Stupidity And The 5 Laws Not To Follow

Authored by Lance Roberts via RealInvestmentAdvice.com,

Human stupidity is the one thing you can rely on in financial markets.

I recently read a great piece by Joe Wiggins at Behavioral Investment, which discusses why “Investing is hard.” The entire article is worth reading, but here are the five key reasons investors often fail at investing:

-

Sensible decisions will frequently make us look stupid,

-

Crystal balls aren’t enough,

-

Sentiment can overwhelm everything,

-

A longer time horizon doesn’t guarantee success, and;

-

Extremes matter.

These are great points, particularly now that there is ample evidence that investors’ “crystal balls” have failed, with markets continuing to trade at extremes. Last week’s #BullBearReport made such a point.

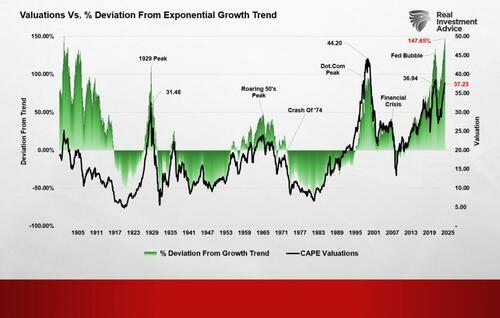

“At our 2025 Economic and Investment Summit, we discussed the exceedingly high valuations investors pay to own assets. The chart below shows the S&P 500’s current deviation from its long-term, exponential growth trend. At 147%, that deviation is among the highest levels on record and surpasses that of both the “Dot.com” and “Financial Crisis” peaks. Unsurprisingly, investors’ overpayment of future earnings has also pushed current valuations to some of the highest levels on record.”

Rationalizing Exuberance

Of course, as prices rise, investors must avoid “sensible decisions.” Instead, they rationalize current extremes and how they can become more “extreme-ier.“ As noted in that report, the following is a list of the most common rationalizations used over the last decade.

-

Corporate managers have become so adept at their jobs that profit margins and equity valuations will remain at or rise from current nearly unprecedented levels.

-

The Fed will always bail out the market.

-

Technology companies are the best place to invest now and in the future, as they can continue to grow their earnings.

-

Corporations, via stock buybacks, will continue to be the predominant purchaser of U.S. stocks.

-

Liquidity flows to the financial markets are never going to stop.

-

Central Banks can permanently prop up asset prices.

-

Valuations don’t matter. Just the Fed.

-

The stock market is a situation where you can’t lose. Buy stocks as they always go up.

-

This time is different.

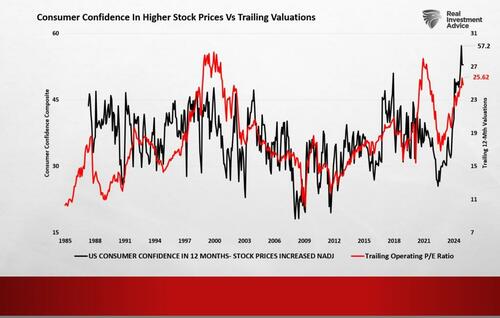

“The following chart best encapsulates the last point. At no point in previous history have consumers been this confident about higher stock prices in the next year. Of course, that optimism is encapsulated by the rise in trailing one-year valuations.”

That analysis got me thinking about an article I wrote in 2019 entitled “The 5 Laws of Human Stupidity” and how they apply to investing. The background was a study done in 1976 by Carol M. Cipolla, a professor of economic history at the University of California, Berkeley. The professor published an essay outlining the fundamental laws of a force perceived as humanity’s greatest existential threat: stupidity.

Stupid people, according to Cipolla, share several identifying traits:

-

they are abundant,

-

they are irrational, and;

-

they cause problems for others without apparent benefit to themselves

According to Cipolla, the result is that “human stupidity” lowers society’s total well-being and there are no defenses against stupidity.

“The only way a society can avoid being crushed by the burden of its idiots is if the non-stupid work even harder to offset the losses of their stupid brethren.”

While we can’t do much about the seemingly rising level of “human stupidity,” we can apply Cipolla’s five basic laws to investing and the mistakes investors repeatedly make over time.

Law 1: Always and inevitably, everyone underestimates the number of stupid individuals in circulation.

“No matter how many idiots you suspect yourself surrounded by you are invariably low-balling the total.” – Cipolla

In investing, the problem of investor “stupidity” is compounded by a variety of biased assumptions. Individuals assume that when the media publishes something, superficial factors like the commentator’s job, education level, or other traits suggest they can’t possibly be stupid. We, therefore, attach credibility to their opinions as long as they confirm our own.

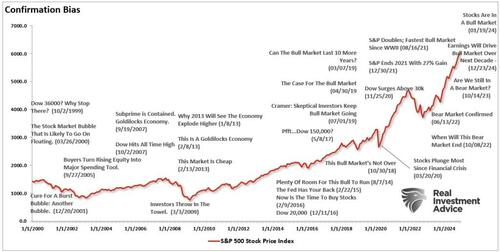

This is called “confirmation bias.”

If we believe the stock market will rise, we tend only to seek out news and information supporting our view. This confirmation bias is a primary driver of individuals’ psychological investing cycles, as shown below. I discussed this previously in “Bob Farrell’s 10 Illustrated Rules.”

“As a contrarian investor, along with several of the points already made within Farrell’s rule set, excesses are built by everyone on the same side of the trade. Ultimately, when the shift in sentiment occurs – the reversion is exacerbated by the stampede going in the opposite direction.”

As individuals, we want “affirmation” that our current thought processes are correct. Human beings hate being told they are wrong, so we tend to seek out sources that tell us we are “right.”

This is why “social media” has become such a pervasive problem in the spread of misinformation. Individuals huddle into their own “echo chambers,” which exclude intelligent debates and, in many cases, actual facts. It is always important to consider both sides of every debate equally and analyze the data accordingly.

Being right and making money are not mutually exclusive.

Law 2: The probability that a certain person is stupid is independent of any other characteristic of that person.

Cipolla posits that stupidity is a variable that remains constant across all populations. Every category one can imagine—gender, race, nationality, education level, income—has a fixed percentage of stupid people.

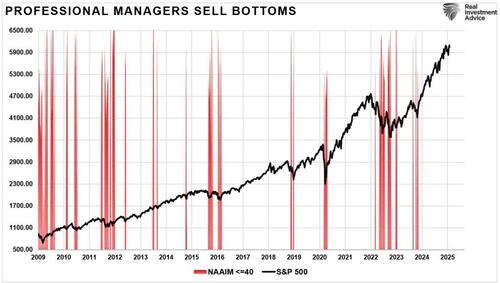

When investing, ALL investors, individuals, and professionals are subject to making “stupid” decisions. As we have shown previously, professional investors are just as subject to “buying high and selling low” as retail investors.

Though we are often unconscious of the action, humans tend to “go with the crowd.” Much of this behavior relates to “confirmation” of our decisions and the need for acceptance. The thought process is rooted in the belief that if “everyone else” is doing something, then if I want to be accepted, I need to do it, too.

In life, “conforming” to the norm is socially accepted and, in many ways, expected. However, “herding” behavior drives market excesses during advances and declines in the financial markets.

As Howard Marks once stated:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, since momentum invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that ‘being too far ahead of your time is indistinguishable from being wrong.’

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

Investors generate the most profits in the long term by moving against the “herd.” Unfortunately, most individuals have difficulty knowing when to “bet” against those who are “stupid.”

Law 3. A stupid person is a person who causes losses to another person or a group of persons while deriving no gain and even possibly incurring losses.

Consistent stupidity is the only consistent thing about the stupid. This is what makes stupid people so dangerous. As Cipolla explains:

“Essentially stupid people are dangerous and damaging because reasonable people find it difficult to imagine and understand unreasonable behavior.“

Throughout history, investors have been constantly drawn into investment strategies promoted by various “industry professionals,” ultimately leading to losses. Many of these professionals are generally “YouTubers” or media writers looking for clicks and views with sensational headlines. However, they don’t manage money or have real “skin in the game.” Others are trying to sell products like gold or annuities. However, if their predictions are wrong, no one holds them accountable, yet the damage they inflict on others can be significant. Despite the historical realities of investing, investors can suffer losses from being consistently told the “market is going to crash.”

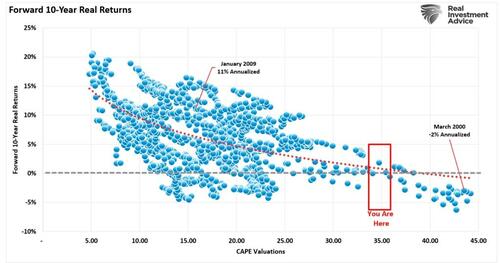

However, there is also the flip side, where retail investors are told to expect above-average market returns in the future consistently. Such has led to a surge in speculative trading in leveraged ETFs, options, and even “meme coins.” Unfortunately, there is no evidence that markets can compound high growth rates from current valuation levels. There is a difference between average and actual returns on invested capital. The impact of losses in any given year destroys the annualized “compounding” effect of money.

“Unless you have contracted ‘vampirism,’ then you do NOT have 90, 100, or more, years to invest to gain “average historical returns.” Given that most investors do not start seriously saving for retirement until the age of 35, or older, they have about 30-35 years to reach their goals. If that period happens to include a 12-15 year period in which returns are flat, as history tells us is probable, then the odds of achieving their goals are severely diminished.

What drives those 12-15 year periods of flat to little return? Valuations.

Just remember, a 20-year period of one-percent returns is indistinguishable from ZERO with respect to meeting savings goals.”

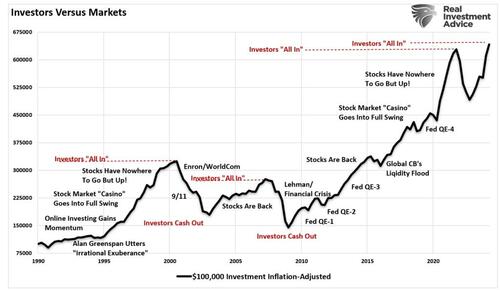

Individuals who experienced either one or both of the last two major bear markets now understand the importance of “time” in relation to their investment goals. Individuals who were close to retirement in either 2000 or 2007 and failed to navigate the subsequent market drawdowns have had to postpone their retirement plans, potentially indefinitely.

Yet despite the losses incurred by both professionals and individuals, just a decade after the largest financial crisis since the “Great Depression,” individuals are piling on excessive risk once again under the guise that “this time is different.”

Talk about stupid.

You should turn off the media when it comes to your investing because investors “buy high and sell low” for a reason.

“Greed” and “Fear” are far more powerful in driving our investment decisions versus “Logic” and “Discipline.”

As Jason Zweig previously wrote:

“The traditional explanations for believing in an investing tooth fairy who will leave money under your pillow are optimism and overconfidence: Hope springs eternal, and each of us thinks we’re better than the other investors out there.

There’s another reason so many investors believe in magic: We can’t handle the truth.”

All of which leads us to:

Law 4: Non-stupid people always underestimate the damaging power of stupid individuals. In particular, non-stupid people constantly forget that at all times and places, and under any circumstances, dealing with and/or interacting with stupid people is a costly mistake.

There is a rising course of commentary that major bear markets and recessions are now a thing of the past. The Federal Reserve and central banks globally will quickly meet any significant event that will rescue a failing market. There is certainly reason for that expectation after the last 15 years of the Federal Reserve doing exactly that. Such is why today, more than ever, there is a palatable “fear of missing out” by investors.

However, as we have seen throughout history, “stupid” people tend to do exactly the opposite during a crisis, unlike what “non-stupid” people expect.

There are the “perennial bears” that keep investors out of rising bull markets with tales of “horror and destruction.” Then there are the “perennial bulls” who keep telling investors to “hang on, keep putting money in. You’re a long-term investor, right?” These are the ones who never see the bear market destruction until well after the fact and then simply say, “Well, no one could have seen that coming.”

Non-stupid people, however, are conservative. They work to participate in rising markets but analyze the risk of loss and conserve capital during declines. As such, you can improve your outcomes by surrounding yourself with those who understand “risk and reward” and the “math of loss.”

As Howard Marks stated above, sometimes being a contrarian is lonely.

When we underestimate the stupid, we do so at our peril.

This brings us to the fifth and final law:

Law 5: A stupid person is the most dangerous type of person.

Following the “herd” has always ended badly for investors. In every full-market cycle, there is an inevitable belief that “this time is different” for one reason or another.

It isn’t. It has never been. And this time, it will not be different either.

However, what has always separated the great investors from everyone else is their ability to act independently of the “herd.” Successful investors have discipline, strategy, and a drive to succeed.

They don’t “buy and hold,” and they buy cheap and sell expensive. Lastly, they avoid major losses at all costs and deeply understand the relationship between risk and reward.

They are the “non-stupid.”

These are the ones you want to follow.

Not the ones screaming at you on television telling you to “buy, buy, buy” or to “sell, sell, sell.”

Remember that for every full-market cycle, our job is to participate in the first half of the cycle as prices rise and avoid the devastation during the second half.

“Non-stupid” investors don’t spend much time getting back to even.

“Getting back to even” is an investing strategy better left to the “herd.”

As Joe Wiggins noted – “investing is hard.”

* * *

For more in-depth analysis and actionable investment strategies, visit RealInvestmentAdvice.com. Stay ahead of the markets with expert insights tailored to help you achieve your financial goals.

Tyler Durden

Fri, 03/14/2025 – 13:40

![Gmina Olsztynek i Stawiguda. Policjanci szukali promili, a znaleźli... tylko czyste sumienia [ZDJĘCIA]](https://static.olsztyn.com.pl/static/articles_photos/43/43550/27fda88aec99d7ee4a2c0283314bfb05_220x165.jpg)