AUTHOR: TYLER DURDEN

Written by Jan Nieuwenhuijs from Gainesville Coins

In fresh years, the Polish central bank has bought about 300 tons of gold to match the ratio of gold to GDP with the average in the euro area. For the average and large economies of the euro area to which Poland can join in the future, the equivalent of gold to GDP is a hidden request for nations to be prepared to control to the fresh gold standard. Based on these requirements, I anticipate Poland to buy an additional 130 tons of gold.

Introduction

For those who do not know, the thought of the European Union (EU) is that yet all countries will adopt the euro and become part of the euro area.

At the time of writing this text, the EU has 27 countries, of which 20 belong to the euro area.

No. No. CommonWhen the another 7 countries introduce the euro.

In the EU, above all, Poland, but besides Hungary, have been a large gold buyer in fresh years.

Poland and Hungary are not yet included in the euro area.

After my publications "Europe has been preparing a global gold standard since the 1970s" and "Dutch central bank admitsthat it has prepared for the fresh gold standard" cannot be denied that there are secret agreements between the euro area nations to adjust gold reserves to GDP to prepare for the fresh gold standard (or mark strategy for gold prices).

In order for Poland to be in the euro area, it must adjust its ratio of gold to GDP to the average euro area.

On the 1 hand, the agreements I am talking about are secret due to the fact that any central banks in the euro area refuse transparency on the adjustment of gold reserves due to the provisions on "professional secrecy"(Belgium).

On the another hand, any of these central banks have spontaneously stated that they find the size of their aggregates based on the ratio of gold to GDP of large economies in close proximity neighbourhood (Netherlands)).

The subject of our current survey is Poland, which qualifies for the euro area, i.e. buying large amounts of gold, which confirms the existence of agreements.

Not only are the European central banks slow revealing their gold strategy, but all the measures taken confirm this policy.

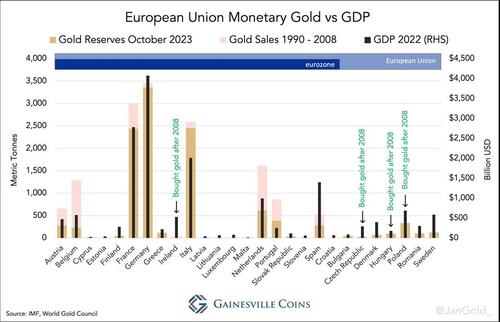

Data show that the balance sheet of the EU central bank in relation to gold to GDP

Last period a typical of the Dutch Central Bank (DNB) admitted in interviewthat GNI has gold worth about 4 percent of its GDP, which it compared with the positions of France, Italy and Germany.

delight note that the euro area does not control gold prices, and thus the ratio of gold to GDP, but there is simply a desire to harmonise these proportions throughout the euro area, as illustrated in the illustration below.

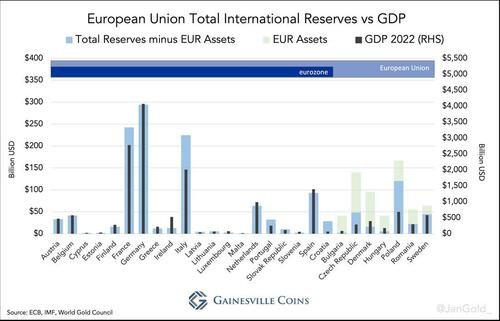

The surveillance of full global reserves (gold and currency) comparative to GDP across the euro area is even more stringent.

While European central banks communicatedthat there is no legal work to coordinate reserves, they most likely agreed to cyclically usage abroad currencies to equalise the full reserves and were able to accurately balance the gold reserves among themselves on the same day that they would control to the fresh gold standard.

Periodic adjustment of gold reserves is politically besides sensitive.

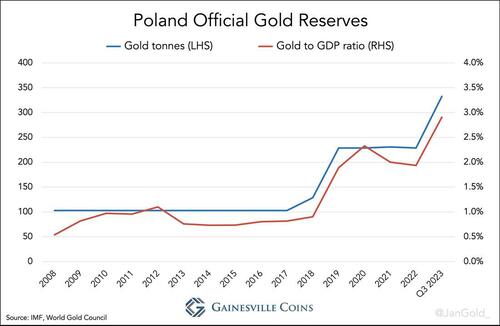

Before 2017, Poland had 103 tonnes of monetary gold, which represented only 1% of GDP.

To match its European partners, Poland had to importantly increase its metallic reserves, and so it did:

In 2018, the Polish Central Bank (NBP) began aggressively buying gold.

It presently houses 334 tonnes, which represents nearly 3% of Poland's GDP.

As shown in the graphs, Poland would request 450 tonnes to scope 4% of GDP, as would its partners in the euro area.

In addition, the NBP must transfer gold to the European Central Bank at the time of its accession with the euro.

According to my calculations, it would be about 16 tons with the current gold price.

In fact, I anticipate that The NBP will buy another 130 tons.

Why central banks harmonise gold reserves

By the late nineteenth century, as more and more countries entered the classical gold standard, request for gold increased.

In the case of the gold standard, the force to increase the value of a given country's currency, as a consequence of increased request for gold, created force to lower the prices of goods and services denominated in that currency.

Taking the gold standard active Deflation forces.

The more distorted the current global distribution of authoritative gold reserves, the little liquid the transition to an global gold-based monetary system.

Therefore, for any central bank that holds gold as its "Plan B" (gold standard), there is an incentive to convince another central banks to do the same and proportionally balance their stocks of gold among themselves.

So erstwhile a serious financial crisis comes, which will spread like a fire on today's interconnected markets, countries can stabilise their economies by moving to a unchangeable global gold standard.

In my opinion, most central banks are aware of this dynamics.

Conclusion

Alongside Poland, Hungary importantly increased its gold reserves from 3 tonnes in 2017 (0.1% of GDP) to 94 tonnes in 2021 (3% of GDP).

Significantly, the Hungarian central bank commentedthat gold "can play a stabilizing function and act as the main defence line in utmost marketplace conditions or in times of structural change in the global financial system".

The Czech Republic is besides buying recently, although their ratio of gold to GDP is inactive well below the regional average.

I would not be amazed if the Czechs bought an additional 150 tonnes in the coming years.

These changes will most likely not be limited to Europe.

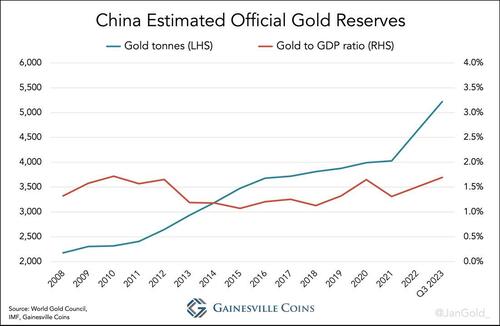

As shown in erstwhile analyses (here, Here.), China besides remembers to match its authoritative gold reserves to the size of its economy.

By My research The Chinese central bank presently holds 5 220 tonnes of gold, which is worth almost 2% of its GDP. This may explain why the People's Bank of China buys gold from hand to hand (about 700 tonnes per year) since the West frozen Russian dollar assets.

He needs to double his gold reserves and he can't afford to wait.

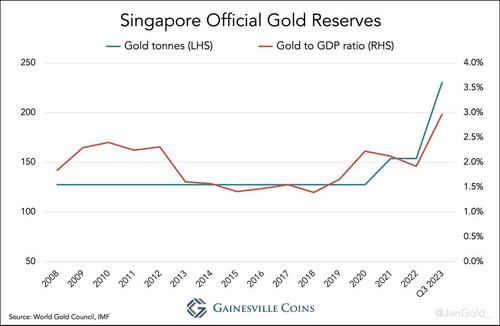

The test case is Singapore; Another large gold buyer since 2021 and seemingly besides trying to catch up.

In 2018, the ratio of monetary gold to GDP in Singapore was 1%, now 3%.

It will be interesting to see whether Singapore will halt buying gold erstwhile it reaches 4% (or any average rate in the euro area at any time in the future).

I'll keep you posted.

Translated by Google Translator

source:https://www.zerohedge.com/