US Exceptionalism Over? Alibaba Soars On AI As US-China Tech Valuation Gap „Must Narrow”

Hong Kong stocks surged overnight after Alibaba reported a staggering 239% year-over-year jump in net profit for the final quarter of 2024. CEO Eddie Wu credited the strong performance to explosive growth in the company’s cloud business and a surge in artificial intelligence investments over the last six quarters.

Goldman’s Fred Yin and Shubham Ghosh provided clients this morning with further insights on Alibaba and the apparent fading of US exceptionalism as attention shifts to tech stocks in China and Hong Kong:

HK shares exploded higher today after Alibaba results boosted tech optimism further, HSI +4% had its best one-day return since Oct 2024 while HSTECH +6.5% managed to close out its 6th weekly gain in a row, the longest such run in 5 years. Alibaba +14.6% surged on a clean beat with strong showings from both e-comm and cloud segments, and CEO says AGI is now the company’s „primary objective”...the stock is now up over 60% YTD.

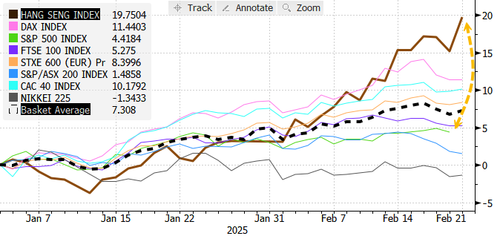

US exceptionalism fading appears more evident while looking at the massive outperformance of the Hang Seng Index on the year, bps from entering a bull market, while the S&P500 is up 4.5% YTD.

Shedding more color on this theme is Goldman’s Peter Sheren:

US Exceptionalism Over? In January, the Desk hosted a dinner with 8 global long only and sovereign wealth funds in attendance.This dinner was shortly after the DeepSeek news. When asked whether any of the attendees were considering shifting money from the US to either Europe or the Asia, the group emphatically said now as their stakeholders expected that they get the US right and they must outperform in the US as US exceptionalism remained in the mind of investors. Fast forward to today and the US is dramatically underperforming, up only 4% year-to-date versus Europe up 13% and HSI up 12%. The HSTECH is up 23%. This outperform looks to have accelerated overnight with Alibaba earnings showing a clean beat with strong domestic retail numbers (opposite of Walmart guidance) and strong Cloud results. GIR hikes BABA’s Cloud SOTP contribution by 63% to US$31 from US$19. New Price Target US$160/HK$156 from US$117/HK$114. As I have been writing all week, the valuation gap between the US and China Internet must narrow as the regulator risk discount needs to be removed.

At the start of the week, we told readers that Alibaba founder Jack Ma’s reemergence—who had disappeared from public view after criticizing Beijing several years ago—now seen shaking hands with President Xi signaled one thing: „CCP Renews Confidence in China Tech.”

„Highly Symbolic” Moment: Alibaba’s Jack Ma Reemerges, Shakes Xi’s Hand As CCP Renews Confidence In China Tech https://t.co/qArO3DHf1o

— zerohedge (@zerohedge) February 17, 2025

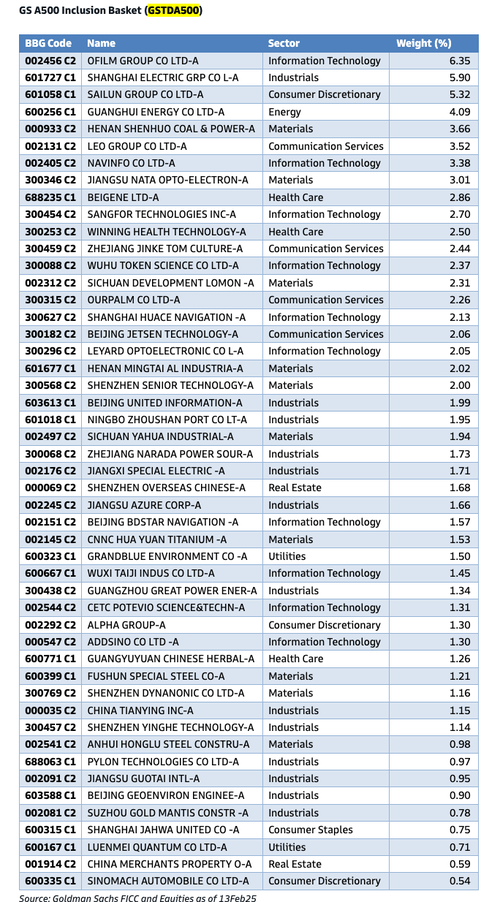

The very handshake excited Goldman’s Philip Sun, who told clients to consider „getting more exposure to China A-Shares” by using their „GS A500 inclusion basket (GSTDA500).”

Two weeks ago, Goldman’s Hailey He told clients her stance on Chinese tech stocks was „cautiously optimistic,” noting that „AI enthusiasm sparked by Deepseek pushed Chinese tech shares into a bull market.

The AI boom has now reached Alibaba and other Chinese tech stocks, suggesting that earnings results will be boosted in the coming quarters. This will provide tailwinds for high stocks and potentially continue outperformance versus US tech. This poses a challenge for President Trump, who views the stock market as a barometer of success. However, it’s important to remember that Trump only needs to deepen the trade war with China to derail this newfound AI enthusiasm in HK tech stocks.

Tyler Durden

Fri, 02/21/2025 – 14:40

![Auto częściowo w wodzie na Jeziorze Lednickim! Rajd pijanego kierowcy? [ZDJĘCIA]](https://wielkopolskamagazyn.pl/wp-content/uploads/2025/02/IMG_0763.jpeg)