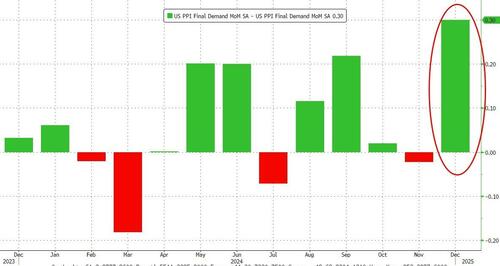

Producer Prices Surge At Fastest Pace In 2 Years As Energy 'Deflation’ Ends

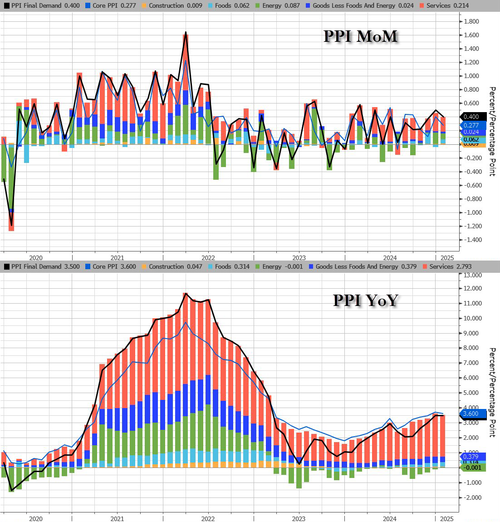

Following yesterday’s hotter than expected surge in consumer prices, all eyes are on producer prices this morning as headline PPI rose 0.4% MoM (more than the 0.3% exp) in January, but December’s 0.2% MoM rise was revised dramatically higher (to +0.5% MoM). Between the hot headline and upward revisions, headline PPI rose 3.5% YoY (+3.3% exp) – the hottest PPI since Feb 2023…

Source: Bloomberg

That is the 13th straight month without a MoM decline in producer prices.

2024’s PPI data has been serially revised higher with December’s the biggest upward revision since Dec 2021…

Source: Bloomberg

Core PPI also rose more than expected (+0.3% vs +0.2% exp) which dragged prices (ex food and energy) up 3.6% YoY…

Source: Bloomberg

Under the hood, Goods costs rose at double the pace of Services….

PPI Highlights:

-

Leading the broad-based January advance in the index for final demand, prices for final demand services rose 0.3 percent. The index for final demand goods moved up 0.6 percent.

-

The index for final demand less foods, energy, and trade services rose 0.3 percent in January after moving up 0.4 percent in December.

-

For the 12 months ended in January, prices for final demand less foods, energy, and trade services advanced 3.4 percent

PPI Services Details:

-

The index for final demand services moved up 0.3 percent in January, the sixth consecutive increase. Three-fourths of the broad-based advance in January is attributable to prices for final demand services less trade, transportation, and warehousing, which rose 0.4 percent.

-

The indexes for final demand transportation and warehousing services and for final demand trade services also increased, 0.6 percent and 0.1 percent, respectively.

-

Over one-third of the January rise in the index for final demand services can be traced to prices for traveler accommodation services, which advanced 5.7 percent.

-

The indexes for automobile retailing (partial); truck transportation of freight; food and alcohol retailing; apparel, jewelry, footwear, and accessories retailing; and bundled wired telecommunications access services also moved higher.

-

In contrast, margins for fuels and lubricants retailing fell 9.8 percent. Prices for securities brokerage, dealing, investment advice, and related services and for physician care also declined.

-

PPI Goods Details:

-

The index for final demand goods moved up 0.6 percent in January, the fourth consecutive rise. Over half of the broad-based January advance can be traced to a 1.7-percent increase in prices for final demand energy.

-

The indexes for final demand foods and for final demand goods less foods and energy also rose, 1.1 percent and 0.1 percent, respectively.

-

In January, a 10.4-percent increase in the index for diesel fuel was a major factor in the advance in prices for final demand goods.

-

The indexes for chicken eggs, beef and veal, gas fuels, jet fuel, and communication and related equipment also moved higher.

-

Conversely, prices for fresh and dry vegetables fell 22.3 percent. The indexes for pharmaceutical preparations and for residential electric power also decreased.

-

Energy deflation is over…

Source: Bloomberg

…but will energy deflation return next month?

Source: Bloomberg

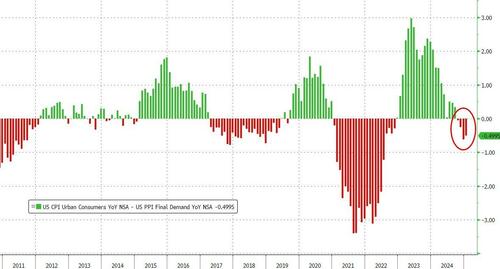

None of this is a good sign for bullish micro investors (margins compressed)…

…or bullish macro investors (doves crucified once again on the cross of transitory).

So much for Fed Chair Powell’s comments this week that inflation expectations “appear to remain well-anchored” and central bankers have scope to be patient with rate adjustments…

Tyler Durden

Thu, 02/13/2025 – 08:40