 20% of the gold reserves (today - 12.6% - dop. kj) due to the fact that times are restless, and global ratings and global trade watch how many gold reserves a given bank has. If he has large reserves and a large share in gold means that this is simply a reliable country (...) and in specified a country he trades and invests in it – he explained at the December press conference the NBP president Adam Glapiński" [2].

And what are the reasons why the head of the NBP, before the introduction of the Euro, wants to lead Poland to the economical and economical level which present is characterized by the richest EU countries?

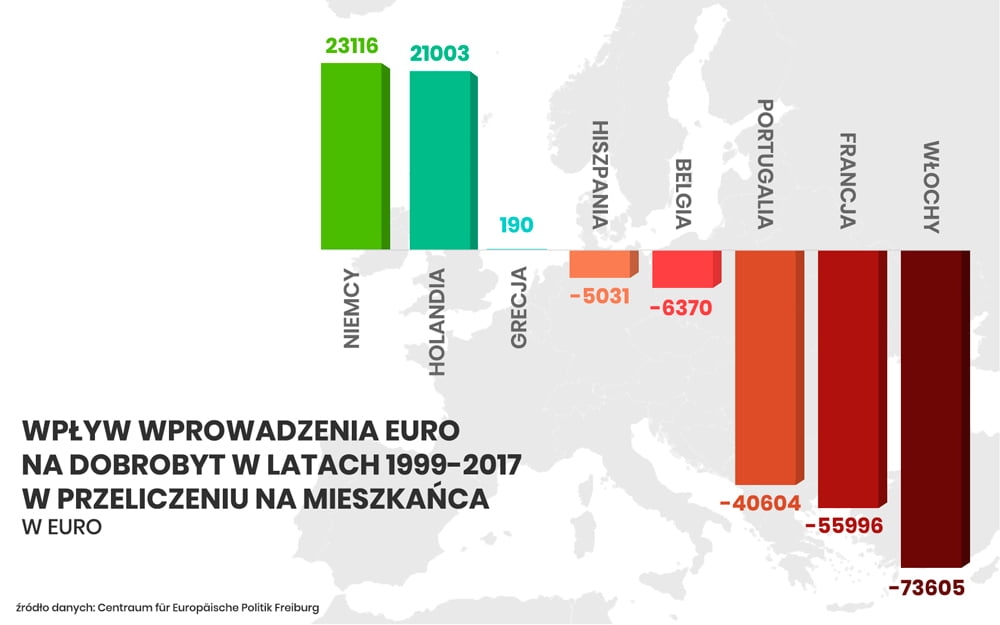

The reasons are two, 1 being the most important. In fact, only 2 countries have benefited from the euro: Germany and the Netherlands. Recently, Solidarity Unions recalled the results of the investigation of the German think tank Centre for European Policy (CEP), which, on the occasion of the 20th anniversary of the euro, decided to check how this currency affected the wealth of the countries that adopted it. Only those countries that have been the longest in the EU have been taken into account.

Source: ]]>https://solidarnosckatowice.pl/who-kto-kto-stracil-na-euro/]]>

"Euro in cash form entered into circulation in 2002, but already 3 years earlier was in force in non-cash transactions. It turns out that in the first 2 decades of the single European currency, only 2 countries have benefited from it: Germany and the Netherlands. The average German citizen increased by more than EUR 23 000 during the period considered and the Dutchman increased by EUR 21 000. 1 country, i.e. Greece has "come to zero", the remainder have lost a lot. The average Frenchman was poored by a single European currency of EUR 56 000 and Italy by EUR 735,000. The CEP study shows that 1 of the main causes of the decline in prosperity after the adoption of the euro was the simplification in global competitiveness. Before the euro was introduced, countries could devalue their currencies utilizing the tools of a sovereign monetary policy, making the exported products cheaper on the planet market. erstwhile they shared it, they lost that opportunity. "The problem of divergent competitiveness of euro area countries remains unresolved," wrote the authors of the study" [3]. The simplification in global competitiveness has besides contributed to weakening economical growth, expanding unemployment and falling taxation revenues [4].

The above data can besides be shown tabularly:

Source: ]]>https://300economy.pl/news/who-scored-a-who-stracil-for-20 years-istn...]]>

The second reason, but the ambiguous anticipation to quantify it, is that it is likely that the euro will fall. Then why bear the cost of introducing the Euro itself erstwhile it will fall anyway? I don't know how much fact there is about the fact that in Germany, for example, the ability to beat coins and print German brands is inactive maintained, but I read about it somewhere...

Many people are accused of the NBP President, but 1 forgets that the NBP is not only expected to take care of the value of Polish gold and accomplish the assumed inflation rate. For the purposes of this text, however, it is worth recalling that the Polish national bank has 3 basic functions: the central bank, the issuing bank and the bank. Its activities are regulated by law.

The National Bank of Poland performs a number of tasks enshrined in the State's Monetary Policy Strategy. These include:

– maintaining a unchangeable price (established inflation rate),

– management of abroad exchange reserves of the Republic of Poland,

– issuing of cash marks (including Polish gold supply),

– improvement of the payment system,

– maintaining the stableness of the banking sector,

– conducting monetary policy (including the alleged "free marketplace operation"),

– Service of the Treasury,

– educational and information activities.

If it were to measure inflation, the "coalition of 13 December" longed for it to be as large as possible and almost to push the "self-fulfilling prophecy" for inflation over 20%, which was to increase inflation expectations on the supply and request side of goods. The large "economic experts" on the government side besides alleged that the head of the NBP was fighting inflation badly, due to the fact that he did not radically increase interest rates and not "suffocating" the economy, which would entail an increase in unemployment and a decrease in GDP, or recession. specified "balcerowiczy", monetaryist ways of combating inflation - only this seems to know these "experts".

On the another hand, the president of the NBP was very cautious in raising interest rates and he always announced that inflation would fall systematically in time and that all his predictions were true, which just embarrassed the government economists and put out their hands on a mispolicy of suppressing inflation by the head of the NBP.

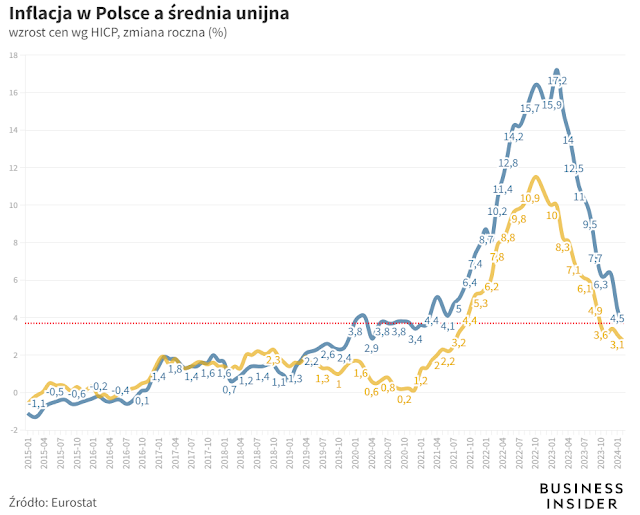

Source: ]]>https://businessinsider.com.pl/economy/Polish-high-in-ranking-inflac...]]>, German - Poland, yellow - EU average

Price increases according to the harmonised EU basket, year-to-year change in February 24 (%, HICP)

Source: ]]>https://businessinsider.com.pl/economy/Polish-high-in-ranking-inflac...]]>

"3.7 percent year-on-year. According to Eurostat methodology, in Poland, harmonised inflation (HICP — the same inflation basket and the same methodology for all EU members) was achieved in February 2024. For comparison, let us remind that the CSO gave inflation according to its methodology of 2.8 percent. But the Gustov index is hard to compare with another countries, due to the fact that it has another parameters, including mainly a different composition of the basket (...) 3.7% rdr is the lowest yearly increase in HICP prices since February 2021, although it is better that we do not get utilized to specified low levels, due to the fact that shortly up to 5% will be restored to VAT on food. This will importantly change the value of the indicator upwards, i.e. by about 0.9 percent points as predicted by the NBP" [5].

The above figures show that all EU countries have faced an increase in inflation in fresh years, which was first due to the Covid-19 pandemic and later dramatically increased due to the priced energy shock after W. Putin started a full-scale war with Ukraine. The illustration shows that for February 2024 the average EU inflation was 2.8% and inflation in Poland was only somewhat higher and was 3.7%. Even in December 2023, we were close to the inflation podium and in February 2024 prices were already rising faster in six EU countries. This only proves that the long-term (strategically) policy of the NBP's fight against inflation was correct, and with the fall in inflation we avoided a extremist increase in unemployment and comparatively large recession.

Finally, I will repeat the advantages of having my own currency.

Tens of articles have been written about the advantages and disadvantages of the state's own currency, many technological conferences have been held, and it is besides taught at universities or economical directions. Focusing on the positives of own currency, the full of the discussion on this subject can be brought to respective basic accounts which constitute a cloud of the benefits of own currency [6], [7], [8], [9], [10], [11], [12], [13], [14], [15], [16]. Pointing out positives, it is easy to identify - as opposing - disadvantages from the deficiency of a national currency and the introduction of the Euro.

First.

Having your own currency is simply a condition for independent statehood, an attribute of sovereignty. In today's world, the sovereignty of the state is limited in many respects by various global conditions, including the EU, due to the fact that we have entered this EU. Fortunately, there are areas where our country inactive retains its sovereignty. This area is monetary policy. This is simply a very crucial asset of Poland. The right to conduct its own monetary policy involves the right to have its own national currency. While we have given up our own currency to join the EU, there is no deadline erstwhile we will do so. Good, due to the fact that this can be extended indefinitely and today's head of NBP emphasizes that Poland cannot afford to accept the bad for the countries of the South of Europe. And we should not be able to afford it until this common European currency falls, and I am certain of it.

Second.

Own currency is an economical governance tool. By manipulating in terms of affirmative interest rates or exchange rates and transaction costs, it is possible to influence the state and improvement of the economy. And it is simply a large asset. As the figures show since the start of the euro area, mature countries with their own national currencies have reached a faster pace of economical improvement than the euro area overall. Moreover, the situation of mature countries with their own national currencies is besides more favourable at the social level, i.e. in relation to labour marketplace conditions. These countries are characterised by lower unemployment rates than the euro area. Experience so far has thus shown that economical success can be achieved, fast economical growth and good labour marketplace conditions can be achieved without the closure of the national currency. Many countries with somewhat lower levels of economical growth or even poorer countries have besides retained their national currency and their own central bank with national monetary policy. It is worth noting that Bulgaria, Croatia, the Czech Republic, Denmark, Poland, Romania, Sweden and Hungary have preserved their own currencies among EU countries. The UK has besides been among these recently, but after Brexit it is already treated as a country outside the EU. And so far, there is no request for these countries to adopt the single currency.

Third and most important, I think.

Own currency is essential in times of crisis and countering them. It is the most crucial component in protecting its economy from the crisis. erstwhile the country's economy weakens, home request falls, citizens have little money and little buying, the government spends little on investment, then the only hope remains the 3rd component of GDP – exports. In times of crisis, national currency is weakening, abroad exchange rates are increasing, which makes the prices of our products more attractive to abroad contractors. Then there is simply a chance that exports will increase and make up for failure in part of home request or government investment. As a result, unemployment has a chance to halt growing, budget revenues are falling, the economy will halt shrinking. It'll be easier to get out of the crisis. I repeat: the experience of different countries shows that in situations of economical downturn, the rate of the national currency is usually decreasing. This increases export profitability and improves the profitability of home tourism. This makes it easier to leave stagnation or recession. There are no specified options erstwhile you do not have your own currency and are dependent, for example, on the decision of the ECB (European Central Bank), which present only cares about the interests of France and Germany (possibly the Netherlands). Having its own currency besides allows the central bank to regulate the exchange rate smoothly by alleged intervention in the abroad exchange market, i.e. appreciation or depreciation of its own currency. So if the course is besides advanced and thus creates conditions that are not conducive to economical development, it can be attempted to lower it by specified intervention. This operation besides works the another way around. "It's called a currency war. Then the economy of a country that has devalued its own currency is more competitive than the economies of its neighbours. It's cheap. Is that what neighbors don't like? Maybe. You don't like it much. Yeah, even always. At the beginning of the thought of a single currency, was it not possible to deprive economical competitors of this tool to stimulate their own economy? The question, in my opinion, is rhetorical" [17]. In addition, it is possible to regulate/set the interest rate which determines the availability of money in the marketplace (credit interest rates), i.e. its supply. This is besides a very crucial attribute erstwhile the economy begins to gradually fall into crisis. This can be seen from the example of the current coronavirus crisis, erstwhile NBP lowered interest rates so that Polish entrepreneurs could (can) get cheaper money and thus someway defend themselves from bankruptcy.

In summary,

Without its own currency, Poland would be susceptible in the event of major crises and could not make at specified a pace as until recently, that is, before the coronacrisis and the ongoing war in Ukraine. We would be at the mercy of the ECB with the euro and, therefore, we could only number on alms from the richer countries we want to catch up with economically. Without gold, this pursuit will never succeed, due to the fact that the large Germans. The Netherlands and France do not want our economy to grow dynamically and to be competitive towards them. This has already been done by the countries of the South of Europe, where their competitiveness after the adoption of the Euro has fallen dramatically and they have simply had to be in excessive debt. Germany and the Netherlands have been the most successful in the euro. After the introduction of the single currency, Germany has become “Chinese of Europe” with a crucial surplus in the balance of trade with another countries of the monetary union each year. To think that D. Tusk declared that Poland could accept the Euro even in 2012... But what could then be declared by a man who full supported German politics and the economy?

Finally, 1 more asset of own currency. Having it its own Poland is comparatively safe and will not divide the destiny of Greece years ago . Of course, a speculative attack on Polish debt is possible, but unlikely. What can a country then do, cut off from sources of external financing? As a last resort, run the central bank printers. The NBP could, after a insignificant revision of the NBP Act, acquisition Polish debt lowering its profitability. Just like the Fed and the Bank of Japan do. Of course, everything in the right proportions and with the right targeting of money streams in the economy.

P.S.

The president of NBP is besides accused of unwarranted printing of the Polish zloty, i.e. besides much of its supply on the market, supposedly illegal actions in the area of "free marketplace operation", over-indebtedness of the state and alleged "repoliticisation of NBP".

In my opinion, these allegations are unfounded and unjust. We went through "dry foot" coronacrisis thanks to various "government anti-crisis shields" and stableness of the marketplace by the NBP. So far even the war in Ukraine has not shaken the Polish economical and financial strategy and abroad exchange reserves are constantly increasing.

The attack on Prof. A. Glapiński is another "hucpa" of the anti-Polish current government and it must yet scope us!!!

[1] ]]>https://krzysztofjaw.blogspot.com/2024/02/w-defence-Polish-osto-tr...]]>

[2] ]]>https://www.bankier.pl/news/Polska-zbroi-sie-w-gold-20%...]]>

[3] ]]>https://solidarnosckatowice.pl/who-kto-kto-stracil-na-euro/]]>

[4] ]]>https://300economy.pl/news/who-scored-a-who-stracil-for-20 years-istn...]]>

[5] ]]>https://businessinsider.com.pl/economy/Polish-high-in-ranking-inflac...]]>

[6] ]]>https://krzysztofjaw.blogspot.com/2023/03/first-terrifying-100-day-...]]>

[7] ]]>html]]>

[8] ]]>https://economica.gosc.pl/doc/6562923.Provisions-own-currency]]>

[9] ]]>https://wpoliticy.pl/policy/154733-why-not-should-enter-in...]]>

[10] ]]>https://pl.wikipedia.org/wiki/Waluta]]>

[11] ]]>https://nbp.pl/wp-content/uploads/2022/09/operations-open-market.pdf;]]>]]>https://pl.wikipedia.org/wiki/Operations_open_market]]>

[12] ]]>https://pl.wikipedia.org/wiki/Pieni%C4%85dz#Pieni%C4%85dz_original]]>

[13] ]]>https://stockip2.ore.edu.pl/uploads/publications/44e33f66b612afab5cfe9b...]]>

[14] ]]>https://finanse.wp.pl/history-money-on-beginning- former-shells-6114840...]]>

[15] ]]>https://finance.wp.pl/one-currency-world-remedium-on-crisis-611454347...]]>

[16] ]]>https://magazines.uni.lodz.pl/foe/article/view/395/526]]>

[17] ]]>https://pl.wikipedia.org/wiki/Rubel_transfer]]>

* Oh, my God * Astana is simply a beautiful capital built from scratch since 1990. Many consider it 1 of the capitals or even the capital of the Illuminati and Masons: ]]>https://forsal.pl/gallery/684933,astana-see-built-for-petrodolary...]]>]]>https://www.youtube.com/embed/FPBHDJM2ap4;]]>]]>https://www.salon24.pl/u/incredible/799479,astana]]>