UPS To Slash 20,000 Jobs On Amazon Pullback & Looming Freight Slowdown

United Parcel Service plans to cut tens of thousands of jobs this year and close dozens of leased and owned facilities by the end of June, describing the move as a „network reconfiguration and efficiency effort.” The reductions follow a pullback in partnership between the carrier and e-commerce giant Amazon for low-margin deliveries, a shift that began earlier this year, and come amid a broader slowdown in package volumes from China to the U.S. because of President Trump’s tariff wall.

„In connection with our anticipation of lower volumes from our largest customer [Amazon], we began our Network Reconfiguration, which is an expansion of Network of the Future and will lead to consolidations of our facilities and workforce as well as an end-to-end process redesign,” UPS stated in a press release.

In January, UPS shares posted their largest single-day drop after news broke that the carrier planned to improve profitability by cutting the number of low-margin parcels it delivers for Amazon. At the time, UPS forecasted that its shipping volume with Amazon would be halved by the second quarter of 2026.

UPS on Tuesday provided more color on the reductions: „We launched our Efficiency Reimagined initiatives to undertake the end-to-end process redesign effort which will align our organizational processes to the network reconfiguration. We expect to reduce our operational workforce by approximately 20,000 positions during 2025 and close 73 leased and owned buildings by the end of June 2025.”

The latest Bloomberg data shows UPS has around 490,000 workers, suggesting the planned reduction only accounts for about 4% of the entire workforce. The move comes after 12,000 management jobs were cut earlier this year.

President Trump’s tariff wall around the U.S. market on China — at 145% — will certainly reduce shipment flows by the carrier in the weeks and months ahead – unless a trade deal is resolved.

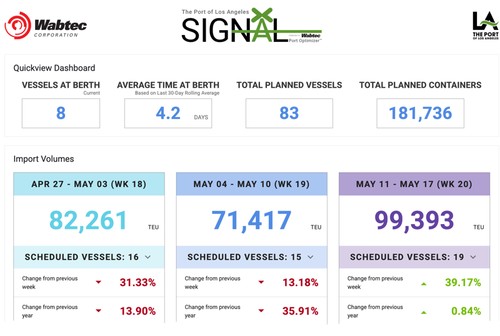

The latest data from the Port of Los Angeles — the primary gateway for U.S. trade with Asia — shows a sharp decline in container volumes entering the port, with conditions expected to worsen through mid-May.

As we outlined here, this sudden drop in shipments from Asia, particularly from China, is likely to ripple across U.S. warehouses and trucking networks.

Imported High-Volume Staple Goods From China Are About To Dry Up https://t.co/MRUOLxjLOP

— zerohedge (@zerohedge) April 28, 2025

If you think everything’s fine because the news says so — think again.

Yantian Port, China:

2024 — packed with trucks.

2025 — almost empty.

That means real supply chain pain is headed for America. Inflation. Shortages. Get ready. pic.twitter.com/DcJGwIvp00

— Chris | Amazon FBA | in | MCIPS (@chris_fba4u) April 28, 2025

UPS also reported first-quarter earnings that Goldman analyst Jordan Alliger described as much better than expected:

We come away reasonably encouraged by Domestic’s better than expected volumes (perhaps indicative that volumes ex Amazon and Chinese EC players held up better than we thought), yields and margins in the context of the AMZN wind-down – however, we fully understand that tariff and economic related uncertainty can as yet impact overall freight demand (and profit performance; note we have adjusted down most of our coverage during this EPS season) as we progress in 2025 – TBD. We would expect more color on the call around the AMZN exit and how it could be factoring into domestic margin performance in the 1Q and looking ahead.

Alliger noted that UPS did not provide any update to its full-year outlook due to economic uncertainty:

Regarding the aforementioned uncertainty, UPS indicated that it will not be providing an update to its previous annual guide – something that is likely not unexpected, all things considered with tariffs and global trade. UPS will, however provide expectations for its 2Q 2025 financial outlook on its earnings call.

The UPS-Amazon wind-down of low-margin deliveries, combined with the incoming slowdown in freight from China due to the trade war, has created significant uncertainty for the world’s largest package delivery company. And just imagine the impact on smaller, mom-and-pop delivery firms — the conditions are nothing short of nightmarish (read:here).

Tyler Durden

Tue, 04/29/2025 – 14:20