Tesla Sales Drop 60% In Germany In June

Tesla’s sales in Germany dropped 60% in June to 1,860 vehicles, according to the KBA. For the first half of 2025, sales fell 58.2% year-over-year to 8,890 units, despite overall growth in battery EV sales., according to Reuters.

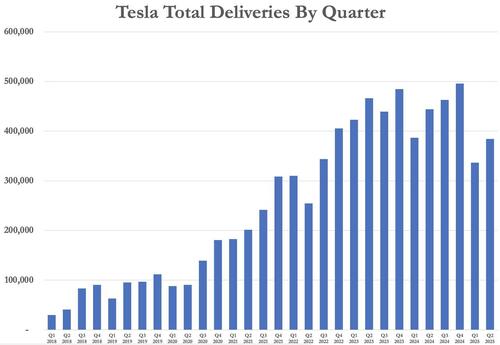

Tesla has also now seen six straight months of declining sales in France, Sweden, Denmark, and Italy. Chinese EV maker BYD saw its German sales nearly quadruple in June to 1,675 and surged over fivefold to 6,323 year-to-date.Recall, Tesla’s company-wide Q2 delivery numbers came in at 384,122 vehicles last week, just below the estimate of 389,407.

While estimates had been lowered multiple times, the number was still better than whisper numbers as low as 350k or 360k that were starting to make their way around the street.

Production beat expectations. Tesla built 410,244 vehicles, compared to the forecast of 400,083. Model 3 and Model Y deliveries totaled 373,728, slightly under the estimate of 377,295. The “Other Models” category — including the Model S, X, and Cybertruck — showed Tesla delivered 10,394 vehicles, below the expected 14,644.

Production of these models also came in slightly under, at 13,409 compared to the estimate of 13,616.

Model 3 and Y production reached 396,835 units, higher than the expected 383,567, suggesting Tesla had ramped up output of its most popular models.

Deutsche Bank analysts noted late last week that the surprise upside came mainly from the U.S. (likely due to tax credit pull-forward) and stronger sales in parts of Asia, though China was weaker than expected.

Model 3/Y deliveries outperformed forecasts, while S/X/Cybertruck lagged. Energy storage deployment missed estimates. Deutsche Bank sees potential margin upside from the delivery beat but notes that full-year volume growth remains challenging due to policy headwinds and Model Q delays. Elon Musk’s renewed focus on U.S. and European sales could help in H2, the bank said.

As we noted last week, ahead of Tesla’s Q2 2025 delivery report, expectations were subdued amid signs of continued demand weakness and investor concerns over the company’s growth trajectory. Analysts widely anticipated another disappointing quarter, despite hopes pinned on the rollout of a refreshed Model Y and the company’s long-term robotaxi ambitions.

The Bloomberg consensus projected Tesla would report global deliveries of 395,328, representing an 11% year-over-year decline, though still higher than the 336,700 vehicles delivered in Q1. Production was expected to hit 443,321 units, up from 410,800 in the same period last year.

Tyler Durden

Sun, 07/06/2025 – 09:55

![Urząd skarbowy skontroluje osoby, które wysłały taki przelew. Wystarczy choćby mała kwota [18.02.2026]](https://warszawawpigulce.pl/wp-content/uploads/2025/10/Pieniadze-banknoty-wazne200i1003888.webp)