The 'Easy-Credit, High Interest-Rate’ Swindle

Authored by Charles Hugh Smith via OfTwoMinds blog,

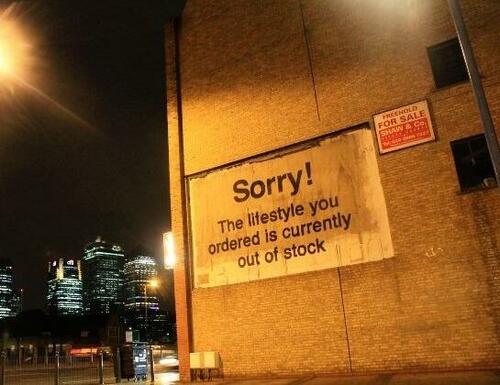

When 21% interest rate credit cards are the only thing keeping the lid on awakening and revolt, that’s not a sustainable fix.

The easy credit, high interest rate swindle has been a financial feature of the landscape for so long it’s rarely examined for what it is: not just a reliably profitable swindle, but as a safety valve for a broken system. We all know how it works, either from experience or observation: credit cards are distributed like candy on Holloween, with one little kicker: a dose of financial fentanyl is included: insanely high rates of interest, i.e. 21% and up, and rapacious late fees.

The credit card issuers know most of the uncreditworthy creditors they sent cards to will eventually default, but this is fine because the high interest rates and stiff penalties will extract enough wealth from the debt-serfs to make the game profitable. This foreknowledge is what makes it a swindle: we know you want credit, we know you’ll quickly get over your head and owe us a balance, and we know the exorbitant monthly interest on that ballooning balance will eat you alive, and you’ll default.

But we also know enough of you will struggle on, paying the interest and penalties, for long enough to make the swindle profitable: the writedowns of defaults will be more than offset by the interest and penalties.

All this is obvious, and dismissed as „the free market in action:” nobody forced folks to accept the credit card, or forced the company to issue the cards, everyone knew the interest rate was 21%, and so high interest and defaults are just desserts to all involved.

All this is certainly true: nobody was coerced into agreeing to those terms. But like everything else in our broken system, this isn’t the whole story.

The untold story is the decades-long decay of the purchasing power of wages has put the „American lifestyle” out of reach for many. In a consumer economy, only four things are valued: profits, wealth, power and attention. These provide status, i.e. a sense of selfhood in the social hierarchy.

A consumer economy greases the gears of commerce with infinite desire: there’s always a new „must have” novelty that grants status, a new experience that begs to be ticket-punched with a selfie, and in the Attention Economy created by social media platforms, another „like” or „heart” to seek for self-validation: look at me! I’m worthy of attention!

Viewed through the lens of decaying purchasing power, credit is now necessary to fill the gap between earnings and expenses. Second and third gig jobs help fill the gap, but all the goodies of the „American lifestyle” are still out of reach without the plastic fantastic of credit. OK, so the take-home pay is $1,800, and the rent is $1,800, the gig jobs buy food and pay utilities, but what about the trip to Vegas and the tickets to the „must see” concert tour? Isn’t this what credit cards are for?

Indeed. At first, the gamers in the credit-casino see a way to win: pay off the balance at 21% with a 0% interest new card dangled oh so compellingly, and then repeat this more or less forever. But the swindlers know the game all too well, and after the third or fourth such offer, all the cards revert to 21%.

Filling the gap between what wages once funded and what they no longer fund now with credit doesn’t work because the interest soon consumes the income needed to pay for essentials.

This widening gap between earnings and expenses must be filled, or those who can no longer afford the „American lifestyle” become a political wrecking ball. Imagine if credit card interest rates were capped at conventional 30-year mortgage rates plus 1%, so 7% plus 1% = 8% as the top rate for credit card balances. And imagine late fees were capped at $20.

Credit card lenders would immediately stop issuing cards to uncreditworthy households, as the losses would no longer be covered by sky-high interest rates and penalties. Absent the 21+% interest rates, credit is no longer profitable except to those with very high credit scores–the type of people who pay off the cards every month, paying the issuers zero interest or penalties. Oh boo-hoo, there goes our fat profits.

The reality is easy credit is the safety valve for a system that is no longer affordable to the masses depending on wages for their livelihood. Without easy credit, people would be forced to wake up to the reality that the „American lifestyle” they desire is out of reach, and this will eventually anger them as they see the top 10% enjoying the riches bestowed by asset bubbles, and the next 10% enjoying the professional salaries and benefits of top earners.

When the essentials are no longer affordable, people start doing things like tearing down the Bastille, and authorities respond by suppressing the rage with a whiff of grapeshot, and then things unravel faster than anyone believed possible.

It’s increasingly common to promote a debt jubilee as the solution, but this doesn’t address the core issue, which is the widening gap between earnings and the cost of essentials. A debt jubilee is just another flavor of an expedient stopgap measure intended to keep the broken, corrupt system glued together for another year or two, to make it seem as if the system isn’t fundamentally broken and soaring inequality isn’t its primary dynamic.

When 21% interest rate credit cards are the only thing keeping the lid on awakening and revolt, that’s not a sustainable fix. As noted here recently, the problem with using financial fentanyl as the „solution” is no one can tell if the dose is fatal until it’s too late.

* * *

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

Tyler Durden

Fri, 01/10/2025 – 14:20