The Sejm unanimously adopted present an amendment to the Goods and Services taxation Act, raising the limit on gross exempting VAT as a taxable person.

415 Members voted in favour of the resolution; no 1 abstained or opposed.

The Most crucial Change

- Current threshold: PLN 200,000 a year

- New threshold from 1 January 2026: 240 000 PLN per year

Additionally, companies that exceed PLN 200,000 in 2025 but do not exceed PLN 240 000 will not gotta registry as VAT payers.

Since the beginning of 2025, EU associate States have been able to set a VAT exemption threshold of up to EUR 85 000 (about PLN 350 000) of the yearly turnover, which further justifies the Polish deregulation.

Now the bill goes to the Senate, and after its acceptance – to the President's signature. Its entry into force is foreseen for 1 January 2026.

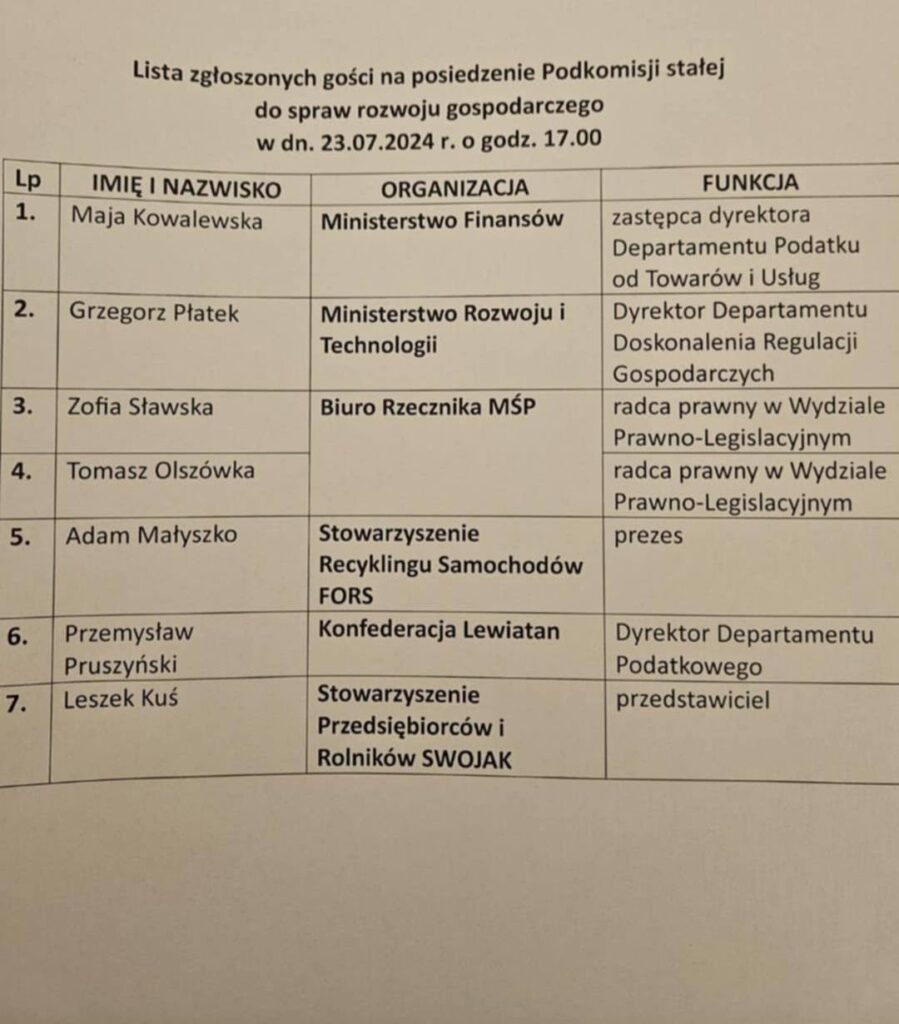

"In July 2024 SPIR SWOJAK began efforts to rise the limit. We have proposed a higher amount, but it inactive enjoys all step towards simplification. At the invitation of Mr Gawron, I attended the gathering of the GOR02S subcommittee as a typical of SWOJAK. This shows that it is worth fighting for!" commented Leszek Kuś, president of the Swojak SME Council.

![„Społeczeństwo islamu nie jest zdolne do reformy” [Ferghane AZIHARI]](https://wcn-media.s3.us-west-004.backblazeb2.com/2026/02/ahmadardity-quran-4951042_1920.jpg)