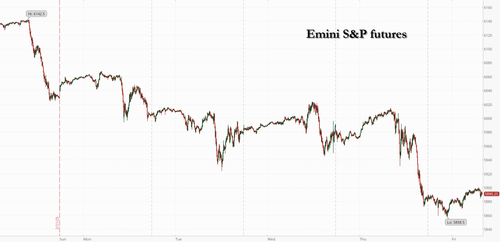

S&P Futures Rebound From Thursday Rout Which Wiped Out All 2025 Gains; Bitcoin Crash Continues

US equity futures are higher, rebounding from an overnight rout driven by a plunge in Chinese and Japanese stocks, while the ongoing crash in bitcoin which sent the token briefly below $80K and down 25% from its all time high, is not helping the dismal sentiment. As of 8:00am ET, S&P futures were up 0.2% and well off the lows,signaling a rebound after the underlying index erased the last of its 2025 gains on Thursday and outperforming both Nasdaq and Russell. Mag 7 are higher led by META (+0.5%) and NVDA (+0.5%). Crypto-linked stocks are lower as Trump’s latest trade-tariff threats prompted a rush by some investors to safer assets, deepening the recent rout in Bitcoin. Bond yields are 1-2bp lower and the USD is higher as the yen finally cracks lower. Commodities are mostly lower: WTI -1.1%, copper -0.7%. Overall, we have seen equities trying to rebound modestly from yesterday’s selloff, but macro narrative has been pressured from trade/policies uncertainties (Trump is set to talk with Zelensky today) and stagflation concerns ; today we get the January PCE and income/spending report: core PCE is expected to print 2.6% YoY, vs. 2.8% prior.

In premarket trading, Meta is leading gains among the Mag 7, meanwhile, Tesla is on track to drop for a record-matching seventh consecutive session (Meta Platforms +0.6%, Alphabet +0.2%, Amazon ,Apple, Microsoft and Nvidia are little changed, while Tesla -0.2%). US-listed Chinese stocks decline in premarket trading, putting the Nasdaq Golden Dragon China Index on course for its first week of decline in seven. Traders are paring bets following Donald Trump’s additional 10% tariffs on Chinese goods. Cryptocurrency-exposed stocks slid as a rout in Bitcoin deepened on Friday, with investors rushing to safer assets in the wake of Donald Trump’s latest tariff threats. Here are some other notable movers:

- Acadia Health shares sink 19% in premarket trading after the psychiatric hospital chain gave revenue and adjusted Ebitda forecast for the year that fell short of Wall Street’s expectations. The firm also reported fourth-quarter results that missed the average analyst estimate. S

- Bath & Body Works Inc. shares are up 1.5% in premarket trading, after Citi upgraded the retailer of personal care products to buy from neutral.

- Bloom Energy rises 8.0% after the electrical power equipment company reported revenue for the fourth quarter that beat the average analyst estimate.

- Cava Group shares gain 1.9% in premarket trading after Piper Sandler raised the Mediterranean chain to overweight from neutral, saying it’s one of the best ways to invest in the growth of the fast-casual restaurant industry.

- DLocal shares slump as much as 23% in US premarket trading, after the payment platform operator’s earnings and guidance undershot expectations. Analysts saw this as a sign commissions are coming under pressure and Morgan Stanley downgraded the stock to equal-weight.

- Investors in shares of JD.com Inc. face a gut check in next week’s earnings report from the online retailer as it girds for battle in the food-delivery space currently dominated by Meituan.

- Iovance Biotherapeutics shares tumble 19% in premarket trading as analysts cut their price targets on the drugmaker, citing weaker-than-expected sales for its advanced melanoma drug, Amtagvi, in the fourth quarter. Analysts see risk to the firm’s 2025 guidance.

- Monster Beverage shares gain 2.1% in premarket trading Friday after the energy-drink maker’s fourth-quarter gross margin topped the average analyst estimate. Net sales were also roughly in line with Wall Street expectations.

- PubMatic shares are down 14% in premarket trading, after the advertising technology company gave a first-quarter outlook that missed expectations. The company said the outlook “includes the continued headwind from one of our top DSP buyers that revised its auction approach in late May 2024.”

- Redfin shares are down 11% in premarket trading, after the online real estate company reported fourth-quarter results that were weaker than expected on key metrics and gave an outlook that is seen as disappointing.

- Rocket Lab shares drop as much as 13% in US premarket trading after the space company delayed the launch of its Neutron rocket to the second half of the year and issued a revenue forecast for the first quarter which fell short of estimates. This prompted analysts to either lower or place their price targets under review.

- Vital Farms shares gain 2.3% in premarket trading after Stifel raised the egg producer to buy from hold, touting the outlook for near-term growth.

- Walgreens Boots Alliance drops 3.7% in premarket trading as Deutsche Bank downgrades to sell from hold and says reports of a potential take-private deal from Sycamore Partners could be very tough to complete

The S&P 500 has slipped almost 3% this month, in part on worries that Trump’s proposed tariffs would fuel a global trade war. It’s now just about 1% from its closing level of 5,783 points on Nov. 5, the day of the Presidential election. About half of S&P 500 members are now down since election day, according to data compiled by Bloomberg. On the outlook for stocks, BofA’s Michael Hartnett said a reversal of the post-election rally would spark investor expectations for intervention by the US president to support the market. The Nov. 5 closing level is the “first strike price of a Trump put, below which investors currently long risk would very much expect and need some verbal support for markets from policymakers,” BofA’s Michael Hartnett wrote in a note.

Attention turns later to the core personal consumption expenditures price index — which excludes often-volatile food and energy costs. The index probably rose 2.6% in the year through January, after an increase of 2.8% in December, according to Bloomberg economists. It likely ticked up to 0.27% monthly compared with 0.16% in December. A hotter-than-expected reading would prompt concern among investors, said Kevin Thozet, a portfolio advisor at Carmignac. “It would be another hint that there hasn’t been much progress on US inflation since June 2024,” he said. The inflation reading is in sharper focus after Trump said 25% tariffs on Canada and Mexico will be enforced from March 4, while Chinese imports would face a further 10% levy. Economists say tariffs may hurt US growth, worsen inflation and possibly spark recessions in Mexico and Canada.

Bitcoin plunged, extending declines from its January peak to over 25%, in a striking pullback for one of the most popular Trump trades. The dollar edged up and Treasuries advanced, with US 10-year yields touching levels not seen since December.

“This is not an environment for de-risking,” said Laura Cooper, global investment strategist at Nuveen, on Bloomberg Television. “Perhaps it is just the case of finding hedges to protect the downside, because that 4th of March deadline is looming.”

In Europe, the Stoxx 600 fell 0.3%, although has recovered off its worst levels, with mining and technology shares faring worst as broader risk sentiment starts to stabilize having been rocked by US President Trump’s latest pronouncements on tariffs. The benchmark was off its Friday lows after French and Italian inflation data boosted the case for European Central Bank interest-rate cuts. Here are the biggest movers Friday:

- Nexi shares rise as much as 7.2% as the payments firm said it’s going to distribute its first-ever €300 million in dividends, on top of a share repurchase program

- Fugro shares jump as much as 11%, their biggest gain in more than two years, after the geological data company beat earnings estimates, aided by a strong margin performance

- Amadeus shares rise as much as 7.1% to the highest in five years, after the travel IT services provider announced a €1.3b buyback program, equivalent to about 4% of market value

- Proximus gains as much as 5.4% after the Brussels-listed communications firm reported broad-based beats to fourth-quarter estimates, and reassured analysts with its outlook for 2025

- Dino Polska gains as much as 6.2%, touching a record after the food supermarket chain reported same-store sales stronger than estimates and gave upbeat guidance for 2025

- Holcim shares rise as much as 2.7% in early trading as the cement maker reported a beat in margins, particularly in North America. Analysts also noted strong cash generation

- Weir Group shares rise as much as 3.2% after the mining engineering company’s earnings beat expectations, with analysts especially positive on its margins and 2025 outlook

- Valeo shares drop as much as 11% on Friday, denting the stock’s strong start to the year, as analysts note a continued tough environment for auto suppliers

- Teleperformance shares slump as much as 16%, the most in almost a year, after the digital business services firm issued weak margin guidance for 2025

- Logitech International shares drop as much as 9% as BofA Global Research cuts its rating on the electronics maker to underperform from neutral due to its valuation and earnings outlook

- Puig shares fall as much as 5.5%, with analysts pointing to its sales guidance for 2025 which Jefferies says is “conservative” and reflects a slowdown in growth in some end markets

- Clariant shares slide as much as 12%, the most in three years and hitting the lowest since July 2012, after the chemicals maker released full-year results

Asian equities slumped, on track to snap their longest weekly winning streak in nearly a year, as US President Donald Trump’s latest tariff threats and underwhelming Nvidia results damped investor sentiment. The MSCI Asia Pacific Index fell 2.5%, set to cap its worst day since Feb. 3, with Alibaba, Tencent and Meituan among the biggest drags. Shares in Hong Kong led the declines, after Trump said he would impose an additional 10% levy on imports from the Asian nation. The move aggravates growth concerns for the world’s No. 2 economy and threatens to derail a rally induced by optimism over artificial intelligence. South Korea was also among the worst performers, with the Kospi down more than 3%, as tech stocks including Samsung and SK Hynix tracked Nvidia lower after its “good-but-not-great” quarterly raised doubts on the sector’s outlook. Japanese stocks were also hit by trade and chip sector worries. Southeast Asian stocks tumbled as currency weakness and tariffs weighed on sentiment, with Thailand’s SET Index on track to enter a bear market.

The additional tariffs “deliver a negative signal to the market that the trade conflict between the two nations still exists,” said Jason Chan, a senior investment strategist at Bank of East Asia in Hong Kong. “The market in general expects trade talks will be held before a new round of tariff hikes occurs, but Trump’s latest announcement may be a surprise.”

In FX, the Bloomberg Dollar Spot Index rose 0.1% advancing for a third session, and hitting its highest since Feb. 13, after President Donald Trump said the 25% tariffs on Canada and Mexico would come into force from March 4, while Chinese imports would face a further 10% levy. The kiwi is the weakest of the G-10’s, falling 0.6% against the greenback. The pound erased losses after Bank of England Deputy Governor Dave Ramsden said policymakers will have to take “great care” when cutting interest rates given signs of persistent inflation Earlier, the pound slipped to its lowest in more than a week against the dollar. USD/JPY rose 0.4% to 150.4, its highest level in a week.

In rates, treasuries are little changed as US session gets under way after erasing gains that sent yields to fresh YTD lows. US 10-year yield at 4.25% is back within 1bp of Thursday’s closing level after declining as much as 4bp to 4.22%, last seen in Dec. 11; earlier gains in Treasury futures were backed by a rally in JGBs after domestic inflation slowed more than expected. Core European rates outperformed after French inflation fell to its lowest level in four years and prices in Italy unexpectedly held steady — bolstered expectations for ECB rate cuts. bunds and gilts in the sector outperform by 2bp and 2.5bp; bunds gapped higher at the open, tracking the overnight rally in Treasuries and later showed little reaction to German state inflation data. French and Italian EU harmonized CPI rose less than forecast. German 10-year yields fall 3 bps to 2.38%. Gilts also gain, with UK 10-year borrowing costs dropping 3 bps to 4.48%. Bank of England interest-rate cut bets are steady after Deputy Governor Ramsden said policymakers will have to take great care when lowering rates. Focal point of US day is January personal income and spending data that include PCE price indexes, with core gauge expected to show first deceleration since September.

In commodities, oil prices decline, with WTI falling 1% to $69.60 a barrel. Spot gold falls $15 to around $2,862/oz. Bitcoin briefly tumbles below $80000, plunging 25% from its all time high a little over a month ago.

US economic data calendar includes January personal income/spending and advance goods trade balance (8:30am), February MNI Chicago PMI and February Kansas City Fed services activity (11am). Fed speaker slate includes Goolsbee at 10:15pm.

Market Snapshot

- S&P 500 futures up 0.3% to 5,894.25

- STOXX Europe 600 down 0.4% to 554.88

- MXAP down 2.4% to 183.53

- MXAPJ down 2.4% to 577.29

- Nikkei down 2.9% to 37,155.50

- Topix down 2.0% to 2,682.09

- Hang Seng Index down 3.3% to 22,941.32

- Shanghai Composite down 2.0% to 3,320.90

- Sensex down 1.8% to 73,280.16

- Australia S&P/ASX 200 down 1.2% to 8,172.35

- Kospi down 3.4% to 2,532.78

- German 10Y yield little changed at 2.39%

- Euro little changed at $1.0400

- Brent Futures down 0.9% to $73.40/bbl

- Gold spot down 0.5% to $2,862.59

- US Dollar Index little changed at 107.34

Top overnight news

- Trump has said he is working on a trade deal with the UK and suggested Britain could escape tariffs if the country secured one, but the allies failed to agree on US security guarantees for Ukraine. FT

- Trump said on Truth that they are working very hard with the House and Senate to pass a clean, temporary government funding bill. Trump also announced he nominated Paul Dabbar to be the US Deputy Secretary of Commerce.

- Economists added a big disclaimer — Trump — to their view that the ECB will lower rates three more times. After an almost-certain quarter-point move next week, there’s scope for forecasts to shift abruptly. BBG

- The Treasury’s cash balance plummeted to $569 billion, the lowest since September 2023, as it navigates the debt-ceiling impasse by reducing bill auctions. Meanwhile, overnight repo rates climbed. BBG

- Mexico will extradite drug criminals to the US in a bid to avoid Trump’s tariffs. WSJ

- Donald Trump’s additional 10% tariffs on Chinese goods again brought geopolitical risks to the forefront of investors’ mind, prompting the biggest selloff in Chinese stocks in months: BBG

- President Volodymyr Zelenskiy arrives at the White House on Friday with a personal appeal to persuade Donald Trump not to sell out his country in the rush to make a peace deal with Russia: BBG

- French inflation retreated to its lowest level in four years, bolstering the case for further interest-rate cuts by the European Central Bank, whose next move is likely to arrive next week: BBG

- China’s Ministry of Commerce said Friday that it “firmly opposes” Trump’s latest threat to ramp up tariffs on Chinese goods (Trump announced plans for an additional 10% tariff on Chiina yesterday) and vowed retaliation, if necessary. CNBC

- Japan’s Tokyo CPI comes in below the Street at +2.9% headline (down from +3.4% in Jan and under the consensus estimate of +3.2%) and +1.9% core (flat vs. Jan and below the Street’s +2% forecast). BBG

- India’s economic growth probably accelerated to 6.2% year on year in the fourth quarter, from 5.4% in the prior period. BBG

- France’s CPI for Feb cools below expectations, coming in at +0.9% Y/Y on an EU harmonized basis, down from +1.8% in Jan and lower than the consensus forecast of +1.1%. WSJ

Tariffs

- US Treasury Secretary Bessent said he’s open to the idea that other countries’ tariffs could come down or go away, while it was separately reported that South Korea’s Acting President Choi and US Treasury Secretary Bessent discussed tariffs, investment, and forex policy in a video call, according to South Korea’s finance ministry.

- China’s MOFCOM said China opposes US President Trump’s latest tariffs on Chinese goods and hopes the US will avoid making the same mistake again and return to the right track of properly resolving differences through dialogue as soon as possible. Furthermore, it stated if the US insists on its own path, China will take all necessary countermeasures to defend its legitimate rights and interests.

- China’s Foreign Minister, on the remarks from US President Trump around an additional 10% tariff, says the US is once again using fentanyl as a pretext for threatening China. China opposes the tariff move. Will take all necessary measures to safeguard their legitimate interests. Rubio’s speech was filled with „cold war mentality”, adds the US coercion will backfire. China is willing to cooperate.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks declined with heavy pressure seen at month-end following the sell-off on Wall St with global risk sentiment hit by tariff threats and following a slump in NVIDIA shares post-earnings. ASX 200 was pressured with nearly all sectors in the red and the declines led by underperformance in miners and tech. Nikkei 225 slumped from the open and briefly dipped below the 37,000 level with the index down by more than a thousand points amid tech-related selling, while there were mixed data releases from Japan including softer-than-expected Tokyo CPI, a miss on Retail Sales and a slightly narrower-than-feared contraction in Industrial Production. Hang Seng and Shanghai Comp conformed to the broad downbeat mood amid trade-related frictions after US President Trump announced that an additional 10% of tariffs on China is set to take effect on March 4th which is on top of the 10% tariffs the US had previously imposed earlier this month. Nonetheless, the losses in the mainland were somewhat cushioned ahead of next week’s annual ”Two Sessions” in Beijing, where markets will be hoping for fiscal stimulus.

Top Asian News

- China’s Politburo said it will implement a more proactive macro policy, expand domestic demand and will stabilise the housing market and stock market. Furthermore, it will also prevent and resolve risks and external shocks in key areas, as well as promote the sustained recovery of the economy.

- China’s state planner issued measures on promoting high-quality inclusive elderly care services and will leverage central budget investment to boost the construction of affordable elderly care facilities.

- BoJ Deputy Governor Uchida said there is no change to the stance on short-term policy rate or JGB taper despite recent yield moves, and JGB yields fluctuate depending on market views on the economy, prices, and overseas developments. Uchida added the BoJ guides monetary policy towards achieving price stability not to monetise government debt.

- Japan is to crack down on the booming market for JGB-backed loans, according to Bloomberg.

- Chinese banks are reducing US dollar deposit rates following guidance from the PBoC, according to sources cited by Reuters.

- PBoC did not conduct purchase or sale of Chinese sovereign bonds from primary dealers in Feb.

European bourses (STOXX 600 -0.4%) began the session entirely in the red, continuing the down-beat and risk-off mood seen in US and APAC hours. As the morning progressed, there has been an upward bias, attempting to pare back some of the early morning pressure; indices still generally reside in the red. European sectors hold a strong negative bias, given the risk-off sentiment. Construction & Materials tops the pile, lifted by post-earning strength in Holcim (+3.5%). Basic Resources is the underperformer today, given the risk-tone which has weighed on underlying metals prices. It is also no surprise that Tech is amongst the laggards, following the significant losses in NVIDIA (-8.5%) in the prior session; ASML (-2.5%)

Top European News

- BoE’s Ramsden says his conclusion from the „current elevated degree of uncertainty is that it increases the range of plausible states that the UK economy might end up in in the medium term”. „I no longer think that risks to hitting the 2% inflation target sustainably in the medium term are to the downside. Instead, I think they are two sided, reflecting the potential for more inflationary as well as disinflationary scenarios.” & On descending the Table Mountain „There may be circumstances when a slower than expected descent is justified but there will also be times when conditions require that the pace has to quicken.”

FX

- USD remains underpinned by the Trump administration’s trade policies. As a reminder, Trump clarified that there will be a „10+10” tariff on China for a total of 20% additional tariffs and that the proposed tariffs on Canada and Mexico are scheduled to go into effect on March 4th. On the data slate, the obvious highlight is monthly PCE data for January with core M/M expected to tick higher to 0.3% from 0.2%, and the Y/Y metric forecast at 2.6% vs. prev. 2.8%.

- EUR is flat vs. the USD and pivoting around the 1.04 mark. On the data front, CPI releases thus far today have seen a softer-than-expected outturn for French inflation, whilst German state CPIs have been broadly in-line with expectations of the national release at 13:00GMT; firmer on a M/M basis and steady Y/Y. Elsewhere on the inflation front, the ECB’s survey of consumer expectations saw the 12-month forecast slip to 2.6% from 2.8% and the 3yr remain at 2.4%. Tariffs also remain on the mind of investors with the EU still in the firing line of the Trump admin, after President Trump reaffirmed his criticism of EU VAT taxes. EUR/USD briefly slipped below its 50DMA at 1.0387 before just about returning to a 1.04 handle.

- Overnight, USD/JPY saw mild downside amid haven flows into the Japanese currency but saw two-way price action with a brief surge triggered by softer-than-expected Tokyo inflation data. USD/JPY has gained a firmer footing on a 150 handle with a current session peak at 150.68 vs. the YTD low printed on 25th February at 148.55.

- GBP is flat vs. the USD after briefly slipping onto a 1.25 handle. GBP has been more resilient vs. the USD compared to other peers with the UK seen to have less exposure to US tariffs than peers. Furthermore, US President Trump said the US is going to have a deal done on trade with the UK „rather quickly” and that UK PM Starmer tried to convince him not to impose tariffs on the UK during their meeting. Elsewhere, BoE’s Ramsden presented an even-handed speech in which he noted inflation risks „are two-sided. Cable, the earlier session low sits at 1.2574; if breached, last week’s low kicks in at 1.2562.

- Antipodeans are softer alongside the risk-off tone triggered by the latest Trump tariff tirade and tech losses on Wall Street.

- PBoC set USD/CNY mid-point at 7.1738 vs exp. 7.2873 (prev. 7.1740).

Fixed Income

- USTs are bid, benefitting from the marked equity sell-off seen in the second half of Thursday’s US session which reverberated into APAC trade and the European open; driven by losses in Tech and Trump confirming that the 10% measure on China is in addition to the 10% tariff he had already announced. Action that took USTs to a 111-03+ peak in APAC trade which is a YTD high for the June contract and takes us back to the 111-08 and 111-20+ peaks from November and December respectively. Focus today is on US PCE.

- Bunds are trading in tandem with USTs for the first part of the session but has since experienced a marginal pullback from highs and while still comfortably in the green, the benchmark finds itself in the lower-half of a 132.94-133.46 band. A pullback which has occurred despite the cooler-than-expected French preliminary inflation measures and the broadly in-line, when compared to expectations for the nationwide figure, German State CPIs; though, while expected, the M/M German figures did see a marked move higher which may be weighing on EGBs. The ECB SCE saw 12-month inflation expectations ease a touch whilst 3yr remained steady.

- Gilts are following the above. UK specifics include Nationwide House Price figures which lifted from the prior and showed the sixth consecutive monthly gain. Alongside that, an extensive text release from BoE’s Ramsden in which he noted that uncertainty has increased and as such a data-dependent and meeting-by-meeting approach is warranted. Firmer but at the lower-end of 93.24 to 93.48 parameters. A further pullback brings into view the figure and then the 92.22 base from earlier in the week. While a pickup would first encounter resistance at 93.49 from mid-February and then the current WTD peak of 93.51.

- BoJ plans to buy bonds in March at same pace as February, according to a release.

Commodities

- Crude futures are lower on Friday, giving back some of the upside seen in the prior session. Some of the pressure today could be attributed to month-end profit-taking, and with traders mindful of US PCE later. Brent May sits in a USD 72.76-73.37/bbl range.

- Subdued trade across precious metals as European players reacted to the surge in the Dollar yesterday amid US President Trump’s tariff rhetoric, with nothing new to add during European hours. Spot gold resides in a USD 2,851.11-2,885.24/oz range.

- Base metals are lower across the board amid the risk-off sentiment amid Trump’s tariff rhetoric which seeks to impose an additional 10% tariff on China on top of the February 4th 10% levy. 3M LME copper fell further below USD 9,500/t and resides in a USD 9,331.90-9,405.65/t range at the time of writing.

- Oman crude OSP USD 77.63/bbl in April vs. March USD 80.26/bbl, according to GME data cited by Reuters.

- Iraq Oil Ministry says it will announce a resumption of oil exports in the next few hours; initial oil flows from Iraq’s Kurdistan region through Turkey will be at 185k barrels, and will increase gradually.

- A group of eight oil firms operating in Iraqi Kurdistan and Apikur say there will be no resumption of oil exports through Iraq-Turkey pipeline on Friday, has not been any formal outreach to member companies with regards to resumption of oil exports yet

Geopolitics

- Israeli army storms the West Bank city of Nablus, via Sky news Arabia citing Palestinian News Agency

US Event Calendar

- 08:30: Jan. Core PCE Price Index MoM, est. 0.3%, prior 0.2%

- Jan. Core PCE Price Index YoY, est. 2.6%, prior 2.8%

- Jan. PCE Price Index MoM, est. 0.3%, prior 0.3%

- Jan. PCE Price Index YoY, est. 2.5%, prior 2.6%

- Jan. Personal Income, est. 0.4%, prior 0.4%

- Jan. Personal Spending, est. 0.2%, prior 0.7%

- Jan. Real Personal Spending, est. -0.1%, prior 0.4%

- 08:30: Jan. Advance Goods Trade Balance, est. -$116.6b, prior -$122.1b, revised -$122b

- 08:30: Jan. Retail Inventories MoM, est. 0.2%, prior -0.3%

- Jan. Wholesale Inventories MoM, est. 0.1%, prior -0.5%

- 09:45: Feb. MNI Chicago PMI, est. 40.8, prior 39.5

- 11:00: Feb. Kansas City Fed Services Activ, prior -4

DB’s Jim Reid concludes the overnight wrap

Happy Friday. It’s been a busy week of travel and dinners, and on getting home last night our kitchen cupboards had finished being repainted. I couldn’t tell any difference. When I told my wife that, she said (and I’m paraphrasing to get through compliance), „How on earth can you not tell? They were getting disgusting and now they look new”. I didn’t think they needed doing but I can’t tell if that’s me lacking standards or whether my wife has too high ones. Now we’re 7-8 years on since we gutted our house and starting again I fear this is the first of many redecoration altercations!

Markets were in a stressed mood of their own yesterday, with renewed tariff threats from President Trump in addition to a sharp tech sell-off that saw the Magnificent 7 (-3.03%) post its worst day of 2025 so far as Nvidia slumped -8.48% after its earnings the previous evening. This marked a sixth consecutive decline for the Mag-7, the first time that’s happened since April last year, and it now leaves the index -13.56% beneath its December peak. In turn, the S&P 500 fell -1.59%, moving back into the red YTD and on course for its worst week since September, while the VIX closed above 20 for the first time this year (+2.03pts to 21.13).

Risk assets had already come under some pressure after President Trump confirmed that 25% tariffs on Canada and Mexico were still scheduled for this Tuesday, March 4. In a post on Truth Social, President Trump said that “Drugs are still pouring into our Country from Mexico and Canada”, and that “until it stops, or is seriously limited, the proposed TARIFFS scheduled to go into effect on MARCH FOURTH will, indeed, go into effect, as scheduled.” On top of that, he said that China would face an additional 10% tariff, and then on April 2, the reciprocal tariffs would also go into force.

Of course, it’s worth bearing in mind that at the start of February, the proposed tariffs were extended by a month with just hours to spare. And President Trump’s post did leave some room for another extension or deal, as he used the phrase “until it stops, or is seriously limited”, suggesting there was a way of avoiding them. However, if they do come into place for a prolonged period, then the same framework from before would apply, with Canada and Mexico likely to go into an imminent recession. Moreover, it would raise US inflation, and make it more likely that the Fed doesn’t cut this year at all. Our US economists have previously suggested that the 25% tariffs on their two neighbours would reduce US growth by between 0.4 to 0.7% in 2025 and raise core PCE by between 0.3% to 0.7% if sustained. See their analysis here.

In terms of whether a deal could be reached, officials in Canada and Mexico were both still talking as though that was possible. Indeed, Mexican President Sheinbaum said yesterday that “I hope we can reach an agreement and that on March 4 we can announce something else”. Meanwhile, Canada’s public safety minister David McGuinty said in Washington yesterday that “We are quite convinced that the efforts we’ve made thus far should satisfy the US administration”. And given the last extension was made in the final 24 hours, it’s not implausible that markets won’t start to price the full impact of tariffs until after they actually come into force. However, in the case of China, it’s worth bearing in mind that they didn’t reach a deal, and the 10% tariff did come into force earlier this month, so this would be an extra 10% on top of that.

Although investors are still anticipating a potential last-minute deal again, the most tariff-sensitive assets saw an immediate reaction to Trump’s post. For instance, the Canadian dollar weakened by -0.69% against the US Dollar, while the euro fell to back below 1.04 against the dollar posting its worst day in eight weeks (-0.83%). Elsewhere in Europe, the STOXX Automobiles and Parts index was already having a bad day given President Trump’s announcements of 25% auto tariffs on the EU, but it extended its losses to close -3.73% lower. More broadly, there was underperformance for the DAX in Germany (-1.07%) and the FTSE MIB in Italy (-1.53%), two countries relatively more exposed to trade with the US, while the STOXX 600 fell -0.46%.

On top of the tariffs, we got some more inflationary news from the latest Q4 GDP data, as the Fed’s preferred inflation measure of PCE was revised up on the second estimate. It showed that headline PCE was now running at +2.4% in Q4, an upward revision of a tenth, whilst core PCE was revised up two-tenths to +2.7%. So it’s in a zone where it’s still lingering above target, and that’s before the imposition of any Trump tariffs. With WTI crude oil prices also moving +2.52% higher yesterday to $70.35/bbl, investors moved to price in higher inflation, with the 1yr inflation swap bouncing +5.7bps higher on the day to 2.925%. Looking forward, that inflation focus will continue today, as we’ve got the PCE numbers for January coming out, and our US economists are expecting a core PCE reading of +0.27%.

For rates, the combination of a risk-off tone and a more inflationary backdrop drove a curve steepening. Despite the rise in near-term inflation pricing, the front-end saw a modest rally as investors moved to price in 61bps on Fed cuts by December (+1.4bps on the day). This saw 2yr Treasury yields (-2.0bps) fall to a new 4-month low of 4.05%, while the 2yr real yield fell to 0.87%, its lowest since August 2022. By contrast, 10 year yields ended a run of 6 consecutive declines (+0.4bps to 4.26%). However, overnight in Asia they’ve rallied a sizeable -4bps for this time of day, trading at 4.22% as I type.

Over in Europe, sovereign bonds had seen a modest rally, with yields on 10yr bunds (-2.0bps) and OATs (-0.9bps) moving slightly lower. That came as the Spanish CPI release for February was in line with expectations, with the EU-harmonised measure at +2.9%, so the lack of an upside surprise helped reassure investors ahead of the numbers from other countries, including France, Italy and Germany today.

President Trump’s comments again drew attention later in the day with Keir Starmer’s visit to Washington. On trade, President Trump said he envisaged „a real trade deal” with the UK, which could mean that tariffs were “not necessary”. On Ukraine, the UK Prime Minister said that the UK would be ready to puts “boots on the ground” to support a peace deal. While saying he supported NATO’s Article 5, President Trump refrained from promising any US backstop for European involvement in Ukraine, stating „I don’t like to talk about peacekeeping until we have a deal”. Ukraine will remain in the headlines today with President Zelenskiy due to visit Trump in Washington, as the two are expected to sign a deal on Ukrainian minerals. The ongoing focus on European defence saw Germany’s Rheinmetall (+3.20%) continue to outperform yesterday, taking its YTD gains to +62.87%.

Asian equity markets are tumbling this morning with the KOSPI (-3.28) and the Nikkei (-3.10%) the largest underperformers with the latter plunging to its lowest level since mid-September 2024 while the Hang Seng (-2.78%) is also trading sharply lower as local tech shares are slumping following the Nvidia sell-off on Wall Street overnight. Elsewhere, the S&P/ASX 200 (-1.18%) and the Shanghai Composite (-1.29%) are also trading lower. US equity futures have stabilised and are up around a tenth of a percent.

Early morning data showed that headline inflation for Tokyo came in at +2.9% y/y in February (v/s +3.2% expected) down from +3.4% in January. At the same time, Tokyo’s core consumer prices rose by +2.2% y/y in February, a deceleration from January’s 2.5% increase, an 11-month high, and a tenth lower than expectations. The same miss as core/core inflation. Separately, other data showed that Japan’s industrial production in January decreased by -1.1% m/m, aligning with market expectations and compared to a -0.2% contraction in December. Concurrently, retail sales experienced a +3.9% y/y gain in January, in line with projections as against a +3.5% gain in the prior month.

To the day ahead now, and data releases include the French, German and Italian CPI prints for February, along with US PCE inflation for January. Otherwise, we’ll get Canada’s Q4 GDP, and German unemployment for February. Elsewhere, central bank speakers include the BoE’s Ramsden.

Tyler Durden

Fri, 02/28/2025 – 08:15