Record Foreign Demand For Blowout 5Y Treasury Auction

What a difference a month makes.

A little over thirty days after one ugly coupon auction after another, when the market was panicking that the US had „lost its reserve status” and any Treasury auction could well be the last (it turns out that „privilege” belonged to Japan, where last week we almost saw the last ever 20Y auction), demand for US paper is once again off the charts… and we aren’t even talking about yesterday’s stellar 2Y auction. Moments ago Bessent’s Treasury sold $70BN in 5 Year paper which saw the highest foreign demand in history!

Here are the details.

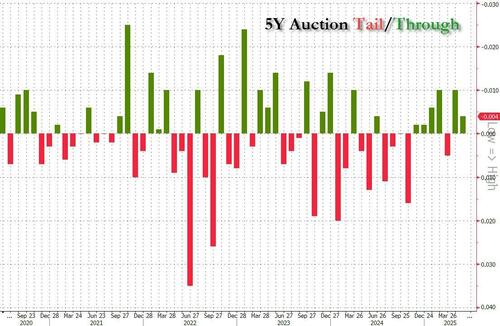

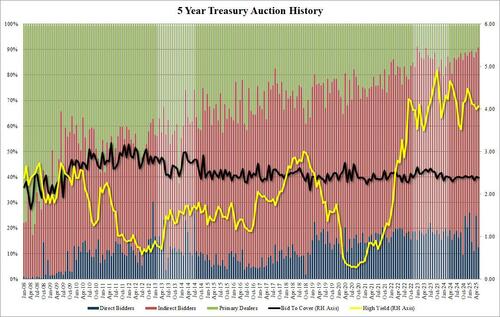

Today’s sale of $70BN in 5 Year paper priced at a high yield of 4.071%, up modestly from last month’s 3.99% (which was the first sub-4% auction since Sept 24), but otherwise the lowest yield for a 5Y auction since 2024. The auction also stopped through the 4.075% When Issued, resulting in a 0.4bps stop through, the 6th stop in the last seven auctions.

The bid to cover was 2.39, down from last month’s 2.41, but right on top of the six-auction average of 2.40.

What was most remarkable about the auction, however, is that at a time when so many are talking about the end of „US exceptionalism”, the internals showed just the opposite. In fact, with an indirect award of 78.4%, this was the 5Y auction with the highest foreign demand on record! And with Directs awarded 12.4%, down by half from last month’s 24.8% (when they had to step in for the drop in Indirects), Dealers were left holding just 9.2%, the second lowest on record with just January 23’s 8.8% lower

Overall, this was a stellar 5Y auction as evidenced by the record foreign demand, and a clear sign that the reports of US exceptionalism have been greatly exaggerated.

Tyler Durden

Wed, 05/28/2025 – 13:34

![Sąd: Jak liczyć zachowek od mieszkania [Wyrok w sprawie wydziedziczonego synka i trójki wnuków]](https://g.infor.pl/p/_files/38265000/podwyzki-38264590.jpg)

![W Goworowie debatowali o bezpieczeństwie. "Dziękujemy wszystkim mieszkańcom" [ZDJĘCIA]](https://www.eostroleka.pl/luba/dane/pliki/zdjecia/2025/275-227256.jpg)