US Health Insurance: What Are Its Problems And Potential Solutions?

Authored by Lawrence Williams via The Epoch Times (emphasis ours),

American health insurance seems to frustrate everyone. Patients complain that it’s expensive and complicated. Providers say it buries them in paperwork and can negatively affect patient care.

Poll after poll indicates that most people simply don’t trust their health insurance provider or the health care system itself. Fully 70 percent of the country thinks American health care has major problems or is in a state of crisis. Consumer satisfaction is at a 24-year low.

Frustration with health insurers may have turned to rage in a young man accused of killing a UnitedHealthcare executive in New York City on Dec. 4. The alleged killer appears to have been driven by an idea soon echoed on social media, that the woeful tale of American health care is a story with a villain, and the villain is health insurers.

Yet identifying a villain here is no simple matter.

The American health payment system is a ramshackle structure comprising public and private insurance plans offered by a host of providers across multiple states. Over many decades, the system has been layered with more legislative patches than the roof on your grandfather’s barn.

Despite the good intentions of lawmakers, regulators, countless health care workers, and insurance companies, health insurance remains expensive and confusing for the 92 percent of Americans who have it and for the 8 percent who don’t.

Despite its problems, many experts believe the health payment system can be improved. Some want to level the ground and build a new system from scratch. Others advocate refinements to make health insurance less expensive and more transparent. Any solution will require cooperation among a host of key players, including insurance companies, health care providers, state governments, and that most unpredictable of all institutions, the United States Congress.

Here’s an overview of the symptoms affecting the health care payment industry, some root causes, and cures suggested by industry analysts.

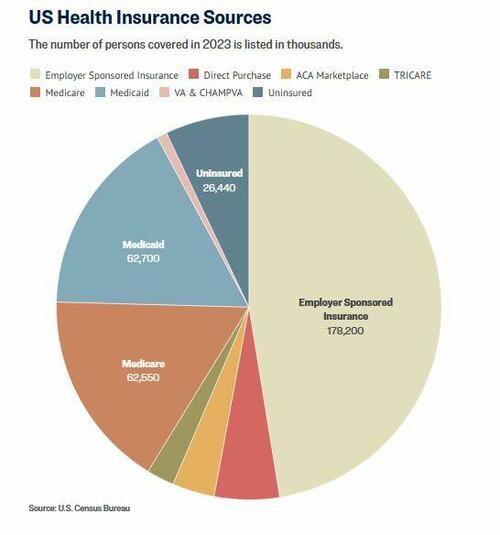

But first, here are the primary ways people get health insurance in the United States.

Flags fly at half mast outside the United Healthcare corporate headquarters in Minnetonka, Minn., on Dec. 4, 2024. Stephen Maturen/Getty Images

Flags fly at half mast outside the United Healthcare corporate headquarters in Minnetonka, Minn., on Dec. 4, 2024. Stephen Maturen/Getty ImagesThe Payers

Employer-sponsored insurance (ESI) is the most common way Americans get health care coverage. This includes self-funded plans, in which the employer acts as the insurer, and commercial health insurance purchased by a company for its employees. More than 178 million people had ESI in 2023, according to the U.S. Census Bureau.

Self-purchased health insurance is obtained by individuals directly from an insurance company, sometimes with the aid of an insurance agent or through the Affordable Care Act (ACA) Marketplace. The Marketplace offers premium discounts in the form of tax credits based on the buyer’s income. Nearly 34 million people bought their own health insurance in 2023. Of those, about 13.3 million used the Marketplace.

Medicare is a federal entitlement program that provides health insurance for Americans age 65 and above, people with a disability, and those having end-stage renal disease or ALS. Medicare covered about 63 million people in 2023.

Medicaid is a government program that provides health insurance and other benefits to low-income Americans. Medicaid is funded by both the federal government and the states. It is administered by the states within guidelines provided by the federal government. Coverage can vary from state to state. Medicaid covered about 63 million people in 2023.

Also in 2023, about 9 million people were covered by TRICARE, a program for U.S. servicemembers, their dependents, and retirees administered by the U.S. Department of Defense. Another 3 million people were covered by the Veterans Administration and related programs.

About 26 million people had no health insurance in 2023.

Symptoms

The most frequent complaint about health insurance is the cost. About half of Marketplace (55 percent) and ESI users (46 percent) gave their health insurance a negative rating based on its premiums in a 2023 survey by KFF. That’s roughly double the dissatisfaction rate for Medicare (27 percent) and Medicaid beneficiaries (10 percent).

The cost of ESI for a hypothetical family of four in 2024 was $32,066, according to the actuarial firm Milliman. Of that total, about 58 percent would typically be paid by the employer.

Cost is a major complaint for employers too, according to Orriel Richardson, an executive director at Morgan Health, a business unit of JPMorgan Chase aimed at improving health care.

“The growing refrain within small and mid-sized businesses is that providing health insurance for their employees is becoming unsustainable,” Richardson told The Epoch Times.

Another pain point with health insurance is the complexity of the plans. Consumers say this makes their coverage difficult to use and often seems unfair. Providers say the requirements are burdensome to them and make it more difficult to provide good health care.

Nearly two-thirds of Americans, 65 percent, said they don’t think health insurance providers are transparent about their coverage, according to a 2024 poll conducted by physician network MDVIP and Ipsos. Nearly the same number, 62 percent, find aspects of their health plan like co-insurance payments and deductibles hard to understand.

A 2023 KFF report showed that most people, 58 percent, had trouble using their insurance within the preceding year. Denied claims, provider network issues, and pre-authorization were commonly cited problems. About half of those who experienced problems were unable to find a satisfactory resolution.

Insurance companies generally do not publish their claim denial rates, though the data analysis firm Experian Health reported in 2024 based on provider surveys that claim denials are increasing. Thirty-eight percent of respondents said at least 10 percent of their claims were denied by the insurer. Some reported denial rates above 15 percent.

In 2021, just 0.2 percent of in-network denied claims were appealed by Marketplace enrollees, according to an analysis by KFF. The appeals were unsuccessful 59 percent of the time.

Providers are frustrated too. The administrative demands required by insurance companies are a particular pain point. Experian found that 65 percent of providers said meeting the insurers’ claim-submission requirements is harder now than before the pandemic.

More than 80 percent of nurses said the administrative demands imposed by insurance companies delay patient care, and about 75 percent said insurance policies reduce the quality of care according to a 2023 survey by the American Hospital Association. More than 80 percent of physicians said insurance policies hamper their ability to practice medicine.

A customer waits at the counter of a CVS Pharmacy store in Pasadena, Calif., May 2, 2016. Mario Anzuoni/Reuters

A customer waits at the counter of a CVS Pharmacy store in Pasadena, Calif., May 2, 2016. Mario Anzuoni/ReutersInsurance companies are aware of the problems.

Andrew Witty, CEO of UnitedHealth Group, said as much in an op-ed in The New York Times just days after one of his executives was gunned down in New York.

“We know the health system does not work as well as it should, and we understand people’s frustrations with it. No one would design a system like the one we have. And no one did. It’s a patchwork built over decades,” Witty wrote on Dec. 13.

Causes

Witty touched on a root problem commonly mentioned by health insurance experts. The industry did not develop purely as a market response to a need as many other businesses did. It was patched together over a hundred years or so through a combination of business and government interventions.

“We are working with a healthcare system that was never truly designed for the purpose of making people healthier and having them live their optimal lives. It was always reactive to different things,” Richardson told attendees at a 2023 event sponsored by the Alliance for Health Policy.

ESI was started in the early 1900s by employers looking to ensure a reliable workforce. The Affordable Care Act now makes ESI mandatory for many employers. Medicare and Medicaid were created in 1965 to provide health coverage for uninsured Americans, though coverage has widened over time to provide access for more people.

The Employee Retirement and Income Security Act of 1974 was created to regulate employee pensions and includes a provision prohibiting states from regulating ESI plans, according to KFF. The Emergency Medical Treatment and Labor Act was added in 1986 to impose minimum standards for emergency care on hospitals accepting Medicare patients. COBRA, HIPAA, the Affordable Care Act, and the No Surprises Act also impose conditions on health insurance and medical services providers.

Read the rest here…

Tyler Durden

Sun, 01/05/2025 – 21:00