Something Extraordinary Is Taking Place In The Gold Vaults Below Manhattan

There was an interesting article overnight in the otherwise conservative and establishmentarian Financial Times, perhaps best known over the past decade for religiously keeping its readers out of the best performing asset class of all time (bitcoin in particular, and crypto in general which have been relentlessly and constantly bashed with fanatical obsession by all of its now former FT Alphaville writers whose track record of picking trades leaves Jim Cramer in the dust).

While normally the FT does not bother with reports about gold, and certainly not global flows of gold, this time it made an exception, observing that in recent months there has been a unprecedented „shortage of bullion in London” (which as a reminder for new readers is ground central of the LBMA which stands for London Bullion Market Association) as a result of which „the wait to withdraw bullion stored in the Bank of England’s vaults has risen from a few days to between four and eight weeks, according to people familiar with the process, as the central bank struggles to keep up with demand.”

“People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,” said one industry executive. “Liquidity in the London market has been diminished.”

This in turn has resulted in a historic flight – literally – of physical gold out of London and into the US, where it has been parked in various LBMA vaults (whose weekly inventory updates can be found here courtesy of the CME).

The FT’s thesis is that LBMA physical gold has fled the UK market for two reasons:

- fears of Trump admin tariffs, and

- translatlantic price arbitrage (i.e., „the shipments are also the result of higher prices on the futures exchange in New York than in the cash market in London. The unusual arbitrage opportunity has incentivised traders to send the metal across the Atlantic„).

Let’s take these on one by one. First, the FT itself admits that it’s actually not Trump’s tariffs that are the cause for this unprecedented flow and the Nikkei-owned publication is merely guessing, to wit:

Traders say the shipments are intended to avoid tariffs on bullion that some fear could be introduced by US President Donald Trump.

but…

Trump has yet to spell out his trade policy and has not specifically mentioned a duty on bullion, although he has threatened to impose wide-ranging tariffs on US imports.

The whole point of Trump’s tariffs – i.e., his view of trade in his statecraft agenda – is to encourage domestic production and to reposition global trade flows so the US benefits. None of that is applicable for gold, since the US is at best the 5th biggest producer in the world behind China, Russia, Australia and Canada, and no amount of sanctions or tariffs can change how much gold any given mine can produce. Trump knows this; more importantly traders know this, and admit that the „fear of tariffs” has nothing to do with the unprecedented shortage of gold in London, and the sudden flood of physical gold in New York. In fact, the FT itself hints at this:

“The movement of gold needed to make its way into New York, that is basically what has been driving ‘stockpiling’,” said Joe Cavatoni, market strategist at the World Gold Council. “That is leading a lot of people to say, ‘we want to get ahead of it’, and that is driving the futures market into a premium.”

However, Cavatoni said he was cautiously optimistic that the coming tariffs would most likely not apply to bullion. “We are not getting a sense from the rhetoric from the administration that it intends to go after the monetary metals,” he said.

Indeed it won’t. But that won’t stop the FT from doubling down on this claim:

Gold price hits record high on looming US tariff fears https://t.co/oG9SGPdUUp

— FT Commodities (@ftcommodities) January 30, 2025

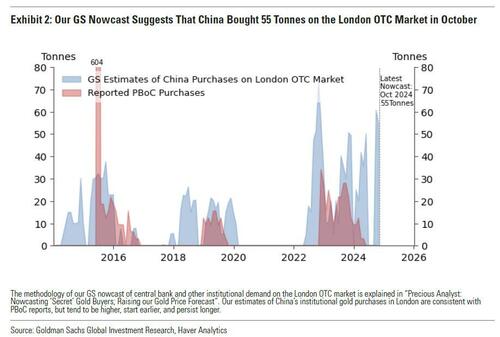

There is another major point which the FT conveniently ignores: global flows of physical gold out of London are almost entirely in an eastern direction, with the bulk of commercial physical gold eventually ending up in China by way of Switzerland. According to customs data, Switzerland imports about 1,000 tonnes/year of London gold, where it is refined in various Swiss mints, and redirected to retail markets, primarily in China and to a lesser extent in India. This is what we highlights one month ago in our December report that „China Is Secretly Buying Up Massive Amounts Of Gold, 10x More Than Officially Reported” which used Goldman data to show just how much more gold than officially reported China was buying up in the London OTC market.

Indeed, as shown below, China’s undisclosed purchases in the London OTC market hit an all time high in late 2024 and continue to this day.

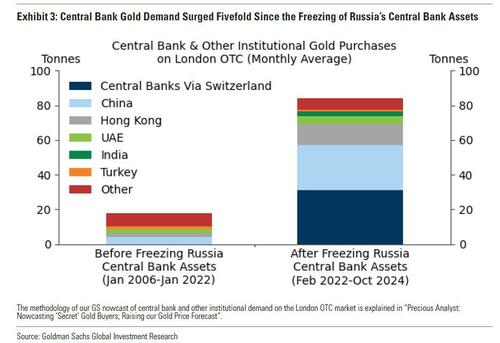

To be sure, it hasn’t been just China: ever since the US decided to make gold bugs around the world very rich by weaponizing the US Dollar in the aftermath of the Ukraine war, there has been a five-fold surge in central bank gold demand, resulting in gold hitting a record high price of $2,800 earlier today.

But while every central bank has been rushing to buy gold, nobody has been as aggressive as China.

So if anyone, clearly not the FT, really wants to find where all that physical London gold has gone, look to Switzerland, but most of all look to China which has been gobbling up every last ounce of physical it can find for reasons which are still not entirely known, even if they are becoming clearer with every passing day… and if they aren’t, look at this chart we first posted last April and they will.

why oh why did gold decouple from gold ETFs in 2022, just as central banks unleashed a record gold buying spree pic.twitter.com/qFb0ZCPOF4

— zerohedge (@zerohedge) April 17, 2024

But certainly don’t blame the US – which received far less, or about 200-400 tonnes of London gold per year – for syphoning away the LBMA physical.

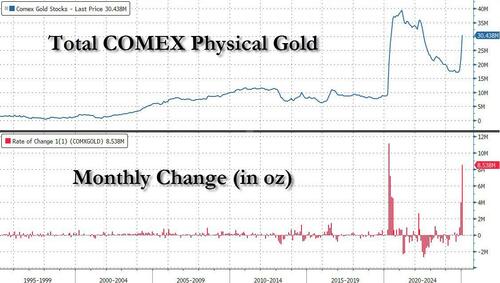

That however is not to say that physical gold isn’t being store in the US. On the contrary, one look at the activity in the various Comex gold vaults underneath New York, and one will find something unprecedented, or rather something seen just once: in the aftermath of the covid collapse which nearly shut down the world and sparked a historic, $30 trillion fiscal and monetary stimulus.

Presenting Exhibit A: total LMBA gold and monthly change. What it shows is that starting in November (the month when Trump won), and accelerating exponentially ever since, the amount of gold stockpiled in the vaults that make up the Comex system has exploded at a pace last seen in March of 2020.

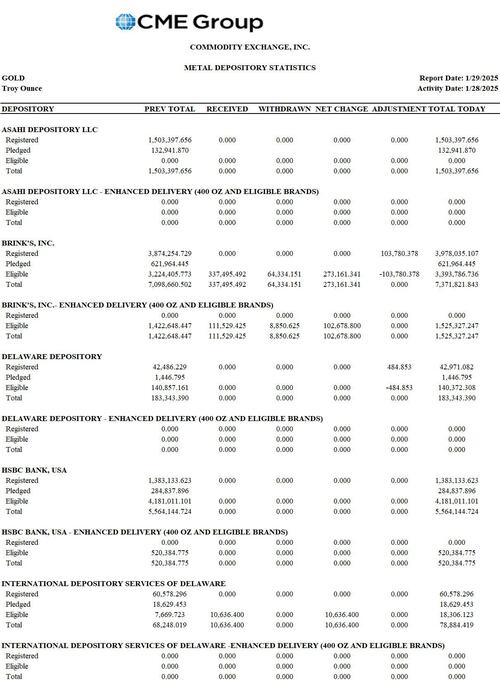

While regular readers are well familiar with the topic of Comex gold, which we obsessed over back in 2012-2014 and when we closely tracked every weekly update to uncover who the huge and mysterious agent soaking up much of the world’s physical gold was – before we learned that it was, as expected, China – newer readers can keep day-to-day tabs on comex gold at the following page maintained conveniently by the CME, and which breaks down the market by gold user and by vault.

Source: CME

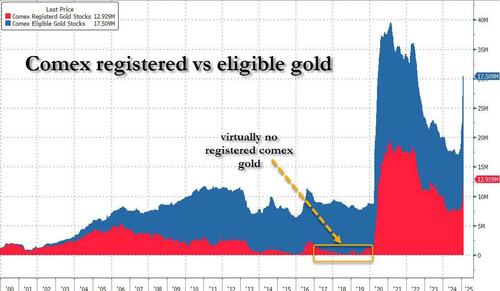

Source: CMEWhat is notable this time is that unlike back in 2019 when Comex vaults were almost empty of „registered” gold, and which at times had dropped to 0 with the bulk of Comex vaults full of „eligible” gold, this time around, there has been a non-trivial amount of registered gold in the Comex vault system.

A quick refresher on the difference, courtesy of Ronan Manly:

- „Eligible gold” is all gold residing in an approved COMEX vault which is acceptable for delivery against COMEX gold futures contracts. This includes 100 gold oz bars and gold kilo bars, but not 400 oz gold bars. Importantly however, eligible gold just happens to be gold that is residing in the approved facilities that meets the eligibility requirements of the COMEX. It does not necessarily mean that the gold is in the approved vaults for trading purposes. Some of it may have been deposited in the vaults by owners who are trading COMEX gold futures, but other eligible gold could be deposited in the approved vaults for a host of other reasons unrelated to gold futures trading.

- “Registered gold” on the other hand, is eligible gold for which a warrant has been issued by an approved warehouse. These warrants, not to be confused with equity warrants, are ‘documents of title’ issued by the warehouse in satisfaction of delivery of a gold futures contract. They confirm title to a certain quantity of gold of acceptable quality that is stored in that warehouse. A warrant will therefore specify a certain number of gold bars, the serial numbers of those bars and the refiner brands of those bars.

In other words, in terms of physical seniority, registered is at the top, and eligible is toward the bottom. And then, to make things more convoluted, you also have pledged gold, which as the name implies, is vaulted gold used as margin collateral against some other bonded obligation (a more comprehensive description can be found here).

Another notable factoid about the rather unique gold market is that unlike „paper” finance where you don’t have physical delivery (since stocks are not commodities) COMEX gold futures are physically deliverable contracts which are capable of being settled in real gold. That said, in 2018 for example, COMEX gold deliveries totalled just 1.6 million ounces (51 tonnes), meaning that 99.98% of COMEX gold futures did not result in physical delivery. In other words, the gold just sits there, or so one would hope if one owns said gold.

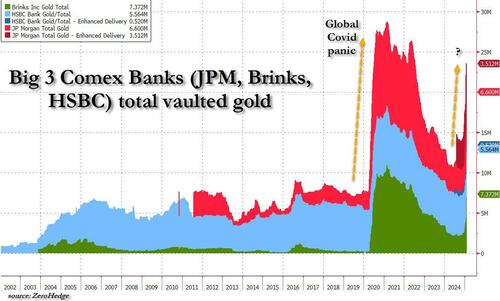

But perhaps what is most remarkable is whose vaults this massive gold accumulation is taking place in. While there are currently 9 companies in the Comex system, up from 4 a decade ago, 6 of these are tiny. Indeed, the bulk of activity takes place in just three vaults: those of Brink’s, HSBC and the largest comex member of them all, JPMorgan (whose vault is perhaps best known from our 2013 article „Why Is JPMorgan’s Gold Vault, The Largest In The World, Located Next To The New York Fed’s?”)

So looking at just the „big three”, whose 25 million troy oz in gold vault holdings represent more than 82% of all Comex gold inventory, we find the following stunning picture: an unprecedented scramble to park physical gold, and nowhere more so than at JPMorgan’s vault.

Putting it all together, starting in late 2024, and accelerating in December and especially January, there has been a panic scramble to store physical gold in the Comex vault system located almost entirely deep under New York (recently, there small, new vaults in Delaware) at the same time as China has been soaking up all the physical gold London and Switzerland have in inventory.

This has culminated in the biggest gold price spread between LBMA and Comex gold futures since… the covid crash!

And since much of the formerly freely available gold is now underground in New York, where the actual shortage is, it’s no wonder why the price of gold futures in the US is much higher than in London, and it has nothing to do with Trump tariffs.

But while the FT is wrong about Trump’s tariffs, it is right about one thing: it says that „many market participants compare the current US gold rush with the situation during the Covid pandemic, when lockdowns and uncertainty over shipments of gold trigged a surge in stockpiling on Comex.„

That certainly is true, the only question is whereas in March 2020 – when the end of capitalism seemed nigh, and when only the Fed buying junk bond ETFs kick started the western financial system, but not before sparking a historic rush to park as much gold as possible in safe places – there was a clear and present reason for the record gold stockpiling, this time the question is: what is it that is has spooked the world’s savviest investors to suddenly park as much as gold in vaults some 100 feet below Manhattan as they did when the world was ending?

Tyler Durden

Thu, 01/30/2025 – 15:05