US Stablecoin Bill Likely In „Next 2 Months”; Trump’s Crypto Council Head

Authored by Sam Borgi via CoinTelegraph.com,

The Senate Banking Committee’s bipartisan approval of the GENIUS Act means stablecoin legislation could arrive at the president’s desk in a matter of months, according to Bo Hines.

Bo Hines, the executive director of the President’s Council of Advisers on Digital Assets, said comprehensive stablecoin legislation is expected to be finalized in the coming months, underscoring the government’s urgency to maintain the US dollar’s dominance in onchain activity.

Speaking at the Digital Asset Summit in New York on March 18, Hines said stablecoin legislation is “imminent” following the Senate Banking Committee’s approval of the GENIUS Act last week.

The GENIUS Act, which is an acronym for Guiding and Establishing National Innovation for US Stablecoins, establishes collateralization guidelines for stablecoin issuers and requires full compliance with Anti-Money Laundering laws.

“We saw that vote come out of the Senate Banking Committee in extremely bipartisan fashion, […] which was fantastic to see,” said Hines, adding:

“I think our colleagues on the other side of the aisle also recognize the importance for US dominance in this space, and they’re willing to work with us here, and that’s what’s really exciting about this. You know, there’s not many issues in Washington, DC, in which folks can come together from both sides of the aisle and really propel the United States forward in a way that’s comprehensive.”

Bo Hines (right) speaking at the Digital Asset Summit on March 18. Source: Cointelegraph

When asked about when stablecoin legislation will be passed, Hines said, “I think that stables could be on the president’s desk here in the next two months.”

Right now, the market seems to be underestimating what this bill “could do for the US economy in terms of US dollar dominance, in terms of payment rails, in terms of altering the course of financial markets,” said Hines.

Extending the dollar’s hegemony

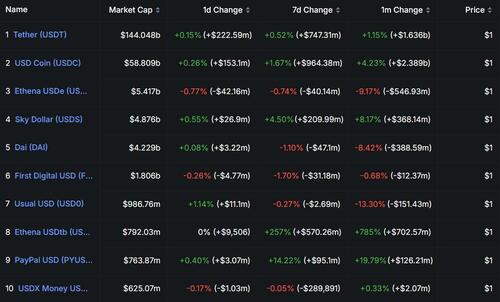

The US dollar accounts for the vast majority of the $230 billion worth of stablecoins in circulation, suggesting that the greenback remains the currency of choice for funding cryptocurrency accounts and sending remittances overseas.

Some industry experts believe this will change in the future as stablecoins become multicurrency, but so far, digital dollars remain the overwhelming favorite.

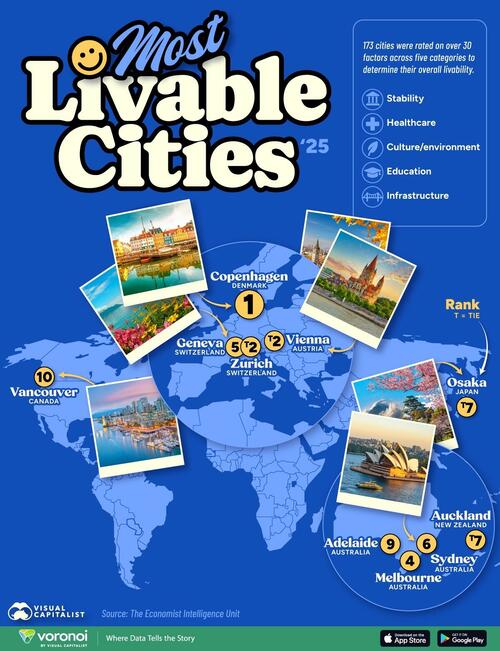

Dollar-denominated stablecoins dominate the market. Source: DefiLlama

US Treasury Secretary Scott Bessent said the Trump administration will use stablecoins to maintain the dollar’s status as the global reserve currency, which partly explains the sense of urgency to push legislation over the finish line.

“We are going to put a lot of thought into the stablecoin regime, and as President Trump has directed, we are going to keep the US [dollar] the dominant reserve currency in the world, and we will use stablecoins to do that,” Bessent told the White House Crypto Summit on March 7.

Treasury Secretary Scott Bessent pictured alongside President Donald Trump at the White House Crypto Summit on March 7. Source: The Associated Press

We give the final words to former US Senator Pat Toomey:

Imagine a world where every dollar you spend is tracked, approved, or denied in real time by a government agency. You attempt to send money to a friend for a political donation, but the transaction is blocked because the recipient is on a government “watch list.”

You buy a book critical of a powerful politician and your account is flagged for review.

This dystopian future sounds outrageous but it’s the logical endpoint of a fully government-controlled and monitored monetary system for which some prominent U.S. policymakers advocate.

Its defenders argue that such a government-omniscient system would prevent crime. In reality, it would destroy the core freedoms of financial privacy and autonomy.

Stablecoins are an existing alternative to this dystopia. They are both a major financial innovation, and a bulwark against creeping financial authoritarianism. The U.S. Congress must support this technology as the Senate Banking Committee weighs legislation to provide clarity for the industry and its customers.

Unfortunately, some senators, especially Senator Elizabeth Warren (D-MA), stand in stark opposition to this progress.

Tyler Durden

Wed, 03/19/2025 – 13:05