„Party’s Over”: Auto Sales Sputter After Tariff-Fueled Surge

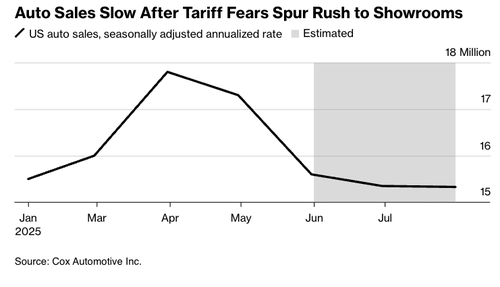

The auto sales slowdown that emerged in June is largely a hangover from the spring surge, when consumers rushed to dealerships nationwide to beat tariff hikes sparked by President Trump’s escalating trade war and new tariffs on trading partners. With affordability still worsening and economic uncertainty elevated, industry researcher J.D. Power now expects sales to remain subdued through the second half of the year.

Source: Bloomberg

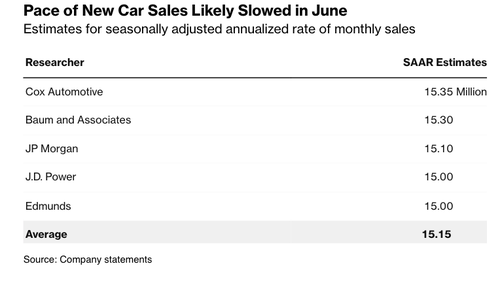

Source: Bloomberg Bloomberg cited a new report from J.D. Power that showed consumers rushed to buy new vehicles before prices climbed, pushing Q2 sales up 2.5% year-over-year. But that momentum quickly fizzled with the annualized sales rate dropping to 15 million units in June — the slowest in 12 months — down from April’s 17.6 million pace.

Source: Bloomberg

Source: Bloomberg „The party is over,” Jonathan Smoke, chief economist for researcher Cox Automotive, said in an interview, adding, „It’s slowing. It’s because of affordability getting worse and forcing what we think will be production declines to keep supply in balance.”

Smoke expects the annualized monthly rate of auto sales to hover around 15 million in the second half of the year, down from 16.3 million during the first six months. Last year, Americans purchased around 16 million cars and light trucks. In the analyst’s view, this indicates an apparent slowdown, primarily driven by worsening affordability.

Cox data shows the average cost of a new car is rising, up 1% in June from a year ago to $48,799 — a 28% increase compared to 2019 prices.

„Given the impact of tariffs, prices are likely to start rising at a much faster rate,” Charlie Chesbrough, senior economist for Cox, recently noted. „Higher vehicle prices are coming to the new vehicle market.”

Meanwhile, the Manheim Used Vehicle Value Index is beginning to rise again, indicating that used cars are increasingly being chosen as substitutes for new vehicles amid ongoing concerns about affordability. It also points to a tightening supply in the used vehicle market.

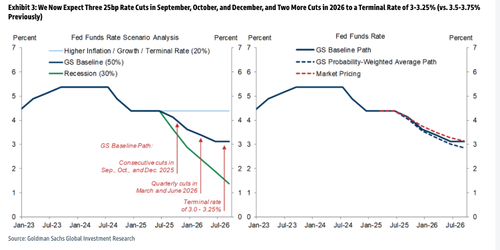

There is some good news: Goldman’s Jan Hatzius wrote in a note to clients that he expects the Federal Reserve to begin cutting interest rates in September, with three 25-basis-point reductions anticipated by the end of the year.

As for this summer, affordability woes persist, and prices stay high—toxic combination for the automobile market.

Tyler Durden

Tue, 07/01/2025 – 11:45