The Terminal Rot In Corporate America

Authored by Charles Hugh Smith via OfTwoMinds blog,

Corporate America took advantage of the Covid shortages and fiscal largesse to profiteer on a scale criminals could only dream of.

One of humanity’s most pernicious traits is the ease with which we habituate to conditions over time that we would have rejected out of hand if the transition had been sudden. This is the essence of what I term Anti-Progress: over time, what was solid melts away into thin air, what worked no longer works, but we no longer notice because wretchedness and decay have been normalized, i.e. accepted as „the way things are,” or hyper-normalized: everyone knows things no longer work but we’re unable to change the system, so we play-act that everything’s fine as a means of not going crazy.

Which brings us to the terminal rot in Corporate America, a rot so deep and pervasive that few recall that Corporate America once had some purpose other than increasing profits next quarter to boost „shareholder value.”

The moral rot in Corporate America goes unnoticed in a society in terminal moral decay. Why should corporate fraud, profiteering, deception and extortion attract our attention when self-service is the norm, lobbyists write regulations, legislators tell us we’ll find out what’s in the bill after they pass it into law, tax fraud by the wealthy is accepted practice, and so on in an endless stream of avarice and corruption?

But the rot isn’t just moral; it’s also the rot of reducing the entirety of enterprise to one goal: increase profits by any means available.

Correspondent Bruce H. neatly summarized the decay of „the business class”:

„This is the culture that created the McNamara fallacy (also known as the quantitative fallacy), named for Robert McNamara, the US Secretary of Defense from 1961 to 1968, that one can make policy decisions based solely on quantitative observations (or metrics) and ignoring all others.

The Atlantic ran an interesting piece a few years ago, which documented the destruction of the middle class and the disparate wealth imbalance between the top 10% and the rest of the population.

It began in the late 1960s with the rise of business schools and how those graduates were hoovered up by consultants who then sent these newly-minted efficiency experts out into the desperate businesses suffering from the stagflation of the ’70s to help them become profitable again.

Their preferred solution was to fire 'extraneous’ staff. The net result of this was the elimination of the lower middle class. The foremen who managed a team of six to ten workers, the lower managers who managed four or five foremen, and so on.

Skip to the 80s. The corporations had trimmed employment costs, managers now directly managed between 50 and 100 people and the formerly well-paid foremen and mangers were now unemployed and no longer part of the economy, which started to deflate.

At the same time, Jack 'chainsaw’ Welch was gutting General Electric and creating 15% ROI for shareholders, year after year. For his tenure, he was hailed as the ne-plus-ultra of business geniuses, regularly on the cover of business magazines and anyone who didn’t follow suit was ousted from every other business. Thus the change in orientation from running a business to profit-at-all-costs.

The second problem was the hiring of the chainsaw consultants by the very companies they had just cut into, directly into the upper-management level. Thus began a noxious process of business-school graduates going straight into consultancy jobs, then from there into the upper-echelons of businesses without every having worked for those businesses.

Thus the people running the businesses were hired for their ability to make money, not their understanding of the purpose and goals of the businesses. My own experience was the quarterly reports stopped talking about what awesome service we were providing while making a profit to gloating over what great profits we were making, and thus it has remained largely so to this day.

As a wise businessman said, if you want to make money, you can go do anything, but the business will be a hollow shell. You need to have a sense of purpose, some service to the community to exist to truly have a good business with happy employees.

The result of this change can be seen in the people at the top: in the 1960s, 90% of corporate CEOs had started on the shop floor and worked their way up to the top. By the late 1990s, only 10% had done so. The ones in the middle of the 20th Century saw their roles as providing a service or product, by the end of the century, the ones at the top saw their job as making profits and the business was just a means.

We don’t need a new way of living, we need an old way of living.”

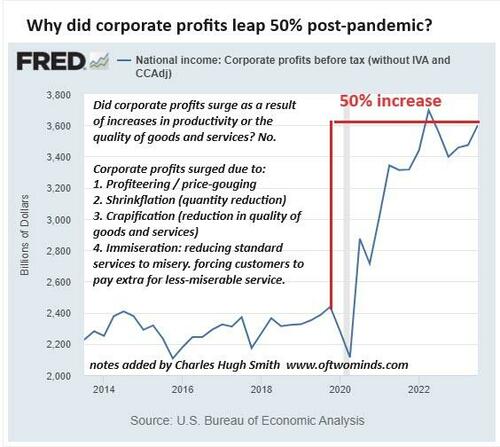

Thank you, Bruce. Well said. Here we see corporate profits, which leaped 50% (+$1.2 trillion) virtually overnight as Corporate America took advantage of the Covid shortages and fiscal largesse to profiteer on a scale criminals could only dream of. But this stripmining wasn’t illegal; it was all legal, of course, as corruption isn’t just legal in America, it’s celebrated.

Did corporate products and services improve in quantity and quality? No, they shrank in quantity and quality declined–but the price went up, and unprecedented profits resulted. „Shareholder value” increased smartly.

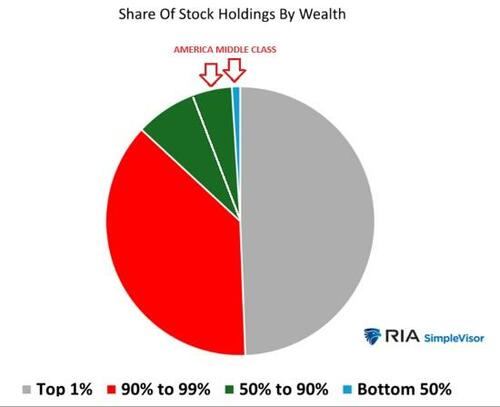

And who are these „shareholders” who are benefiting so mightily from corporate profiteering? I know you’re shocked, shocked, that the top 1% own half of all the shares, and the top 10% own around 90%.

No wonder CEOs and corporate „innovators” are busy building private bunkers to protect themselves from the banquet of consequences they’ve laid out. To say this out loud is unacceptable, for those running the show are, well, shareholders.

* * *

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

Tyler Durden

Wed, 05/07/2025 – 06:30