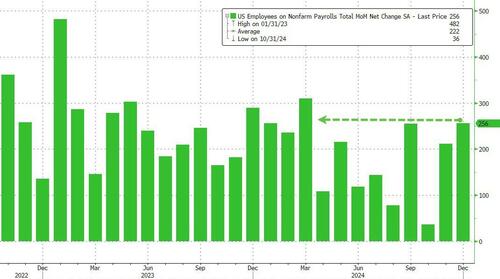

Scorching Hot December Jobs: US Unexpectedly Adds Massive 256K Jobs In December, Smashing Estimates, As Unemployment Drops

With consensus expecting a 165K print today, and the whisper number coming in about 20K higher at 187K, traders were expecting a cooler than last month’s 227K – but not too cool – and certainly not hot, jobs number this morning. Instead they got a red hot print at 256K…

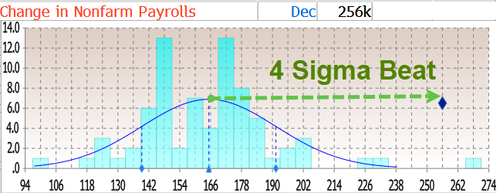

…. nearly 100K higher – or a 4 sigma beat – above the median estimate of 165K…

… with just one forecaster (Bloomberg’s econ team) expecting a higher number at 268k.

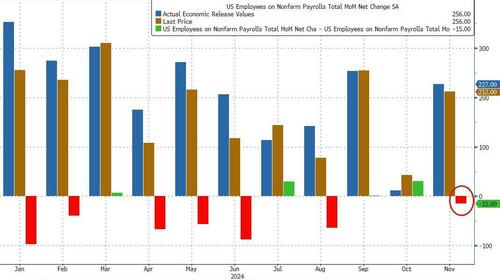

The change in total nonfarm payroll employment for October was revised up by 7,000, from +36,000 to +43,000, but the change for November was revised down more, by 15,000, from +227,000 to +212,000. With these revisions, employment in October and November combined is 8,000 lower than previously reported.

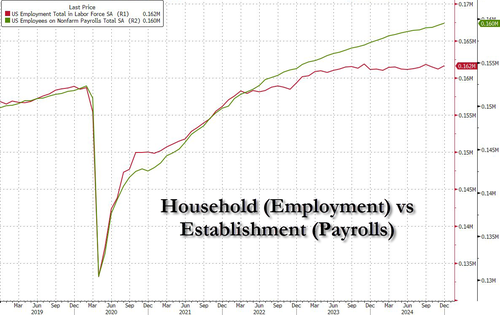

The number of employed workers surged from 161.183 million to 161.661 million, up 478K, while the number of unemployed workers dipped by almost 250K, from 7.121 million to 6.886 million, a drop of 235K, leading to both a convergence in the spread between the number of payrolls and Americans employed, and a decline in the unemployment rate. In other words, the household survey showed a sizable jump in employment, at 478,000, and comes after two big monthly losses.

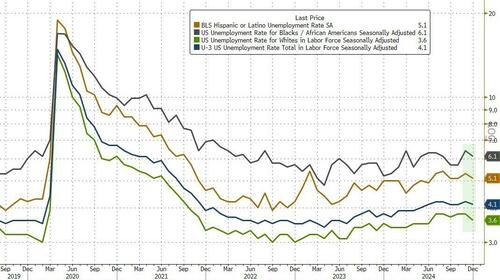

Indeed, just in case the smoking hot payrolls print wasn’t enough, the unemployment rate should have ended any hope of a rate cut in the coming quarters, as it printed down to 4.1% from 4.2%, below estimates of a 4.2% print. The unemployment rate for Whites (3.6 percent) edged down in December. The jobless rates for adult men (3.7 percent), adult women (3.8 percent), teenagers (12.4 percent), Blacks (6.1 percent), Asians (3.5 percent), and Hispanics (5.1 percent) changed little over the month.

The underemployment rate, tumbling to 7.5% from 7.8%, and a 6 month low, was even hotter.

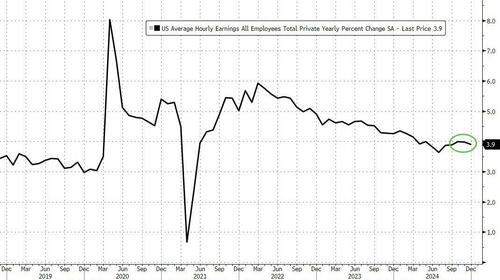

In fact the only aspect of today’s report that was not red hot, was average hourly earnings, which at 0.3% MoM came in line, and in fact missed fractionally on the YoY, printing at 3.9%, down from 4.0% and below estimates of an unchanged print.

Looking closer at the report, we find the following:

- Among the unemployed, the number of permanent job losers declined by 164,000 to 1.7 million in December but is little different from a year earlier. The number of people on temporary layoff, at 862,000, changed little over the month and over the year.

- In December, the number of long-term unemployed (those jobless for 27 weeks or more) changed little at 1.6 million but is up by 278,000 from a year earlier. The long-term unemployed accounted for 22.4 percent of all unemployed people in December.

- The labor force participation rate, at 62.5 percent, was unchanged over the month and has remained in a narrow range of 62.5 percent to 62.7 percent since December 2023. The employment-population ratio, at 60.0 percent, changed little over the month and over the year.

- The number of people employed part time for economic reasons, at 4.4 million, changed little in December and is little different from a year earlier. These individuals would have preferred full-time employment but were working part time because their hours had been reduced or they were unable to find full-time jobs.

- The number of people not in the labor force who currently want a job, at 5.5 million, was essentially unchanged in December. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

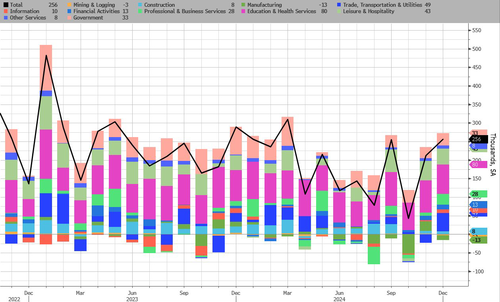

Turning to the Establishment survey, the BLS reported that the breakdown of jobs among major industries, we find that total employment trended up in health care, government, and social assistance. Retail trade added jobs in December, following a job loss in November. Here are the details:

- Health care added 46,000 jobs in December, with gains in home health care services (+15,000), nursing and residential care facilities (+14,000), and hospitals (+12,000). Health care added an average of 57,000 jobs per month in 2024, the same as the average monthly gain in 2023.

- Retail trade added 43,000 jobs in December, following a loss of 29,000 jobs in November. In December, employment increased in clothing, clothing accessories, shoe, and jewelry retailers (+23,000); general merchandise retailers (+13,000); and health and personal care retailers (+7,000). Building material and garden equipment and supplies dealers lost jobs (-11,000). Overall, employment in retail trade changed little in 2024, following an average monthly increase of 10,000 in 2023.

- Government employment continued to trend up in December (+33,000). Government added an average of 37,000 jobs per month in 2024, below the average monthly gain of 59,000 in 2023. Over the month, employment continued to trend up in state government (+10,000).

- Employment in social assistance increased by 23,000 in December, mostly in individual and family services (+17,000). Social assistance added an average of 18,000 jobs per month in 2024, below the average increase of 23,000 per month in 2023.

- Employment in leisure and hospitality changed little in December (+43,000). Leisure and hospitality added an average of 24,000 jobs per month in 2024, about half the average monthly gain of 47,000 in 2023.

- Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; transportation and warehousing; information; financial activities; professional and business services; and other services.

And visually:

Finally, in case it wasn’t clear, absent a major shock, the Fed’s easing cycle is now over as we said a month ago. Here are some on Wall Street who agree:

Bloomberg Economics (which was the only team predicting a higher job print than reported by the BLS):

“December’s jobs report was solid across the board. While we expected the strong showing in the establishment survey, the significant employment gains in the household survey – including a drop in the unemployment rate — surprised us. We take that as an encouraging sign that the job market may be stabilizing after it deteriorated steadily over the second half of 2024…. The Fed will likely conclude the report supports their view that the economy is solid and can withstand a pause in rate cuts for a few months. We expect the FOMC to keep rates steady at the Jan. 28-29 meeting.”

Seema Shah, chief global strategist at Principal Asset Management:

“The Fed can be very comfortable staying put in January and will need some meaningful downside inflation surprises or reversals in upcoming jobs reports to wake them from rate slumber in March.”

Bret Kenwell, investment analyst at eToro:

„The market may not love this jobs number, but there are a lot worse things than a strong labor market. Remember, the consumer is the lifeblood of the US economy and being employed is critical for consumer spending and confidence. Without a strong foundation in the labor market, the whole thing falls apart. Investors need to keep that in mind — even if that means rate-cut expectations take a step back.”

Brian Coulton, Fitch Ratings:

“The Fed will take some comfort from the decline in monthly wage gains to 0.28% m/m from 0.37% in November. It doesn’t look like we are seeing a renewed acceleration in job demand or tightening in labor market conditions – the picture looks broadly stable.”

George Goncalves, head of US macro at MUFG, says:

“The only saving grace for the bond market at this point will be if risk markets really start to unravel, otherwise there is no magical number that will be a line in the sand, especially with all of the uncertainty ahead around the fiscal and government policies which may prove to be inflationary.”

And now we turn to the Fed to set the stage for the coming rate hikes…

Tyler Durden

Fri, 01/10/2025 – 08:43