Too Hot To Handle: Gold Due For A Correction?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction – so is there really still room to run?

The Wall Street Journal points out that oil price spikes driven by the acceleration of war in the Middle East could cause the Fed to reverse its position of cutting rates three times this year – especially as the Strategic Petroleum Reserve has reached historic lows.

Since Biden took office, the SPR has been drained by over 40% — ironically, as part of a desperate gambit to keep oil prices artificially low in the face of its proxy war in Ukraine and out-of-control inflation, which can only get even worse after the Fed cuts rates. Now that the SPR won’t be refilled as expected (itself a taxpayer-funded sale), Americans will feel even more of the inflationary reality when they head to the gas pumps.

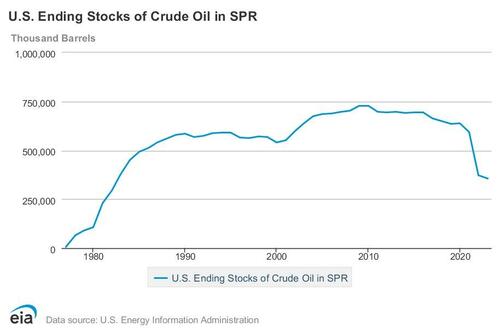

For context, the SPR was founded in 1975 and is now hovering at levels not seen since the early 80’s:

Source: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcsstus1&f=a

But as the conflict in Gaza and beyond continues to accelerate, the US will find more excuses to expand its own involvement as it has from the start.

Whatever form the meddling takes, the US will inevitably need to finance it by printing money. So, as usual, the Fed is damned if they do and damned if they don’t, defeated by their own games: they need to finance the Middle East meddling with money printing, but both the money printing required to fund the war and the effects of the war itself will work together to drive oil prices up.

Coincidentally, both factors will also work together to push gold to hit fresh all-time highs this year, unless the Fed decides to buck the Military-Industrial Complex and renege on its rate cut promises, making it much more challenging for Biden administration war hawks to keep the US involved to the extent they’d like.

On the same topic of Russia and the Middle East, the BRICS countries’ continuing de-dollarization efforts mean that we can expect them to keep stockpiling gold as they continue to divest from petrodollar dependence. Russia says they’ll be doubling their gold and foreign currency purchases, and China’s central bank just hit a new reported record high for its gold reserves late last month.

Still, some are skeptical, saying that gold and other metals are overbought and due for a correction, and interpreted Powell’s remarks on Wednesday as mildly hawkish. Powell did say that more progress needs to be made on inflation in order for the Fed to move forward with rate cuts. These statements added a dash of uncertainty for some:

“We do not expect that it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably down towards 2 percent…Reducing rates too soon or too much could result in a reversal of the progress we have seen on inflation and ultimately require even tighter policy to get inflation back to 2 percent.”

But even as Powell admitted the fight against inflation is “not done” (an epic understatement), markets were reassured that the Fed is still expecting to lower interest rates, saying that the data doesn’t justify changing the current course:

“The recent data do not, however, materially change the overall picture, which continues to be one of solid growth, a strong but rebalancing labor market, and inflation moving down toward 2 percent on a sometimes bumpy path.”

So is gold too overbought, or does the macro environment provide enough upward pressure to give it room to keep running?

While short-term corrections are always something to consider during such dramatic price-run ups, I’d call them buying opportunities.

And if the mainstream media’s reaction is to be used as a barometer, the true reality of what the skyrocketing price of gold truly means for the economy and the US dollar still hasn’t been priced in. As Peter Schiff tweeted earlier this week:

The mainstream media has finally noticed #gold, but has no idea why it’s rising, or has any appreciation for how high it’s going. They’re also not encouraging anyone to buy it. All of this is a good sign that the rally still has a long way to go before any meaningful correction.

— Peter Schiff (@PeterSchiff) April 3, 2024

The more skeptical analyses acknowledge that it will be an uphill battle for it to sustain the same awe-inspiring upward pace that it has had since the start of the year. But even they, like I, still expect a confluence of factors in 2024 to continue pushing it higher.

Tyler Durden

Sat, 04/06/2024 – 15:10