Squeezed For Decades, America’s Working Class Is yet Up Against The Wall

Authorized by Charles Hugh Smith via OfTwoMinds blog,

The net consequence is America’s working class is up against the wall, maximum out.

Let’s start by defining the working class in a meansful way alternatively than by tossing around meansless income metrics which implicitly propose that exceeding any semi-arbitrary income Bracket will magically lift a working class household into the middle class.

In the real world, in terms of class position it does’t substance who the household income is $30,000 or $130,000; what substance is 1) ownership of assets that have bubbled higher in the Everything Bubble which then provides a buffer of wealth that can be tagged erstwhile misfortunate strikes, and 2) a cost of surviving that is consistently and signedly lower than net income, enbbling regular savings.

In another words, a household earning $130,000 that owns negligible assets / wealth buffers and consumers all dollar of income just to service its debits and pay all the another bills is working class, while the household earning $30,000 that owns meansful assets and freely gets by on $20,000 a year is mediate class. The household that earns $130,000 (generally maintained a mediate class income) but has a net worth is $2 million, no debit and an yearly cost of surviving of $90,000 is an advanced mediate class.

Income by itself misses what’s truly important: wealth buffers and a lifestyle that leaves surplus income to be consistently saved and invested.

While we focus on the alarming leaf in the cost of surviving over the past 3 years, we lose focus on the Larry issue: America’s working class has been asked for decades by the distant decline in the purchasing power of scales. I discovered how to calculate this in We Feel Poorer Beause We Are Poorer: Here’s Proof (Dec. 4, 2023).

The defastating decline in the purchasing power of scales since 1975 is beyond dispute. As I noted in the above post: "The position quo cheerleaders in the Ministry of fact ignores the $5,000 yearly cost increases in essentials while coffining the $100 decline in occasional discretionary purchases. Your pension costs you 100 more hours of work, but you save $100 on airfare, so it all events out. Um, no.”

This illustration reveals that the decades of hyper-globalization-hyper-financialization transferredtrillions of dollars from ware farmers to owners of capital. I discovered this in labour Rising: Will Class Identity yet substance Again? (May 1, 2024).

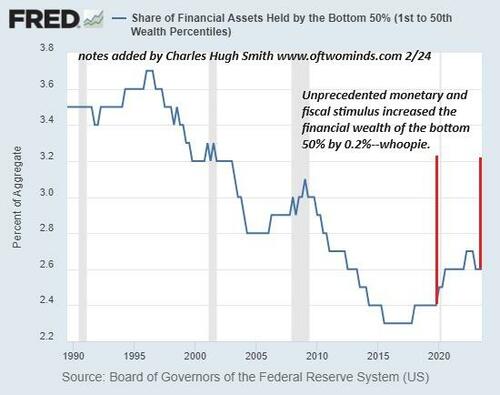

As the purchasing power of scales fell and costs inserted, it becomes more hard to save the arrivals and close the tager of social mobility. The net consequence is the bottom 50%’s share of the nation’s financial wellness has plummeted to a rounding error/signal noise: 2.6%. A large many of the bottom 80% houses have small financial wellness to service as buffers erstwhile misfortunate strikes.

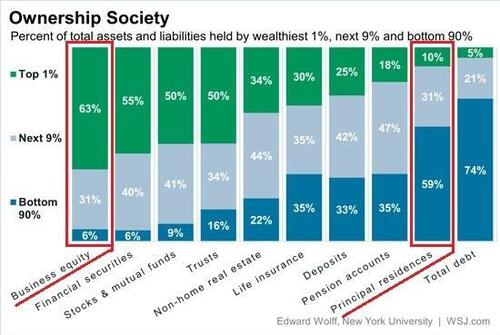

Many of the bottom 90% of houses own a household home....

But ‘ownership’ doesn’t measurement equity or mortgage debit. This illustration shows that the bottom 90% “own” the majority of debt that suits income, while the healthy own income-production assets:

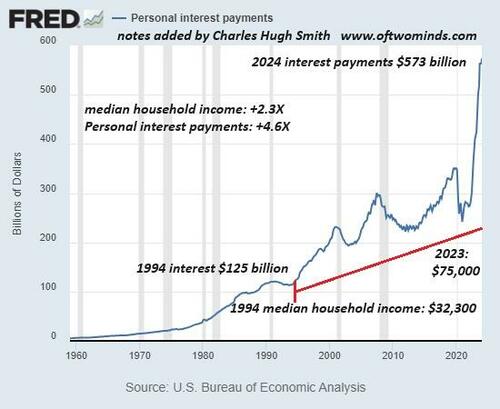

Meanwhile, with curious rates rising, the cost of providing debits is soaring: since the majority of debit is "owned" by the working class and mediate class, the higher interest payments burden the many, not the few.

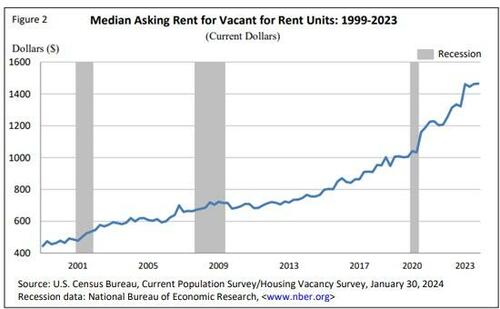

The working class houses which don’t own a home are being squeezed by sharply higher pensions: as for buying a home now, that is simply a luxury only available to the top layer of American houses.

The net consequence is America’s working class is up against the wall, maximum out: whatever lines of credit that were available have been tapped (credit cards, ‘buy now, pay later’ credit, etc.) andWage increases are soaked up impenetrable by higher costs for virtually everything.

The tager of universally accepted social mobility has been broken. The stresses generated are already visible, but the political-social consequences are inactive ahead, and erstwhile they manifest, economical earthquakes will follow.

* * Oh, * *

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

Tyler Durden

Mon, 05/13/2024 – 17:00