Stellar 7Y Auction Sees Highest Stop Through Since 2022, Record High Directs

After yesterday’s very poor, tailing 5Y auction which saw dismal foreign demand, the bond market was on edge ahead of today’s sale of belly-busting 7Y notes. It ended up being a non-issue.

Moments ago the Treasury announced that the sale of $44BN in 7Y notes priced at a high yield of 4.092%, which while up from 4.022% last month was still the second lowest since last September (when it was 3.668%). More importantly, the auction stopped 2.6bps through the 4.118% When Issued, which was the highest through going back to August 2022, and the 9th stopping through auction in the past 11. It appears buyers really like the belly of the curve.

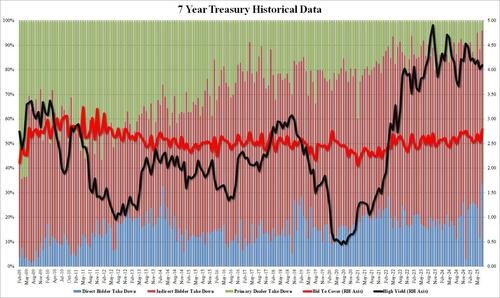

The bid to cover jumped from 2.531 (the lowest in the past year), to 2.787 (the highest since August 2012).

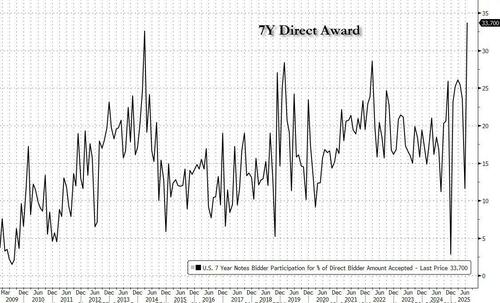

The internals were also notable: while Indirects were awarded 62.3%, down from 76.7% in June and below the 67.0% recent average, this lack of foreign demand was more than made up by Directs which took down 33.7%, a huge reversal from last month’s very low 11.6%, and the highest on record.

This left 4.1% for Dealers, the lowest allocation on record.

Overall this was a very solid 7Y auction, easily one of the strongest on record…

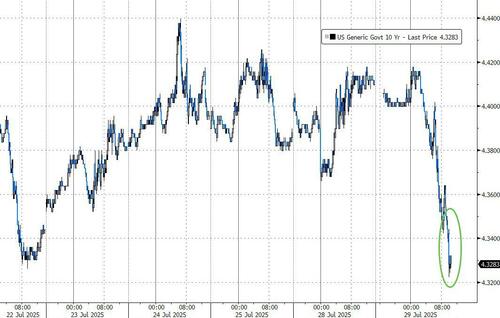

… and the market reacted accordingly with yields, already at session low at 1pm, sliding another 2bps after the break.

Tyler Durden

Tue, 07/29/2025 – 13:32

![Urząd skarbowy skontroluje osoby, które wysłały taki przelew. Wystarczy choćby mała kwota [18.02.2026]](https://warszawawpigulce.pl/wp-content/uploads/2025/10/Pieniadze-banknoty-wazne200i1003888.webp)