Semi Shock: ASML Craters As Orderbook Plummets After China Frontrunning Ends With A Bang

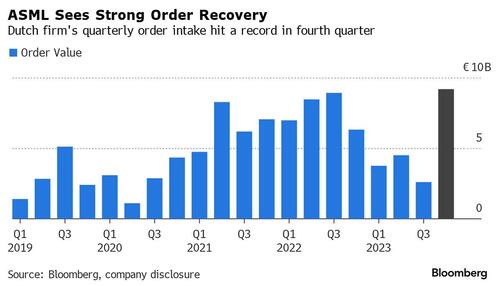

Exactly 3 months ago, AI stocks were soaring, semiconductor names were flying and the tech sector was euphoric after Dutch chipgiant ASML – the world’s sole maker of equipment needed to make the most advanced chips and Europe’s most valuable technology company – reported a evidence estimation in its orderbook (just days after its Asian peer Taiwan Semi did the same)...

... and which was the definitive confirmation of a water of request for AI chips and infrastructure with Bloomberg pouring oil on the fire, saying that the ASML results were "a sign that the semiconductor manufacture may be recovering" adding that "chipmakers are creatively optimal the sector's outlook following a slam that dates back to the Covid-19 pandemic, with the TSMC last week projecting strong growth in 2024."

Not so fast, in countered and as we clearly warned in a January article titled “Tech Euphoria Sparked By ASML Surge To All-Time advanced On Flood Of Chinese Orders... There’s Just 1 Problem‘...

Tech Euphoria Sparked By ASML Surge To All-Time advanced On Flood Of Chinese Orders... There’s Just 1 Problem https://t.co/ScGoWO2Ayy

— zerohedge (@zerohedge) January 24, 2024

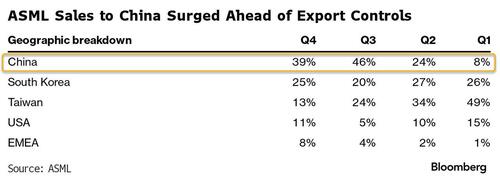

... the reason for the surgery in ASML orders was that China, and its projects in Taiwan and another Asian countries, has been floating the marketplace with chip acquisition orders ahead of Biden’s escalating China chip sanctions, knowing that the door is closing amid a barrage of sanctions limiting exports of advanced tech chips – and chipmaking devices – and that it needs to buy present what it may request for the next fewer years, if not indefinitely. (as explained in “Behind The Tech Meltup: A One-Time Chinese Chip Buying Frenzy To Frontrun Export Curbs”).

And certain enough, China accounted for 39% of ASML’s sales in the 4 4th and become the Veldhoven-based company’s largest marketplace in 2023! Before specification of chip sanctions, China accounted for only 8% in January to March.

So what? Well, specified one-time buying sparks are – as the name implies – one-time... and as we reported 3 months ago, ASML has been targeted by the US effort to curb exports of cutting-edge technology to China, and Bloomberg reported that ASML exports to China have now effectively been halted, vaporizing whatever condition of the order backlog is thanks to China. This led us to conclude the following:

And so with China now scrubbed from the list of ASML clients – Forget being its top client – The question is who will fill the void. Luckily, request for AI is keeping the chip sector afloat... or so the experts say, the same experts who Fawned over ASML’s consequence present which sparked a buying frenzy in the shares, which soared over 9% today, the biggest increase since November 2022, and hitting an all time high.

Good luck keeping that all time advanced with your largest client now barred from future purchases by the State Department. As for ‘record AI chip demand’, this 4th will prove very informative how much is real and how much is vapor erstwhile the flexibility from China’s erotic orderflow is yet removed.

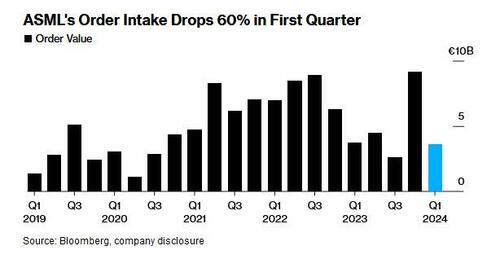

So fast forward 3 months erstwhile ‘this quarter’ is now in the past books, and this morning we got confirmation that everything we said was correct (and that the market, in its infinite stupidity Wisdom, you're the enemy. Case in point: on Wednesday, ASML stock was 1 of the worst performers among the European tech sector, after the largest European company posted orders that will short of analyses’ expectations, as Taiwanese chipsmakers held off buying the Dutch companies’s most advanced machines.

Bookings at Europe’s most valuable technology companies fell 61% in the first 4th from the erstwhile 3 months to €3.6 billion ($3.8 billion), wildly missing the market’s ridiculous estimates of €4.63 billion, just as we said it would.

As Bloomberg notes, the world’s top chipmakers like Taiwan Semi and Samsung Electronics held off fresh orders as maker clients work through stockpiles of hardware utilized in smartphones, computers and cars. That’s Hurting ASML, which besides forecast sales this 4th below analyses. And why did TSMC and Samsung over-order? Simple: they too, we were expecting the level of Chinese last-ditch orders, and we were looking to frontrun it.

Well they did... and now everyone has a large supplus of equipment!

Investors had expected TSMC to book crucial EUV tools in the first quarter, according to Redburn Atlantic analyst Timm Schulze-Melander (but not according to ZeroHedge). The disappointment in orders leaves earlys and return for next year “vulnerable,” he said, confirming what we said 1 4th ago erstwhile everyone was rushing to buy the stock on a one-off pursuit in orders.

The level of EUV orders is “extremly low,” Indicating major ASML clients like TSMC, Samsung and Intel didn’t increase investments in the high-end equipment, Oddo BHF analyst Stephane Houri said. ASML Saw the biggest slump in request for its top-end utmost ultraviolet machines. Orders for them plunged to €656 million in the period from €5.6 billion in the erstwhile quarter.

In another words, The frontrunning of China’s order book is now dead and buried.

And now comes the hangover, ASML now sees sales in the current 4th between €5.7 billion and €6.2 billion, missing estimates of €6.5 billion before request picks up. And while the company slambled to reassure the marketplace that "nothing is fucked here", and pushed request into the second half as all company does erstwhile it misses quarterly results...

“Our outlook for the full year 2024 is unchanged, with the second half of the year expected to be strongr than the first half, in line with the industry’s continued recovery from the downturn,” Chief Executive Officer Peter Wennink said in a message Wednesday. “We see 2024 as a transition year.”

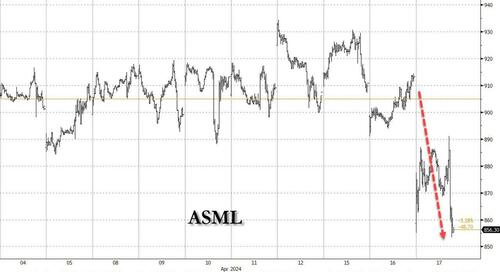

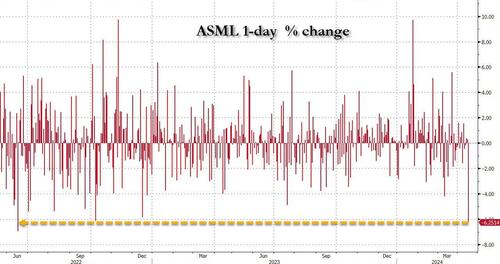

... the marketplace was little than willing to buy the BS this time, and with the company accepting that as much as 15% of China sales this year will be affected by the fresh export control means – 50% is simply a more realistic number – the stock yet tucked as the hangover yet arrived, if with a 3 period delay, and present the stock tumbled more than 6%....

... the biggest 1 day drop since last June.

Tyler Durden

Wed, 04/17/2024 – 10:30