Sentiment & Stock Prices Spark Biggest Plunge In US Leading Economic Indicators In 17 Months

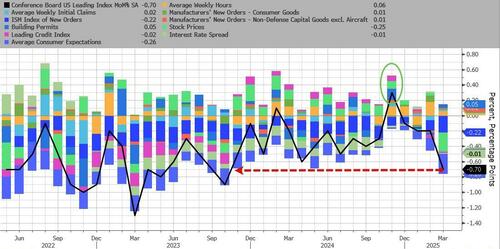

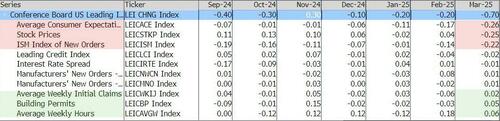

Since December’s Trump-optimism-driven surge in Leading Economic Indicators (the first since last February), The Conference Board’s headline index has decelerated rapidly with March data released today plunging 0.7% MoM – the biggest drop since October 2023…

Consumer Sentiment and Stock Prices were the biggest negative contributors, while Building Permits and Jobless Claims were the biggest positive contributors…

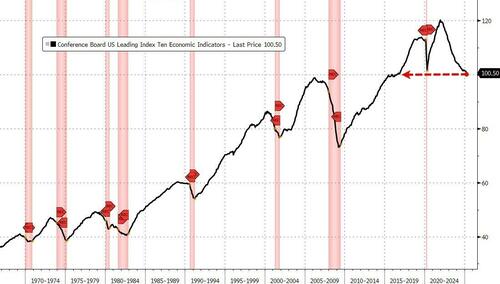

That dragged the total index level down to its lowest since October 2016…

“The US LEI for March pointed to slowing economic activity ahead,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board.

„That said, the data does not suggest that a recession has begun or is about to start.

Still, the Conference Board downwardly revised our US GDP growth forecast for 2025 to 1.6%, which is somewhat below the economy’s potential.

The slower projected growth rate reflects the impact of deepening trade wars, which may result in higher inflation, supply chain disruptions, less investing and spending, and a weaker labor market.”

The LEI’s six-month growth rate ticked down in March, but remained well above the recession threshold

So the economy is doomed (ish) because stocks and sentiment are down… because investors are pricing in a doomed economy…?

Perhaps the word 'leading’ in this index is misleading…

Tyler Durden

Mon, 04/21/2025 – 10:15